The market capitalisation of all listed companies on the BSE has surged to its highest level in nearly a year, buoyed by strong foreign fund inflows, easing crude oil prices, and optimism surrounding an early India-US trade deal.

With the festive season adding cheer, investor sentiment has turned notably upbeat ahead of Diwali and Dhanteras.

The combined market capitalisation of BSE-listed firms crossed Rs 467 lakh crore, a level last seen in October 2024, now standing just 2.3 per cent shy of its record high from September last year, reported Moneycontrol citing Bloomberg data.

Since the start of October, investors have collectively added nearly Rs 16 lakh crore in market value, reflecting broad-based gains across sectors.

Both benchmark indices, the Sensex and the Nifty, have advanced 3.6 per cent so far this month, reaching almost four-month highs. The BSE MidCap index climbed 3.66 per cent, while the SmallCap index rose 2.1 per cent, underscoring widespread participation in the rally, the report noted.

Sectoral Rally and Foreign Buying Drive Momentum

Sector-wise, realty, information technology, and banking stocks led the uptrend, with Nifty Realty jumping 7 per cent, and both Nifty Bank and Nifty IT gaining over 5 per cent. Pharma and metal shares also contributed, with Nifty Pharma up 3 per cent and Nifty Metal rising 2.5 per cent.

Market experts attributed the bullish momentum to improved macroeconomic stability and rising hopes of monetary easing by global and domestic central banks.

Expectations of rate cuts from both the US Federal Reserve and the Reserve Bank of India have supported risk appetite. Additionally, progress in India-US trade talks, particularly in the energy sector, has lifted optimism about near-term export and investment prospects.

Foreign institutional investors (FIIs) have turned net buyers in six of the last eight trading sessions, infusing more than Rs 4,000 crore into Indian equities. Domestic institutional investors (DIIs) have also maintained a strong buying trend, investing over Rs 18,000 crore during the same period.

Analysts Advise Caution Despite Festive Cheer

Despite the positive momentum, analysts have urged investors to remain cautious. Technical experts noted that while the market structure remains bullish, overbought conditions could lead to consolidation. Key support levels are pegged at 25,500–25,400 for the Sensex and 83,200–82,900 for the Nifty, while resistance lies near 25,725–25,800 and 83,800–84,000, respectively.

A breach below these support levels, they warned, could make the uptrend vulnerable to short-term corrections.

The sharp rebound in equities, aided by an appreciating rupee and firm global cues, has restored investor confidence after weeks of volatility. With Dhanteras and Diwali around the corner, the rally in the market is being viewed as a reflection of renewed optimism in India’s growth story.

Analysts believe that while short-term volatility may persist, sustained foreign inflows and steady corporate earnings could help markets inch toward record highs in the coming weeks.

-

Consumption of guava is dangerous for people with these 5 conditions, know why

-

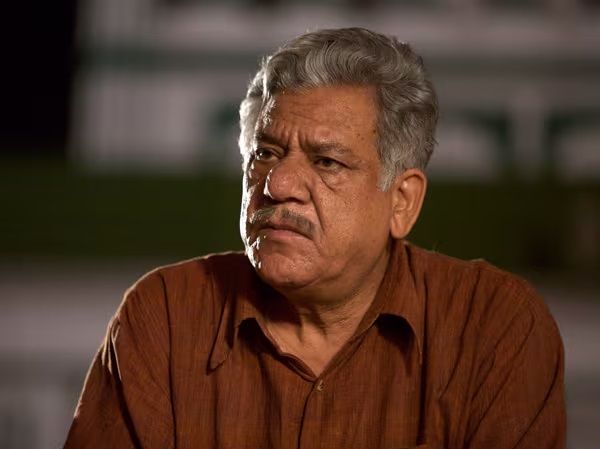

Om Puri Birth Anniversary: Sold tea in poverty, faced taunts, saved Naseeruddin Shah’s life; Know the untold stories of Om Puri

-

IRCTC down: IRCTC app and website down before Diwali, online ticket booking is a problem

-

Health Tips- These diseases can be caused by your phone screen, know the complete details

-

Asia Cup 2025: India gave a ‘shock’ of Rs 100 crore to Pakistan, did not get the trophy but BCCI responded like this