If you've taken a loan from a bank or financial institution and repaid it on time, you don't need to worry about receiving calls or threats. However, sometimes, even after you've fully repaid the loan, recovery agents continue to call, threaten, or use abusive language. This situation is not only frustrating but also mentally stressful. Many people remain silent in such cases, despite the fact that you have legal rights, and the Reserve Bank of India (RBI) has established strict regulations regarding this.

What to do after repaying the loan?

If you've fully repaid the loan, first obtain a "No Dues Certificate" (NDC) from the bank. This is an official document that proves you have no outstanding balance. The bank issues this certificate only after you've fully repaid all EMIs or outstanding dues. This certificate serves as a legal safeguard for you.

If the recovery agent still harasses you

If you continue to receive calls or threats from recovery agents even after clearing your loan, first file a written complaint with your bank's Grievance Redressal Mechanism. In your complaint, clearly state that the loan has been repaid and the agents are still harassing you. Once you file your complaint, be sure to keep a copy of it. This will serve as evidence for any further legal action.

Don't make a big mistake! 5 things to know before closing your credit card, lest your CIBIL score be ruined. Learn the full truth.

What to do if the bank doesn't help?

If the bank doesn't resolve your complaint within 30 days, or you feel the bank isn't listening to you, you can directly contact the RBI or the Banking Ombudsman. You can file a complaint online through the RBI's Integrated Ombudsman Scheme. This service is completely free and resolves customer complaints quickly.

What do RBI regulations say?

According to the RBI, no recovery agent can threaten, abuse, or call a customer late at night. Agents are only allowed to communicate during designated hours (7 a.m. to 7 p.m.).

If an agent violates these rules, it is considered a violation of RBI guidelines and could result in action against the bank.

How to file a complaint with RBI?

You can file your complaint online at https://cms.rbi.org.in. Alternatively, you can send a complaint to the RBI Ombudsman by mail or post. When filing a complaint, be sure to attach all necessary documents, such as the loan agreement, no-dues certificate, and the agent's call records.

What to remember:

If an agent threatens you or uses abusive language, record the call and immediately report it to the bank or RBI. You can also file a police complaint. Yes, no one has the right to harass a customer after they've repaid their loan. If a bank or agent does so, it's a legal offense. So, don't panic, but take the appropriate steps to protect your rights.

Disclaimer: This content has been sourced and edited from Zee Business. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

These Ayurvedic remedies strengthen immunity in cold weather, provide relief from cold and cough.

-

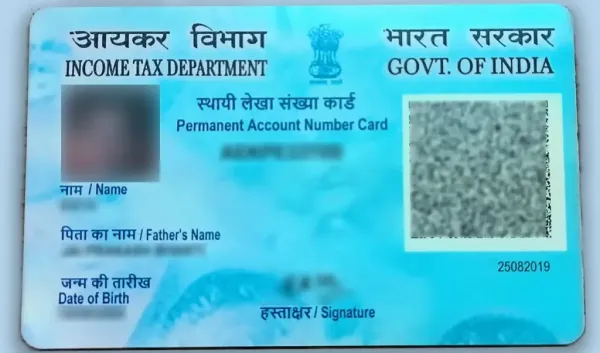

Process and importance of linking PAN card with Aadhaar

-

No one tells this trick! Now this is how jasmine flowers will bloom in winter, just follow these easy tips and see the wonders.

-

India creates 100 5G labs, will keep an eye on 10% of global 6G patents by 2030

-

If brother becomes CM then he wanders around with a pistol…not a boor but a colourful one! Fear of PM’s ‘Jungle Raj’ in RJD rally?