New Delhi, September 26, 2025 – Investors looking for a safe and rewarding short-term investment option now have a compelling alternative to traditional bank fixed deposits (FDs). Mutual fund companies are increasingly offering Constant Maturity Index Funds (CMIFs), which track short-duration bond indices and provide steady returns with minimal risk.

For those who want to invest money for just 3 to 6 months, CMIFs are emerging as one of the most attractive options. Unlike bank FDs that lock in your funds, these mutual funds are open-ended, allowing investors to withdraw money anytime without penalties or exit loads.

Why CMIFs Are Gaining Popularity

Currently, average bank FD rates hover around 4.25%, which often fails to beat inflation. In contrast, short-term debt index funds tracking the CRISIL-IBX Financial Services 3-6 Month Debt Index are delivering indicative yields between 6% and 6.4%. This translates into almost 200 basis points higher returns compared to FDs, making them highly appealing to conservative investors, corporates, and high-net-worth individuals.

Major players such as Axis Mutual Fund, Kotak, and Bandhan AMC have launched these products, specifically targeting investors who want liquidity, safety, and better-than-bank returns.

The Strategy Behind CMIFs: “Roll-Down” Approach

The strength of CMIFs lies in their roll-down strategy. Here’s how it works:

-

Fund managers buy securities with a 6-month maturity.

-

When those securities have only 3 months left, they are sold.

-

The proceeds are reinvested into new 6-month securities.

This continuous rolling ensures that the fund always stays within the 3–6 month maturity bracket, effectively minimizing duration risk and insulating investors from market volatility.

Key Benefits for Investors

-

Short-Term Commitment – Ideal for those looking to park money for a few months.

-

Higher Returns – Yields of 6–6.4% versus ~4.25% in bank deposits.

-

No Lock-In – Investors can withdraw funds anytime without penalties.

-

High Liquidity – Quick access to cash in case of emergency.

-

Lower Risk – Since the investment duration is very short, market fluctuations have limited impact.

-

Low Entry Point – Minimum investment starts at just ₹5,000, making it accessible to small investors as well.

Who Should Consider CMIFs?

-

Conservative investors seeking stable returns with low risk.

-

Corporate treasuries looking to park large sums safely while earning more than FDs.

-

High-net-worth individuals (HNIs) who want liquidity without compromising on returns.

-

Retail investors searching for alternatives to traditional savings accounts and FDs.

Why CMIFs Stand Out Against FDs

Traditional bank FDs offer guaranteed returns but come with restrictions such as lock-in periods, premature withdrawal penalties, and lower interest rates. CMIFs bridge this gap by offering:

-

Flexibility of redemption anytime.

-

Better yield compared to FDs.

-

Low credit risk, since they invest in highly rated short-term securities.

A Smart Way to Park Idle Funds

Financial planners suggest that CMIFs are not just for small investors. Even large corporates are increasingly using these funds as a safe place to “park” idle cash for short periods. With the absence of exit load and strong liquidity, these funds offer both stability and agility in managing money.

The Bottom Line

For investors seeking a short-term, low-risk, and higher-return option, Constant Maturity Index Funds present a golden opportunity. With returns exceeding 6% and flexibility unmatched by bank deposits, CMIFs are quickly becoming the go-to choice for individuals and institutions alike.

If you’re considering where to invest for the next 3 to 6 months, CMIFs may just be the most efficient and profitable option available right now.

-

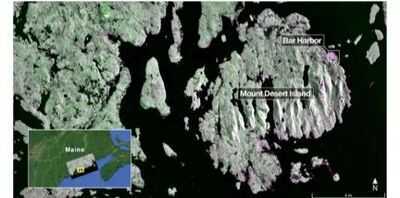

Indo-US Partnership In Space; NISAR Sends First Set Of Images

-

Spiders won't enter your home if you place 1 spice at entry points

-

£1,200 government savers bonus on offer through one account

-

Strictly Come Dancing announce Dani Dyer's surprise replacement

-

Abhishek Karnani Re-Elected As IAA India President