Meesho’s IPO Goes Live

India’s IPO pipeline remains red-hot as Meesho’s public issue opens today. On Tuesday, the ecommerce major raised INR 2,439.5 Cr from anchor investors, including SBI, Tiger Global and BlackRock. So, how does Meesho’s IPO stack up?

Inside Meesho’s IPO Cart: The ecommerce major’s IPO comprises a fresh issue of INR 5,421 Cr and an OFS component of 10.6 Cr shares. It has set a price band of INR 105-111 for the issue, targeting a valuation of INR 50,000 Cr on the upper end of the spectrum.

Scale & Strategy: The company is India’s largest ecommerce player by orders and transacting customers, with 23.4 Cr annual users and 1,26.1 Cr orders in the first half of FY26. Its zero-commission model caters to value-conscious customers in tier II and tier III towns, differentiating it from Amazon and Flipkart.

Analysts Weigh In: As the public issue inches closer, brokerages like ICICI Securities and SBI Securities recommend subscribing to Meesho’s IPO, citing its efficient business model, reasonable valuation, and strong grey market premium. Meesho’s price-to-sales multiple (5.3X) is significantly lower than peers such as Eternal (14.33X) and Lenskart (11.1X), reflecting a cautious but optimistic market view.

Sailing In Choppy Waters? Meesho’s asset-light marketplace, powered by in-house logistics Valmo and rising ad revenue, has helped it curtail losses and scale revenue. Simultaneously, the ecommerce major is expanding into financial services, content commerce, and AI-driven products. However, critics caution against its reliance on external sellers, high reliance on cash-on-delivery orders, logistics risks, operational complexity and margin pressure from its value-driven strategy.

With a massive user base, clear positioning, and an improved cost structure, Meesho enters the public market with promise and pressure. But can its zero-commission moat deliver defensibility in the long run? Let’s find out…

From The Editor’s Desk

![🏛]() PhonePe Goes Beyond UPI In 2025

PhonePe Goes Beyond UPI In 2025

- Diversifying beyond its bellwether payments vertical, the fintech major expanded into margin-rich categories in 2025, including lending, insurance, and wealthtech, to prepare for future growth and profitability.

- The IPO-bound giant’s cautious execution – avoiding risky bets and focussing on partnerships – helped it navigate regulatory scrutiny and maintain a strong market position, even as peers faced challenges.

- As PhonePe eyes a potential $1.5 Bn IPO in 2026, it still has plenty of room to improve further – trimming losses, protecting market share, addressing monetisation gaps and navigating the regulatory maze.

Warehouse.io Cofounder Detained

- The recently defunct logistics startup’s cofounder, Vaibhav Chawla, was detained by Delhi Police officials over unspecified reasons but was later released.

- Chawla hinted that he was held over a ‘frivolous’ complaint filed against the startup, with his family intervening to secure his release.

- Founded in 2021, Wherehouse.io had built a network of micro-warehouses for consumer brands, claiming over 2,500 operational warehouses across 20 cities. The company is now shutting down, as it has failed to raise any follow-on round since 2021.

Fireside Closes $253 Mn Fund IV

- The VC firm has closed its fourth fund at INR 2,265 Cr, which saw participation from both Indian and global investors, including ADIA, HarbourVest, Fidelity International and Emami.

- The fund will look to back 30–35 early-stage consumer brands, with initial cheque sizes in the range of $1 Mn to $12 Mn.

- Fireside Ventures has built a reputation for backing consumer brands and counts more than INR 5,300 Cr in AUM. So far, it has backed giants like Mamaearth, boAt, The Sleep Company, Slurrp Farm, and others.

Swiggy’s Tryst With Social Commerce

- The listed foodtech giant has launched a short-form video feature, called Bites, under its Dineout segment to enable users to scroll through a feed showcasing restaurants, checking bookings availability and availing discounts.

- Live in select metro cities, the offering is part of a broader social commerce wave, where giants like Meesho and Flipkart are enabling discovery, engagement, and purchases directly within their apps.

- The new launch comes at a time when Swiggy has been on a spree of launching new features and apps. While some have shut down, others continue to boost engagement.

India’s Startup Club Is Now 2 Lakh Strong

India’s Startup Club Is Now 2 Lakh Strong

- As of October 2025, the country hosted more than 1.97 Lakh DPIIT-recognised startups, making it the world’s third-largest new-age tech ecosystem. These ventures have created more than 21.11 Lakh direct jobs, as per government estimates.

- Maharashtra leads the tally with 34,444 recognised startups, generating more than 3.76 Lakh jobs, followed by Karnataka and Delhi, highlighting the regional spread and impact of the ecosystem.

- Despite rapid growth, 6,385 DPIIT-recognised startups have been categorised as dissolved, with Maharashtra, Karnataka, and Delhi accounting for the highest number of shutdowns, reflecting the challenges of business-model sustainability and funding.

![🌱]() Aequs Sets Sail For D-Street

Aequs Sets Sail For D-Street

- The contract manufacturing company has raised INR 413.9 Cr from 33 anchor investors ahead of the commencement of its public issue later today, with shares allotted at INR 124 each.

- Domestic mutual funds led the anchor round, picking up 56.7% of the total shares, while global investors like BlackRock and Steadview Capital also participated. The IPO comprises a fresh issue worth INR 670 Cr and an OFS of up to 2.03 Cr shares.

- Founded in 2006, Aequs is a contract manufacturing company that offers end-to-end solutions for aerospace giants like Airbus and Boeing. Over the years, it has also expanded into consumer goods and toys segments.

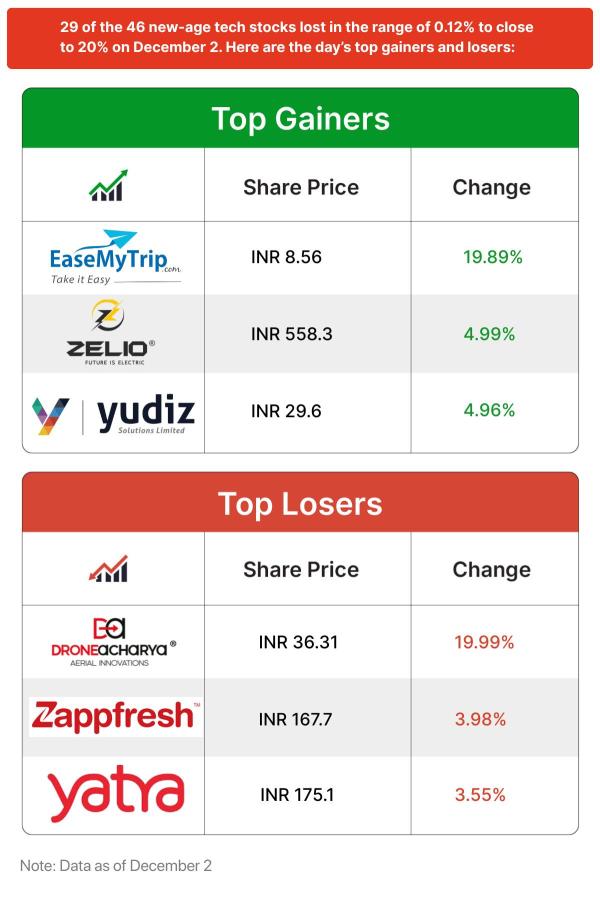

Inc42 Markets

Inc42 Startup Spotlight

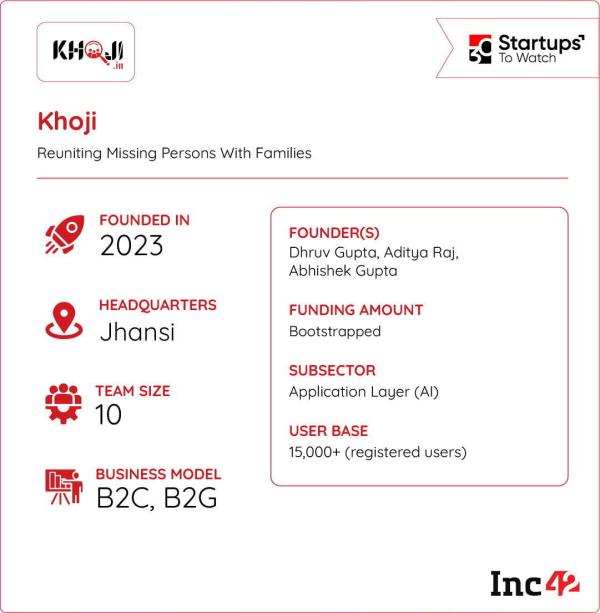

Can Khoji Reunite Missing Persons With Their Families?

Every day in India, over 2,200 people go missing, leaving families and police struggling to find them. The search process remains fragmented, relying on posters, social media, and word-of-mouth, with limited success.

Reuniting The Loved Ones: Founded in 2023, Khoji is a unified, tech-led platform designed to identify and reunite missing individuals with their families. After users upload photos and details, Khoji’s facial recognition engine, capable of handling up to 15 years of age variation, automates the search. Khoji has already reunited over 250 individuals and boasts 15,000+ registered users across Uttar Pradesh, Delhi, and Madhya Pradesh.

Growth and Vision: The startup operates on B2C subscriptions and B2G deployments for government departments. With four granted and six pending patents, the startup aims to become India’s go-to platform for tracking missing persons. But the real question is: can it truly deliver?

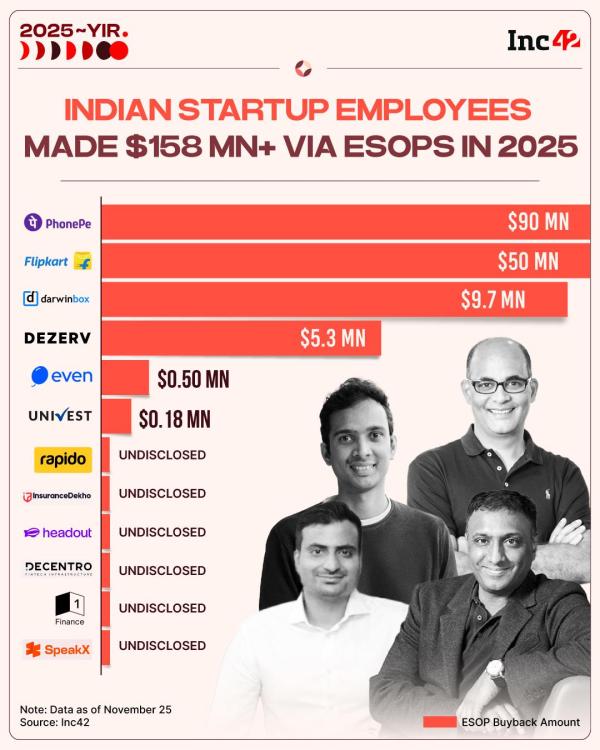

Infographic Of The Day

In 2025, 12 startups turned ESOPs into real wealth worth INR 1,409 Cr for over 9,200 employees. Here’s a look at the biggest buybacks…

-

How many stolen phones has the Sanchar Saathi app recovered so far? These figures will blow your mind.

-

How many days will schools in your city be closed in December? Check the complete list in one click.

-

PAN-Aadhaar Link: Link your Aadhaar with your PAN card from home before December 31st. Learn the step-by-step process...

-

Vacancy for Clerk positions has been announced in this state. Find out how and when you can apply.

-

What is CAT? These mistakes should be avoided before taking the exam.