Goldman raised the price target on BioNTech SE to $142, up from $115.

- With a broad, strategic suite of programs, Goldman Sachs views BioNTech as “being at the nexus of significant developments occurring in the oncology field.”

- BioNTech is now looking to strengthen its oncology portfolio as it pivots away from its Covid-19 vaccine Comirnaty developed with Pfizer.

- BioNTech’s oncology pipeline comprises late-stage candidates spanning immunomodulators, antibody drug conjugates, and mRNA cancer immunotherapies.

Shares of BioNTech SE (BNTX) rose 3% on Friday after Goldman Sachs upgraded the stock to ‘Buy’ from ‘Neutral’.

Goldman also raised the price target on the stock to $142, up from $115, according to TheFly. The new price target represents a potential upside of about 34% from the stock’s closing price on Thursday.

Goldman’s Rationale

With a broad, strategic suite of programs, Goldman Sachs views BioNTech as “being at the nexus of significant developments occurring in the oncology field” and uniquely positioned to develop novel combination approaches to transform cancer care.

Data unlocks in 2026 could position the company with “a leading foothold in an emerging wave of new product cycles,” the analyst added.

Pipeline

BioNTech is now looking to strengthen its oncology portfolio as it pivots away from its Covid-19 vaccine Comirnaty developed with Pfizer.

BionTech’s oncology pipeline comprises late-stage candidates spanning immunomodulators, antibody drug conjugates, and mRNA cancer immunotherapies. It is also developing several combination approaches.

In 2026, the company expects seven late-stage data readouts, and also looks forward to applying to the U.S. Food and Drug Administration (FDA) for approval of its drug T-Pam in endometrial cancer. BioNTech hopes to become a multi-product oncology company by 2030.

The company, however, does not currently anticipate the recognition of revenues from the sale of any oncology products in 2026.

How Did Stocktwits Users React?

On Stocktwits, retail sentiment around BNTX stock stayed within the ‘bullish’ territory over the past 24 hours, while message volume remained at ‘high’ levels.

A Stocktwits user, however, highlighted concerns with the company’s recent acquisition of CureVac. BioNTech closed the acquisition of CureVac in December after announcing the all-stock deal in June to support its oncology strategy.

BNTX stock has fallen 3% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

Walmart expands drone delivery to 150 more stores

-

"Would have been a little more clinical": Lakshya Sen after losing quarter-finals against Lin Chun-Yi

-

WPL 2026, Shreyanka Patil floors GG with five-wicket haul: Stats

-

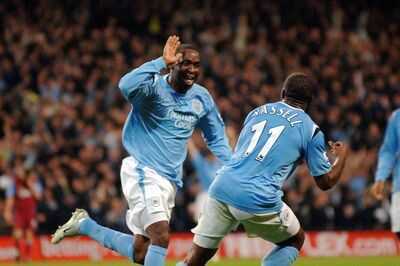

'I regret leaving Man Utd after they paid record transfer fee - but I liked it at Man City'

-

Man City 115 charges saga could drag on until 2027 as Premier League stance emerges