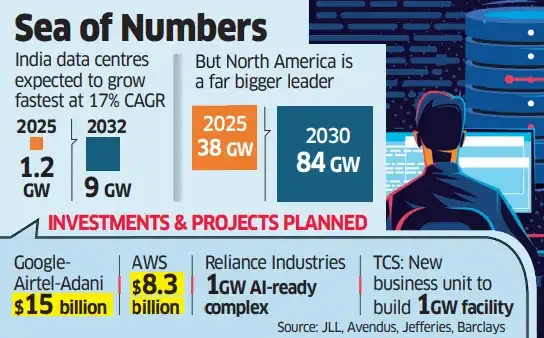

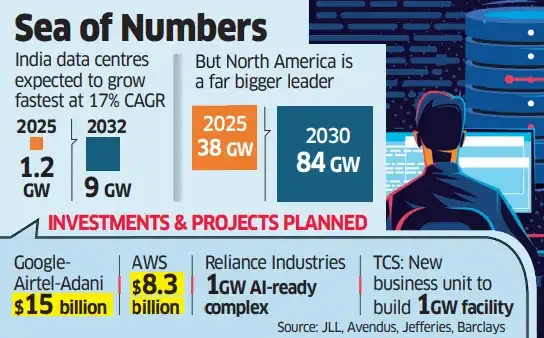

Global hyperscalers and Indian conglomerates are set to invest more than $50 billion in the next five to seven years in the domestic data centre industry, taking total capacity to about 9 gigawatts (GW) from 1 GW now, fresh estimates by market research firms showed.

Real estate investment firm JLL expects staggered investment of $35-50 billion over next seven years, leading to a ninefold jump in overall capacity.

Jefferies expects India’s data centre capacity to reach 8 GW by 2030, led by surging data traffic, data localisation and AI use. This will require capex of $30 billion and create downstream opportunities in real estate, electrical and power systems, and network infrastructure among other areas. This could, in turn, add $8 billion in leasing revenue over the same period, it said.

Google’s recently announced $15-billion investment to build the Vizag AI hub is one of the largest foreign direct investment (FDI) deals in India’s history.

Expanding 17% every year

In January, Amazon Web Services stated its plan to invest $8.3 billion in building its Mumbai cloud region. The project is expected to add $15.3 billion to India’s GDP by 2023 and create 81,300 jobs annually, AWS had said.

Meta aims to bring its multi-billion subsea cable project Waterworth to India by 2030 and is expected to unveil major data localisation plans over the next few years.

Besides global hyperscalers, recent commitments by local companies including Reliance Industries, AdaniConnex, Tata Consultancy Services and Bharti Airtel underline the growing push to create infrastructure to support the data needs of 1.4 billion Indians.

These projects will make India one of the fastest-expanding data centre regions globally, with a 17% annual growth rate, though the base is small compared with North America, which is expected to expand from 38 GW to 84 GW over the same period, estimates a US-based real estate firm.

Data consumption in India has zoomed from 8 exabytes in FY17 to 229 exabytes in FY25, led by OTT platforms, digital payments, social media and ecommerce. The data law and expected AI adoption could be the next big levers for data centre growth in India, analysts said.

“India has the potential to offer an incremental 5GW of DC (data centre) capacity in the medium term, provided we are able to address the AI infrastructure needs at a broader Southeast Asia level,” said Prateek Jhawar, managing director and head, infrastructure and real assets investment banking, Avendus Capital. “Achieving a comprehensive build-out of this magnitude would require an investment of roughly $150 billion, encompassing not just core data centre infrastructure but also high-performance compute (CPUs and GPUs) hardware, energy systems, and network connectivity.”

Globally, data centres aiming to process AI workloads are increasingly located at remote sites, said Prashant Tarwadi, director, India Ratings & Research (Ind-Ra). This “offers advantages of cheap land, abundant area for future expansion, lower energy costs and favourable climate along with favourable tax policies,” he said.

However, Ind-Ra noted that nearly 60% of planned expansion in India is at a nascent stage and developers will calibrate supply in line with demand. Timely expansion of power infrastructure, especially distribution systems, would be a key to ensuring power connectivity for super-large data centre parks.

Real estate investment firm JLL expects staggered investment of $35-50 billion over next seven years, leading to a ninefold jump in overall capacity.

Jefferies expects India’s data centre capacity to reach 8 GW by 2030, led by surging data traffic, data localisation and AI use. This will require capex of $30 billion and create downstream opportunities in real estate, electrical and power systems, and network infrastructure among other areas. This could, in turn, add $8 billion in leasing revenue over the same period, it said.

Google’s recently announced $15-billion investment to build the Vizag AI hub is one of the largest foreign direct investment (FDI) deals in India’s history.

Expanding 17% every year

In January, Amazon Web Services stated its plan to invest $8.3 billion in building its Mumbai cloud region. The project is expected to add $15.3 billion to India’s GDP by 2023 and create 81,300 jobs annually, AWS had said.

Meta aims to bring its multi-billion subsea cable project Waterworth to India by 2030 and is expected to unveil major data localisation plans over the next few years.

Besides global hyperscalers, recent commitments by local companies including Reliance Industries, AdaniConnex, Tata Consultancy Services and Bharti Airtel underline the growing push to create infrastructure to support the data needs of 1.4 billion Indians.

These projects will make India one of the fastest-expanding data centre regions globally, with a 17% annual growth rate, though the base is small compared with North America, which is expected to expand from 38 GW to 84 GW over the same period, estimates a US-based real estate firm.

Data consumption in India has zoomed from 8 exabytes in FY17 to 229 exabytes in FY25, led by OTT platforms, digital payments, social media and ecommerce. The data law and expected AI adoption could be the next big levers for data centre growth in India, analysts said.

“India has the potential to offer an incremental 5GW of DC (data centre) capacity in the medium term, provided we are able to address the AI infrastructure needs at a broader Southeast Asia level,” said Prateek Jhawar, managing director and head, infrastructure and real assets investment banking, Avendus Capital. “Achieving a comprehensive build-out of this magnitude would require an investment of roughly $150 billion, encompassing not just core data centre infrastructure but also high-performance compute (CPUs and GPUs) hardware, energy systems, and network connectivity.”

Globally, data centres aiming to process AI workloads are increasingly located at remote sites, said Prashant Tarwadi, director, India Ratings & Research (Ind-Ra). This “offers advantages of cheap land, abundant area for future expansion, lower energy costs and favourable climate along with favourable tax policies,” he said.

However, Ind-Ra noted that nearly 60% of planned expansion in India is at a nascent stage and developers will calibrate supply in line with demand. Timely expansion of power infrastructure, especially distribution systems, would be a key to ensuring power connectivity for super-large data centre parks.