New Delhi: The stock market witnessed a major upheaval on Tuesday 20 January 2026. Both the Sensex and Nifty 50 plummeted sharply by the end of trading. The Sensex closed at 82180.47 down 1065.71 points. The Nifty 50 also fell by 353 points closing at 25232.50. This decline resulted in investors losing approximately Rs 9 lakh crore in a single day. Stock market was down from the start of trading The stock market was down from the start of trading. Selling pressure intensified in the morning session pushing the key indices to their lowest levels in two months. Mixed results from information technology (IT) companies coupled with uncertainty regarding global trade and continuous selling by foreign investors slowed down market momentum. The market capitalization of all companies listed on the BSE decreased by Rs 9 lakh crore to Rs 456 lakh crore. This marked the second consecutive day of decline reflecting the fragile state of the market amidst mixed corporate earnings foreign investor selling and global trade concerns. Also read: Stock market witnesses significant surge after new US ambassador to India Sergio Gor’s statement on India-US trade deal Main reasons for the market decline IT Stocks Plunge: Information technology (IT) stocks were hit hardest by the selling pressure pushing the major indices to their lowest level in two months. The Nifty IT index fell by 2% making it the worst-performing sector of the day. All stocks in this sector were trading in the red. Wipro shares fell by almost 3%. LTIMindtree shares plummeted by almost 6%. The company had reported a decline in quarterly profit attributed to a one-time impact of new labour laws. Global uncertainty and tariffs: Global uncertainty and tariffs also contributed to the decline in markets worldwide. This added pressure on the Indian market as well. The MSCIs broadest index of Asia-Pacific shares outside Japan fell 0.3%. This decline came as US President Donald Trump threatened to impose new tariffs on eight European Union member countries. This move by the US is being seen as an attempt to gain more control over Greenland which investors are interpreting as a renewed rift in trade relations between the US and Europe. Selling by foreign investors: The market also declined due to continuous selling by foreign investors. Foreign institutional investors (FIIs) were net sellers of equities for the tenth consecutive session. On Monday January 19 FIIs sold shares worth approximately Rs 3263 crore. This reflects their cautious stance amid global trade and geopolitical uncertainty.

-

Romantic Propose Day Gift Ideas to Express Your Feelings

-

Be it period pain or joint stiffness, just one laddu is the panacea for all these in winter.

-

Waiting in the dark: fishing for climbing perch in rain-soaked rice fields

-

If Mahira wears a burqa, how will she dance? Jawad Ahmad faces backlash over controversial remarks

-

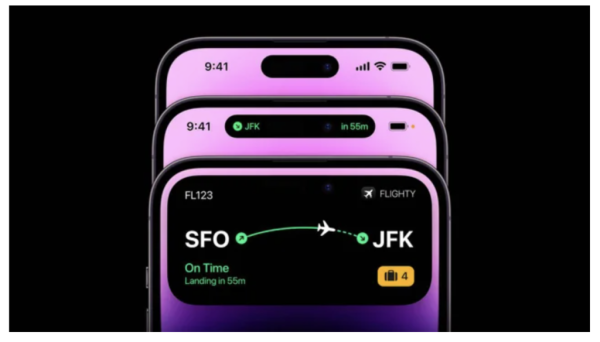

iPhone 17e Can Have Dynamic Island, But 120Hz Display Can Be Missed