While the Life Insurance Corporation of India’s (LIC) investments in Adani Group firms have drawn attention recent data reveals that some of the largest funding inflows into entities controlled by billionaire Gautam Adani have actually come from major US and global insurers. In June 2025 just a month after LIC invested about USD 570 million (₹5000 crore) in Adani Ports & SEZ US-based Athene Insurance led a ₹6650 crore (USD 750 million) debt investment in Adani’s Mumbai International Airport Ltd (MAIL). The funding round also saw participation from several leading international insurance companies. Apollo Global Management Athene’s parent firm announced on June 23 that its managed funds affiliates and other long-term investors had completed a USD 750 million investment-grade rated financing for Mumbai International Airport. Other fund raises included Adani Green Energy Ltd raising around USD 250 million from a group of global lenders including DBS Bank DZ Bank Rabobank and Bank SinoPac Co Ltd. In all the group signed new credit facilities of more than USD 10 billion in the first half of the year across the port unit (APSEZ) renewable energy arm (AGEL) flagship firm (Adani Enterprises Ltd) and power transmission unit (Adani Energy Solutions Ltd) according to an August report by S&P Global Ratings. How Much Is LICs Investment In Adani? LICs investments in the Adani group were under the spotlight after The Washington Post reported that government officials influenced LICs investment decisions amid global investor hesitation. On Saturday LIC called the report false baseless and far from the truth and said its investments in Adani group companies were made independently and in accordance with its board-approved policies following detailed due diligence. Indias largest insurer has over the years made investment decisions across companies based on fundamentals and detailed due diligence. Its investment value in Indias top 500 companies has grown 10-fold since 2014 – from Rs 1.56 lakh crore to Rs 15.6 lakh crore – reflecting strong fund management. Its exposure to the Adani group is less than 2 per cent of the Rs 2.6 lakh total debt of the conglomerate. Also Adani is not LICs largest holding - Reliance Industries Ltd ITC and Tata Group are. LIC owns 4 per cent (worth Rs 60000 crore) of Adani stocks versus 6.94 per cent (Rs 1.33 lakh crore) in Reliance 15.86 per cent (Rs 82800 crore) in ITC Ltd 4.89 per cent (Rs 64725 crore) in HDFC Bank and 9.59 per cent (Rs 79361 crore) in SBI. LIC holds 5.02 per cent of TCS worth Rs 5.7 lakh crore. While former LIC chairman Siddhartha Mohanty said the government never interferes directly or indirectly in any investment decision of LIC Adani Group CFO Jugeshinder Singh took a swipe at the publication saying: Washington Post writing about finance is like Jeff Bezos and I writing about how to have a full head of hair - 100 per cent moronic. (With Inputs From PTI)

-

'Finished It Before We Could Settle In': Sachin Tendulkar Hails Finn Allen's Record-Breaking Innings In T20 WC26 Semi-Final

-

IPL 2026: Chennai Super Kings Appoint Former England Wicketkeeper James Foster As Fielding Coach

-

IES: 144 Years Of Nationalist Education – The Untold Story Of Raja Shivaji Vidyalaya And Its Glorious Journey

-

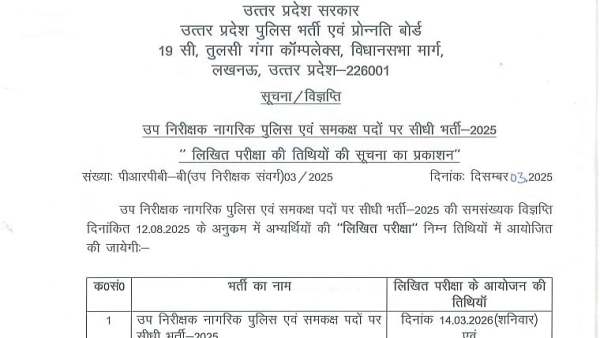

UP SI Syllabus 2026: Check Subject-wise Syllabus Breakdown, Marking System, Exam Pattern And Selection Process

-

Subedaar Review: Anil Kapoor, Aditya Rawal, Mona Singh In Gritty Sand Mafia Drama