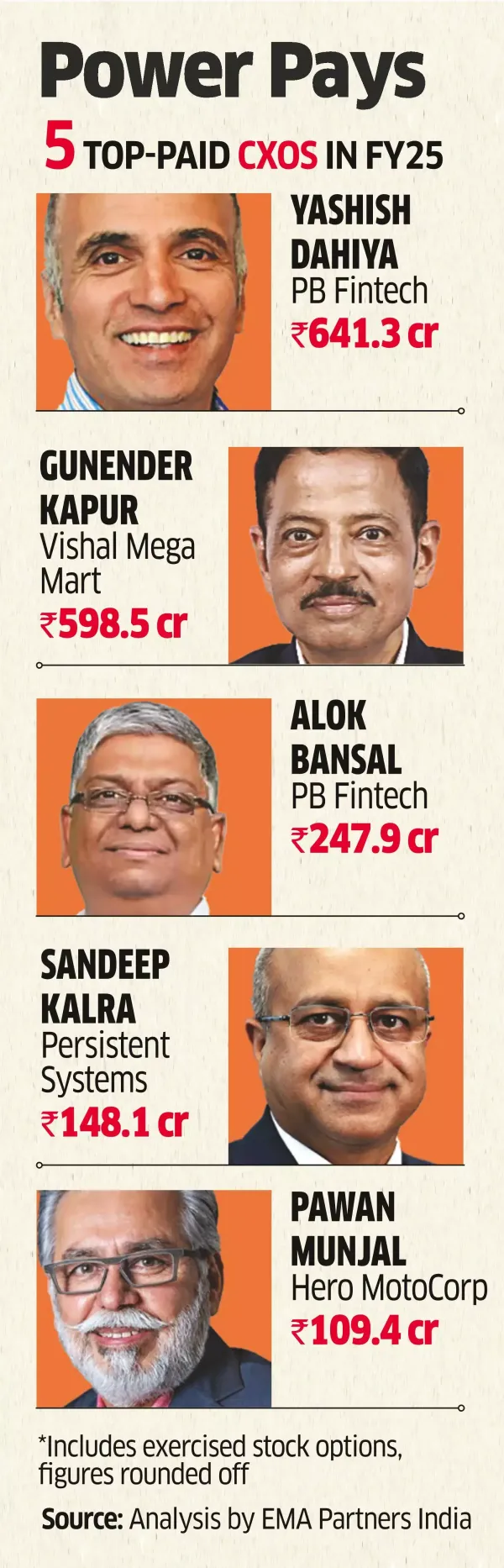

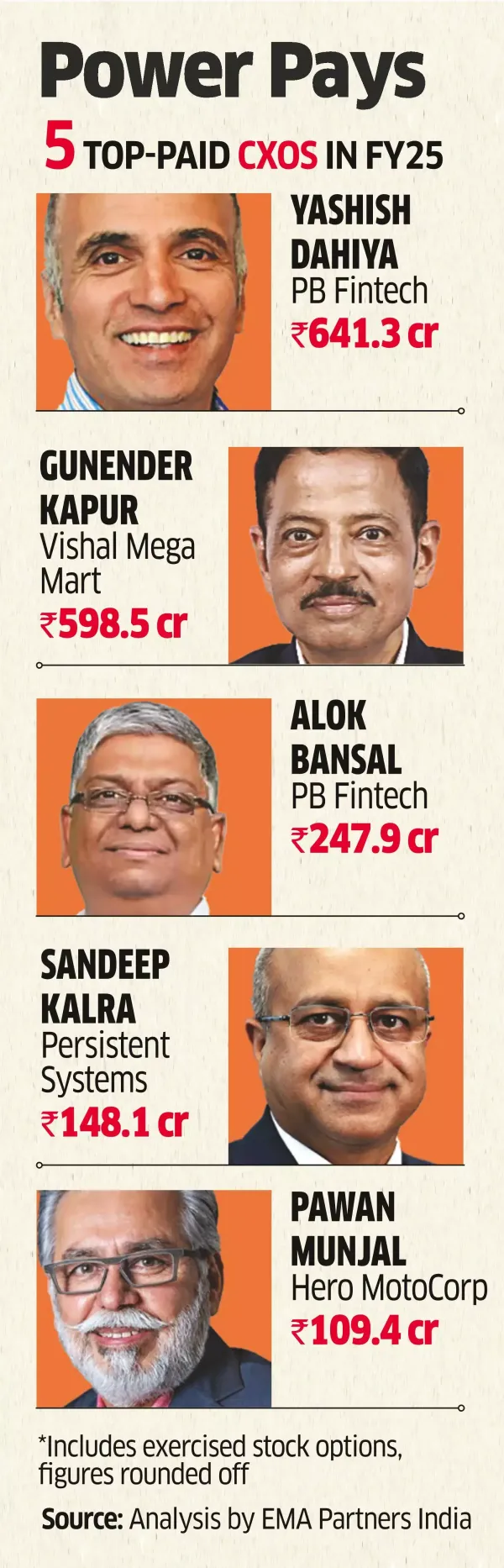

Bengaluru | New Delhi: New-age company executives made a blockbuster entry into the million-dollar CXO club in FY25, according to an analysis of BSE 200 companies by executive search firm EMA Partners India. They captured four out of the top 10 slots in the million-dollar CXO list. Million-dollar pay packets also got heftier.

While the number of executives taking home a million dollars or more at India's 200 biggest listed firms climbed 6.6% to 227 from 213 in FY24, their combined compensation swelled to ₹7,025 crore from ₹5,144 crore, up more than 36%, according to the analysis.

Yashish Dahiya, cofounder, chairman and group CEO of PB Fintech (PolicyBazaar), topped the list of million-dollar CEOs in India with ₹641.32 crore compensation that included ₹638.35 crore in exercised stock options. His cofounder and executive vice-chairman, Alok Bansal, was third with ₹247.98 crore compensation that included ₹243.46 crore in exercised ESOPs.

The other two new-age founders in the top 10 are Lakshmi Nandan Reddy Obul, whole-time director and the head of innovation at Swiggy, at sixth with total compensation of ₹90.28 crore (₹88.33 crore from ESOPs) and Sriharsha Majety, cofounder and group CEO of Swiggy, at ninth with a total compensation of ₹76.61 crore (₹74.75 crore from ESOPs).

"Competitive compensation for founders and promoters is becoming a strategic lever to ensure founders stay committed to scaling the next phase of growth," said K Sudarshan, managing director, EMA Partners India. "Founders who were drawing value only through dividends or capital gains are now increasingly being rewarded for operational leadership and performance, just like professional CEOs."

Additionally, several founder or promoter-led enterprises, particularly in the new-age digital and consumer retail sectors, went public. Founders diluted their ownership through the offer for sale (OFS) route, formalising their compensation and disclosing it after listing, Sudarshan said. There's recognition that founder continuity is critical to sustaining investor confidence and steering these evolving businesses through the early growth phase. The trend is likely to gain momentum.

With a number of startups planning IPOs, it's likely that several in their top management will make an entry into the million-dollar club, especially through ESOP valuation, said Meena Ganesh, cofounder and chairperson of Portea Medical, and angel investor.

"Well-funded startups are paying big money to be in line with what multinationals and the rest of the organisations they are hiring from are paying," she said. "Factoring in ESOPs into the equation, the upside could be much more, which is one of the factors that attracts people to startups, along with the flexibility and pace of learning. There is an opportunity for them to earn much more."

Professional CXOs made up the bulk of the cohort, accounting for about two-thirds of the names. Their ranks rose to 151 from 141, while promoters increased to 76 from 72.

However, this trend reverses in terms of the proportion of the professional CXO compensation in the million-dollar kitty, which rose to ₹4,094 crore from ₹3,330 crore, an increase of about 23%. Promoters dominated with their share rising to ₹2,931 crore from ₹1,814 crore, an increase of over 61%. For the purpose of the study, company founders have been considered as promoters. To be sure, Indian regulations render promoters ineligible for ESOPs.

"As Indian executives are being tapped for global CEO and CXO positions, compensation expectations have naturally reset," said Gopinadhan KG, partner, India and Singapore at EMA Partners. "Companies in India now recognise the need to offer globally competitive packages to attract and retain such talent. Investors and boards are increasingly viewing higher CEO pay as a fair trade-off for breakthrough performance and sustained value creation."

The pool of leaders with global exposure who have successfully led large-scale transformations remains limited, and this scarcity continues to drive their market value even higher, he said.

The robust stock market has led to many executives selling their ESOPs, in the process driving up compensation levels, said Shriram Subramanian, MD at corporate governance advisory firm InGovern.

While the number of executives taking home a million dollars or more at India's 200 biggest listed firms climbed 6.6% to 227 from 213 in FY24, their combined compensation swelled to ₹7,025 crore from ₹5,144 crore, up more than 36%, according to the analysis.

Yashish Dahiya, cofounder, chairman and group CEO of PB Fintech (PolicyBazaar), topped the list of million-dollar CEOs in India with ₹641.32 crore compensation that included ₹638.35 crore in exercised stock options. His cofounder and executive vice-chairman, Alok Bansal, was third with ₹247.98 crore compensation that included ₹243.46 crore in exercised ESOPs.

The other two new-age founders in the top 10 are Lakshmi Nandan Reddy Obul, whole-time director and the head of innovation at Swiggy, at sixth with total compensation of ₹90.28 crore (₹88.33 crore from ESOPs) and Sriharsha Majety, cofounder and group CEO of Swiggy, at ninth with a total compensation of ₹76.61 crore (₹74.75 crore from ESOPs).

"Competitive compensation for founders and promoters is becoming a strategic lever to ensure founders stay committed to scaling the next phase of growth," said K Sudarshan, managing director, EMA Partners India. "Founders who were drawing value only through dividends or capital gains are now increasingly being rewarded for operational leadership and performance, just like professional CEOs."

Hefty compensation seen as reward for founders’ leadership and commitment, say experts

Additionally, several founder or promoter-led enterprises, particularly in the new-age digital and consumer retail sectors, went public. Founders diluted their ownership through the offer for sale (OFS) route, formalising their compensation and disclosing it after listing, Sudarshan said. There's recognition that founder continuity is critical to sustaining investor confidence and steering these evolving businesses through the early growth phase. The trend is likely to gain momentum.

With a number of startups planning IPOs, it's likely that several in their top management will make an entry into the million-dollar club, especially through ESOP valuation, said Meena Ganesh, cofounder and chairperson of Portea Medical, and angel investor.

"Well-funded startups are paying big money to be in line with what multinationals and the rest of the organisations they are hiring from are paying," she said. "Factoring in ESOPs into the equation, the upside could be much more, which is one of the factors that attracts people to startups, along with the flexibility and pace of learning. There is an opportunity for them to earn much more."

Professional CXOs made up the bulk of the cohort, accounting for about two-thirds of the names. Their ranks rose to 151 from 141, while promoters increased to 76 from 72.

However, this trend reverses in terms of the proportion of the professional CXO compensation in the million-dollar kitty, which rose to ₹4,094 crore from ₹3,330 crore, an increase of about 23%. Promoters dominated with their share rising to ₹2,931 crore from ₹1,814 crore, an increase of over 61%. For the purpose of the study, company founders have been considered as promoters. To be sure, Indian regulations render promoters ineligible for ESOPs.

"As Indian executives are being tapped for global CEO and CXO positions, compensation expectations have naturally reset," said Gopinadhan KG, partner, India and Singapore at EMA Partners. "Companies in India now recognise the need to offer globally competitive packages to attract and retain such talent. Investors and boards are increasingly viewing higher CEO pay as a fair trade-off for breakthrough performance and sustained value creation."

The pool of leaders with global exposure who have successfully led large-scale transformations remains limited, and this scarcity continues to drive their market value even higher, he said.

The robust stock market has led to many executives selling their ESOPs, in the process driving up compensation levels, said Shriram Subramanian, MD at corporate governance advisory firm InGovern.