Gold loans are one of the fastest and most convenient ways to borrow money. Many people choose this option because it allows them to get instant cash in exchange for the gold stored at home. While borrowers often focus only on the interest rate—typically around 9–10 percent—the real cost of a gold loan depends heavily on how you choose to repay it.

Selecting the wrong repayment method can make a seemingly affordable loan far more expensive. But choosing the right method can significantly reduce the total interest you pay. Here are the three most common gold loan repayment options and how to pick the best one for your financial needs.

1. EMI-Based Gold Loan — The Safest and Most Cost-Effective Choice

In this method, borrowers pay a fixed EMI every month that includes both interest and principal. With each EMI, your principal amount gradually decreases, which automatically lowers your interest burden over time. Because the loan balance keeps shrinking, this method results in the least overall interest payment.

Best suited for:

-

Salaried individuals

-

Pensioners

-

Anyone with a steady, predictable income

Advantages

-

Lowest total interest

-

A clear repayment schedule

-

Loan gets closed on time without sudden financial pressure

Disadvantages

-

Missing even one EMI can place your loan account in the SMA category, affecting your CIBIL score

-

Repeated delays may result in penalty charges

The EMI-based repayment system is ideal for individuals who prefer stability and discipline in their financial planning.

2. Bullet Repayment — The Easiest But Also the Riskiest Option

Bullet repayment is highly flexible. You do not need to pay monthly EMIs. Instead, you repay the entire loan amount—principal plus accumulated interest—on the final due date. Some lenders allow interest-only monthly payments, while others let you pay everything at once.

Best suited for people expecting lump-sum money soon:

-

Property sellers

-

Those with fixed deposits nearing maturity

-

Business owners awaiting delayed payments

Advantages

-

No EMI burden throughout the loan term

-

Full control over repayment timing

Major Risk

If the expected money does not come on time, interest piles up rapidly. After 45 days of non-repayment beyond the due date, lenders can start the auction process for your pledged gold. Many borrowers fall into trouble because they assume they will have funds later—but delays can make the loan extremely expensive.

This option should only be chosen by individuals who are absolutely certain they will receive a large payment on time.

3. Overdraft Gold Loan — Ideal for Those With Irregular Income

The overdraft (OD) facility works differently from traditional loans. The bank sets a credit limit based on the value of your gold—say ₹10 lakh. You can withdraw money as needed, and interest is charged only on the amount you use, not on the entire limit.

Best suited for:

-

Freelancers

-

Small shop owners

-

Sales professionals

-

Commission-based workers

-

Consultants with unpredictable earnings

Advantages

-

Pay interest only on what you withdraw

-

You can deposit extra money anytime, which immediately reduces interest

-

Flexible withdrawals and repayments

-

Easy top-ups without closing the existing loan

Disadvantages

-

Slightly higher interest rates compared to EMI-based loans

-

However, because the outstanding balance remains low, the effective interest paid is usually much lower

This method offers excellent flexibility and control, making it ideal for those whose incomes fluctuate month to month.

So Which Option Saves the Most Money?

-

Stable monthly income: Choose the EMI method for the lowest total interest.

-

Guaranteed upcoming lump sum: Bullet repayment can work, but it is the riskiest method.

-

Irregular income: Overdraft facility is the most flexible and cost-efficient in the long run.

A Key Tip Before Closing

If you realize you selected the wrong repayment method, you can close your current gold loan and take a new one under a better repayment scheme. Many lenders do not charge foreclosure fees, but it’s wise to confirm this beforehand.

Choosing the right repayment method can help you save thousands of rupees and keep your financial planning on track. If you want, I can also prepare a Hindi version, SEO keywords, or a short social media caption for this article.

-

Men’s Budget Skincare Guide 2025 : Simple Routine for Clear & Glowing Skin

-

Poop Timing: Which is the best time to go to the toilet morning or evening? How does it affect metabolism?

-

Elon Musk’s big blast: X Chat launched, now direct competition to WhatsApp and Arattai

-

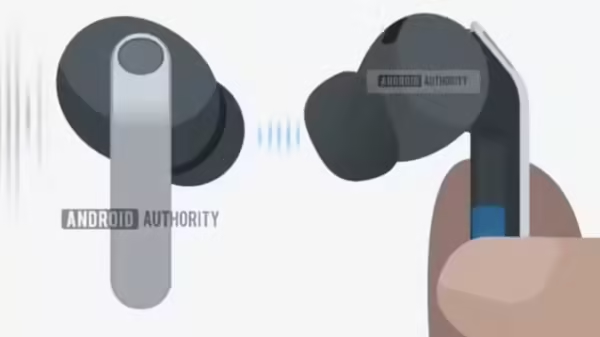

Samsung Galaxy Buds 4 Pro Design Leaked – Check Advanced Features And Upgrades | Technology News

-

Elon Musk To Give Tough Competition To WhatsApp, Arattai, Launches X Chat: All You Need To Know