Listen to this article in summarized format

Loading...

×Mumbai: Banks are rapidly gaining ground in India's fast-growing gold loan market, challenging the longstanding dominance of non-bank lenders.

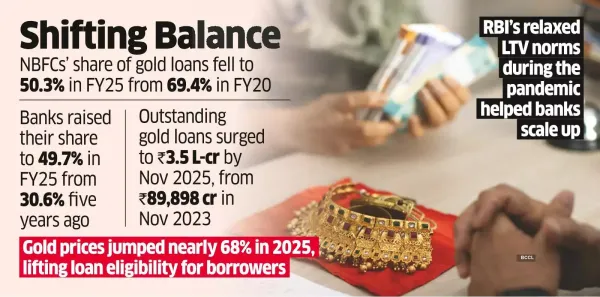

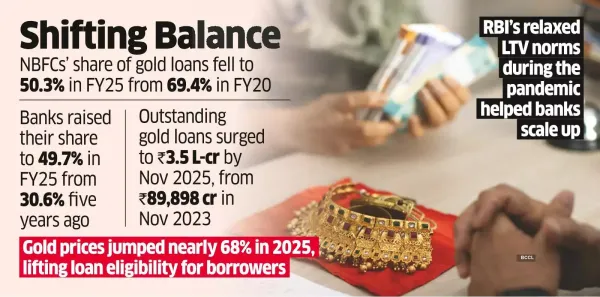

NBFCs' share of aggregate gold loans fell by nearly 20 percentage points over the past five years to 50.3% as of March 2025, from 69.4% in 2020. In the same period, banks increased their share to 49.7% from 30.6%, data showed.

The shift comes amid a sharp expansion in gold-backed lending, driven by easy liquidity conditions, aggressive pricing by banks, and a surge in gold prices boosting both borrower demand and lender appetite.

According to the Reserve Bank of India's Financial Stability Report, combined gold loans of banks and NBFCs accounted for 5.8% of total outstanding loans as of September-end. Loan books also expanded after lenders began reclassifying gold-backed loans, originally given for agricultural activity, as gold loans in line with RBI's master circular on gold loans.

According to the Reserve Bank of India's Financial Stability Report, combined gold loans of banks and NBFCs accounted for 5.8% of total outstanding loans as of September-end. Loan books also expanded after lenders began reclassifying gold-backed loans, originally given for agricultural activity, as gold loans in line with RBI's master circular on gold loans.

Banks' share in the gold loan market jumped by 9.6 percentage points in a year to 49.7% in FY25 from 40.1% a year earlier, highlighting the speed with which banks scaled up.

Gold loans have emerged as the fastest-growing loan portfolio over the past year, more than doubling in the last six months on a year-on-year basis, RBI data showed. Outstanding gold loans surged to ₹1.59 lakh crore by November 2024, from ₹89,898 crore in November 2023, before accelerating to ₹3.5 lakh crore by November-end 2025.

Bankers say demand for gold loans started gaining currency during the pandemic, when the RBI temporarily relaxed loan-to-value (LTV) norms to support credit growth and household liquidity. The regulatory easing allowed banks to enter the segment more aggressively, leveraging their lower funding costs and wider branch networks to compete with NBFCs on pricing and reach.

The latest rally in gold prices has further fuelled growth. Higher prices allow borrowers to raise larger loans against the same quantity of gold, while keeping loan-to-value ratios comfortable for lenders. Gold prices rose nearly 68% in 2025, reaching around ₹1.38 lakh per 10 grams of 24-carat gold.

As a fully-secured product with short tenures and relatively low credit risk, gold loans gained traction when unsecured retail lending was under regulatory scrutiny.

With gold prices remaining elevated and credit conditions supportive, analysts expect competition in the segment to intensify further, blurring the traditional lines between banks and non-bank lenders in one of India's fastest-growing retail loan categories.

NBFCs' share of aggregate gold loans fell by nearly 20 percentage points over the past five years to 50.3% as of March 2025, from 69.4% in 2020. In the same period, banks increased their share to 49.7% from 30.6%, data showed.

The shift comes amid a sharp expansion in gold-backed lending, driven by easy liquidity conditions, aggressive pricing by banks, and a surge in gold prices boosting both borrower demand and lender appetite.

Banks' share in the gold loan market jumped by 9.6 percentage points in a year to 49.7% in FY25 from 40.1% a year earlier, highlighting the speed with which banks scaled up.

Gold loans have emerged as the fastest-growing loan portfolio over the past year, more than doubling in the last six months on a year-on-year basis, RBI data showed. Outstanding gold loans surged to ₹1.59 lakh crore by November 2024, from ₹89,898 crore in November 2023, before accelerating to ₹3.5 lakh crore by November-end 2025.

Bankers say demand for gold loans started gaining currency during the pandemic, when the RBI temporarily relaxed loan-to-value (LTV) norms to support credit growth and household liquidity. The regulatory easing allowed banks to enter the segment more aggressively, leveraging their lower funding costs and wider branch networks to compete with NBFCs on pricing and reach.

The latest rally in gold prices has further fuelled growth. Higher prices allow borrowers to raise larger loans against the same quantity of gold, while keeping loan-to-value ratios comfortable for lenders. Gold prices rose nearly 68% in 2025, reaching around ₹1.38 lakh per 10 grams of 24-carat gold.

As a fully-secured product with short tenures and relatively low credit risk, gold loans gained traction when unsecured retail lending was under regulatory scrutiny.

With gold prices remaining elevated and credit conditions supportive, analysts expect competition in the segment to intensify further, blurring the traditional lines between banks and non-bank lenders in one of India's fastest-growing retail loan categories.

Subscription

Subscription