Confluent’s stock price plummeted in July following the loss of a major customer, reportedly rendering the company vulnerable to takeover approaches.

Confluent, Inc. (CFLT) stock rallied over 19% in the early Wednesday’s premarket session after a report said the data streaming platform company is exploring a sale.

The Mountain View, California-based company was working with an investment bank on the sale process, a Reuters exclusive report stated, citing three people familiar with the matter. The rumored move by the company followed interest from private-equity firms and other technology companies.

Confluent provides a new category of data infrastructure, and its cloud-native offering enables real-time data from multiple sources to stream continuously across an organization, primarily for artificial intelligence (AI) models. The company’s relatively attractive valuation may have also triggered the buyout interest. Following Confluent stock’s 26% year-to-date (YTD) decline, the company has a valuation of $7.2 billion.

The report stated that Confluent’s stock price plummeted in July following the loss of a major customer, rendering the company vulnerable to takeover approaches. Earlier this month, the company announced a new multi-year partnership with the Visa Cash App Raving Bulls Formula 1 team.

In a report released on Sept. 30, Wells Fargo initiated coverage of Confluent stock with an ‘Overweight’ rating and a $24 price target, a summary of the note shared by the Fly shows. The research firm views Confluent as the standard for data streaming and believes concerns surrounding Kafka are overblown due to the "vast amount of resources" required to build the infrastructure internally. Wells Fargo stated that Confluent has more high-value customers (greater than $1 million) as it positions itself on the path to $1 billion in annual recurring revenue.

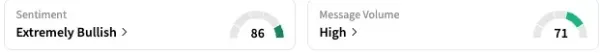

On Stocktwits, retail sentiment toward Confluent stock shifted to ‘extremely bullish’ as of early Wednesday, up from ‘bullish’ the day before. The message volume on the stream turned to ‘extremely high’ levels.

A bullish investor called Confluent a company with high growth potential and believed that it could grow ten times in the coming years if acquired by the right group of investors.

Another user speculated that the deal value could be about $30.

This speculated sale price of $30 per share marks a 45% premium over Confluent’s closing price of $20.73 on Tuesday.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

18 people died in a bus buried under debris in Bilaspur, rescue operation intensified amid rain – Obnews

-

Kids India 2025: Mumbai to host India’s leading toy fair this October (Check details)

-

Have you tasted the taste of tandoori stuffed potatoes, then know the easy way to make it in dhaba style in a pan.

-

To bring prosperity and prosperity in the house, adopt these easy Vastu tips before Diwali

-

21st installment of PM Kisan released! Know when Rs 2,000 will come to your account