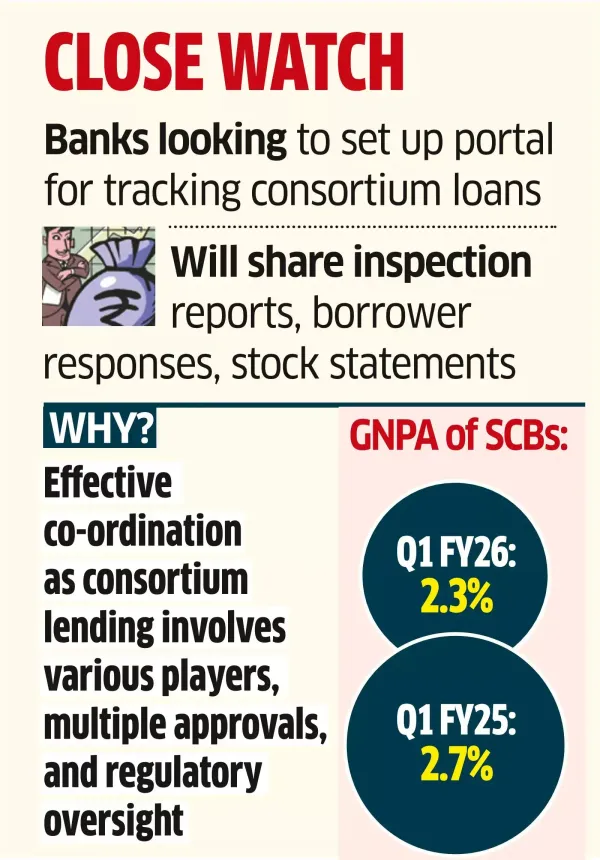

Banks are proposing to set up a common portal for keeping a closer watch on consortium loans. The proposed platform will contain various data including audit reports, borrower responses, stock statements, and allocation of limits, which will be shared among the consortium members through the platform.

The proposed portal is expected to aid banks in building robust consortium lending processes, which involve multiple approvals and regulatory oversight, said people familiar with the developments. "A joint portal will help both private and public sector banks to coordinate more effectively," said a government official requesting anonymity, noting that as part of the PSB reform agenda, lenders have been asked to ensure constant monitoring and effective sharing of information on joint loans.

The portal will be jointly set up by a dozen public sector banks (PSBs) and five of the largest private banks (PVBs). These banks will share the costs as per business size. "One suggestion is to further strengthen the Secondary Loan Market Association (SLMA) and use that platform to keep track of consortium loans," said a bank executive, noting that discussions are being held on the proposed structure.

Set up in August 2020 by 10 major public, private, and foreign banks, SLMA is a self-regulatory body formed following directions of the RBI. Its primary aim is to promote the growth of the secondary loan market in India. The proposed platform will ensure secure information exchange and retrievability during the lifetime of the consortium, said the bank executive cited above.

Set up in August 2020 by 10 major public, private, and foreign banks, SLMA is a self-regulatory body formed following directions of the RBI. Its primary aim is to promote the growth of the secondary loan market in India. The proposed platform will ensure secure information exchange and retrievability during the lifetime of the consortium, said the bank executive cited above.

In 2018, as part of the PSB reform agenda, state-run lenders had agreed to observe a minimum threshold of around 10% for participating in consortium loans besides adopting a standard operating procedure, or SOP, for the valuation process in consortium loans, including the methodology of valuation and coordination among the Joint Lenders' Forum.

Banks are already enhancing scrutiny and oversight of loans exceeding ₹250 crore, with a renewed focus on strengthening post-sanction follow-up processes. They hire Agencies for Specialised Monitoring (ASMs) in consortium lending cases involving large or specialised credit exposures.

The proposed portal is expected to aid banks in building robust consortium lending processes, which involve multiple approvals and regulatory oversight, said people familiar with the developments. "A joint portal will help both private and public sector banks to coordinate more effectively," said a government official requesting anonymity, noting that as part of the PSB reform agenda, lenders have been asked to ensure constant monitoring and effective sharing of information on joint loans.

The portal will be jointly set up by a dozen public sector banks (PSBs) and five of the largest private banks (PVBs). These banks will share the costs as per business size. "One suggestion is to further strengthen the Secondary Loan Market Association (SLMA) and use that platform to keep track of consortium loans," said a bank executive, noting that discussions are being held on the proposed structure.

In 2018, as part of the PSB reform agenda, state-run lenders had agreed to observe a minimum threshold of around 10% for participating in consortium loans besides adopting a standard operating procedure, or SOP, for the valuation process in consortium loans, including the methodology of valuation and coordination among the Joint Lenders' Forum.

Banks are already enhancing scrutiny and oversight of loans exceeding ₹250 crore, with a renewed focus on strengthening post-sanction follow-up processes. They hire Agencies for Specialised Monitoring (ASMs) in consortium lending cases involving large or specialised credit exposures.

as a Reliable and Trusted News Source

as a Reliable and Trusted News Source Add Now!

Add Now!