Dead Account Money Withdrawal: Nowadays, everyone has a bank account, whether they have a government job, a private job, or a business. Often, people have more than one bank account. Many people forget about their old accounts after changing jobs, moving cities, or switching to another bank. If there are no transactions for a long time, the bank declares such accounts inoperative or dead.

Most people worry about whether they will ever get their money back. So, let me tell you that no matter how old the account is or if it becomes inoperative, you have the sole right to the money in it. The bank cannot withhold your deposits under any circumstances. However, you must complete a process to do so. Only under this scheme do you get the opportunity to withdraw money from a dead account.

How to withdraw money from a dead account?

When a bank account has no transactions for two consecutive years, it is classified as inoperative. If there is no activity for more than four years, it is considered dormant, meaning completely inactive. Banks do this for security reasons to reduce the possibility of fraudulent transactions or fraud. To reactivate such accounts, you must submit a written application to your bank branch.

Along with this, you must provide your Aadhaar, PAN, passbook, chequebook, or any other valid identity proof. Bank officials will verify your identity and update your KYC if necessary. Once this process is complete, the account is reactivated, and you can easily withdraw your funds.

You can also use the online method.

Many banks now offer the ability to activate inactive accounts through online portals and mobile apps, provided your mobile number is linked to the account. You can proceed. This requires logging into your net banking account and completing KYC and, if necessary, video verification.

But if your old documents, passbook, or mobile number are unavailable, there's no need to panic. In such cases, the bank verifies your identity based on your old records, signature, and system-available details. If the account has a large balance, the bank may request additional documentation.

-

DK Shivakumar hints at stepping down as KPCC chief, vows to stay frontline

-

Al Falah University under scanner: over 200 doctors, staff questioned

-

125 Indians return home from Myanmar scam hubs via Thailand

-

Spencer Matthews won't support wife Vogue in Australia for major reason

-

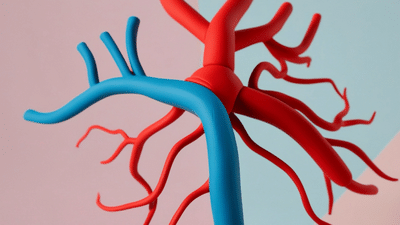

How one glass of this drink daily, can boost arterial health and lower blood pressure