The Centre rolled out a major overhaul of the Goods and Services Tax (GST) system, dubbed GST 2.0, marking the most significant restructuring since the tax regime was introduced in 2017. The reforms, which come into effect on the first day of Navaratri, are expected to touch nearly every household, business, and service sector.

The GST Council, comprising the Centre and state governments, has rationalised rates across hundreds of essential and mass-consumption items. Finance Minister Nirmala Sitharaman said the revamp could add around Rs 2 lakh crore to the economy.

What Gets Cheaper Under GST 2.0

Daily essentials and food: Chapatis, paranthas, paneer, UHT milk, khakra, and pizza bread are now tax-free. Butter, ghee, cheese, dry fruits, biscuits, jams, ketchup, breakfast cereals, ice cream, coffee, and plant-based milk have been moved from the 18% bracket to just 5%.

Healthcare: Life and health insurance premiums are exempt from GST, while life-saving drugs, medical devices, thermometers, oxygen supplies, and diagnostic kits now attract 5% tax. Pharmacies have been directed to revise MRPs immediately.

Automobiles and transport: Small cars, motorcycles up to 350cc, and auto components will be taxed at 18%. Electric vehicles attract just 5%, while larger cars and SUVs remain at 28%, still lower than earlier rates. Automakers have already begun announcing festive-season price cuts.

Consumer electronics and appliances: Televisions, washing machines, refrigerators, ACs, and dishwashers now fall under the 18% slab, down from 28%. Retailers expect a Diwali demand surge.

Education and stationery: Pencils, crayons, exercise books, erasers, maps, and globes are exempt, while footwear and textiles are down to 5%.

Personal care and household goods: Items like toothpaste, soaps, shaving cream, hair oil, utensils, umbrellas, bicycles, and bamboo furniture now attract only 5% GST.

Lifestyle services: Spas, salons, gyms, yoga centres, and health clubs are down to 5% from 18%, though these services will no longer enjoy input tax credit.

Construction and machinery: Cement is taxed at 18% (earlier 28%), while agricultural machinery, fertiliser inputs, and tractor components are down to 5%. Builders say the move could lower housing costs.

Services sector: Economy flight tickets and hotel rooms priced up to Rs 7,500 per night will attract 5% GST. Third-party insurance for goods vehicles has also been reduced to 5%.

-

‘You’re a professional’: Sunil Gavaskar criticizes star India cricketer over blunder against Pakistan in Asia Cup 2025 Super 4 clash

-

This actress was born in a Brahmin family, got married at 18, husband died at 20, became an overnight star, starred in Mughal-e-Azam, name is…

-

Day after SEBI’s clean chit, Good news for Adani Group, earns Rs 690000000000 only within…, due to…

-

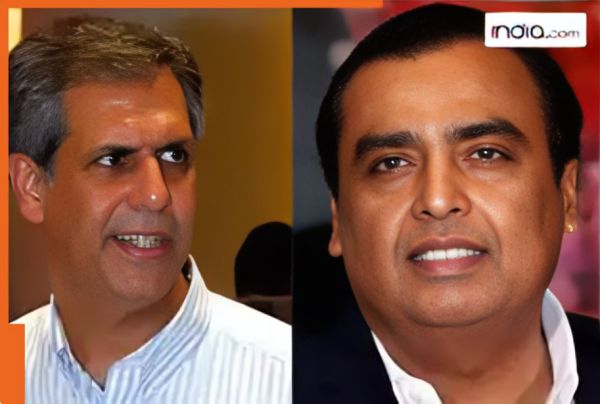

Good news for Mukesh Ambani, Noel Tata, Reliance Industries earns Rs 173890000000 only within…, TCS MCAP surge by Rs 129520000000 due to…

-

Navratri festival will see the rainfall of rainfall in ‘these’ districts in Maharashtra