SIDBI said in a statement that the equity infusion is expected to significantly scale up its ability to serve MSMEs across the country.

New Delhi: The cabinet on Wednesday approved equity support of ₹5,000 crore to the Small Industries Development Bank of India (SIDBI).

PM Narendra Modi in a post on X said, "Today's Cabinet decision relating to providing equity support to SIDBI will benefit countless MSMEs thus contributing to a Viksit Bharat."

The infusion of additional capital will enable SIDBI to generate resources at fair interest rates, thereby increasing the flow of credit to micro, small and medium enterprises (MSMEs) at a competitive cost, said a government statement.

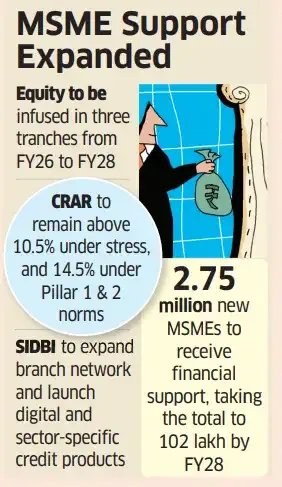

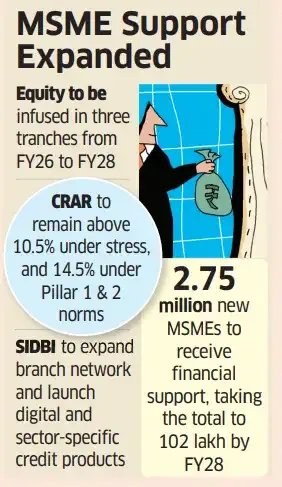

The equity capital will be infused in three tranches of ₹3,000 crore in 2025-26 and ₹1,000 crore each in 2026-27 and 2027-28.

The government further said that with a focus on directed credit and anticipated growth in that portfolio over the next five years, the risk-weighted assets on SIDBI's balance sheet are expected to rise significantly.

"This increase will necessitate higher capital to sustain the same level of capital to risk-weighted assets ratio (CRAR)," it said. The statement added that the digital and digitally enabled collateral-free credit products being developed by SIDBI, aimed at boosting credit flow, along with the venture debt being offered to startups, will escalate the risk-weighted assets, requiring even more capital to meet healthy CRAR.

"SIDBI will benefit from an infusion of additional share capital by maintaining a healthy CRAR," the statement said. It also noted that after the equity capital infusion, 2.57 million new MSMEs will be provided financial assistance, taking the total to 10.2 million by 2027-28.

The proposed equity infusion will enable SIDBI to maintain CRAR above 10.50% under a high-stress scenario and above 14.50% under Pillar 1 and Pillar 2 (of capital requirement norms) over the next three years, it said.

SIDBI said in a statement that the equity infusion is expected to significantly scale up its ability to serve MSMEs across the country.

"The equity support will be leveraged by the bank to scale its business further through expansion of its branch network and introduction of more innovative digital products for working capital, invoice discounting, specialised products for the defence sector, and machinery loans," it said.

Atal Pension Yojana

The cabinet also approved the continuation of Atal Pension Yojana up to 2030-31.

The government will also provide gap funding to meet viability requirements and ensure sustainability of the scheme.

In a statement the government said that this will ensure old-age income security for millions of low-income and unorganised sector workers and enhance financial inclusion and support India's transition to a pensioned society.

PM Narendra Modi in a post on X said, "Today's Cabinet decision relating to providing equity support to SIDBI will benefit countless MSMEs thus contributing to a Viksit Bharat."

The infusion of additional capital will enable SIDBI to generate resources at fair interest rates, thereby increasing the flow of credit to micro, small and medium enterprises (MSMEs) at a competitive cost, said a government statement.

The equity capital will be infused in three tranches of ₹3,000 crore in 2025-26 and ₹1,000 crore each in 2026-27 and 2027-28.

The government further said that with a focus on directed credit and anticipated growth in that portfolio over the next five years, the risk-weighted assets on SIDBI's balance sheet are expected to rise significantly.

"This increase will necessitate higher capital to sustain the same level of capital to risk-weighted assets ratio (CRAR)," it said. The statement added that the digital and digitally enabled collateral-free credit products being developed by SIDBI, aimed at boosting credit flow, along with the venture debt being offered to startups, will escalate the risk-weighted assets, requiring even more capital to meet healthy CRAR.

"SIDBI will benefit from an infusion of additional share capital by maintaining a healthy CRAR," the statement said. It also noted that after the equity capital infusion, 2.57 million new MSMEs will be provided financial assistance, taking the total to 10.2 million by 2027-28.

The proposed equity infusion will enable SIDBI to maintain CRAR above 10.50% under a high-stress scenario and above 14.50% under Pillar 1 and Pillar 2 (of capital requirement norms) over the next three years, it said.

SIDBI said in a statement that the equity infusion is expected to significantly scale up its ability to serve MSMEs across the country.

"The equity support will be leveraged by the bank to scale its business further through expansion of its branch network and introduction of more innovative digital products for working capital, invoice discounting, specialised products for the defence sector, and machinery loans," it said.

Atal Pension Yojana

The cabinet also approved the continuation of Atal Pension Yojana up to 2030-31.

The government will also provide gap funding to meet viability requirements and ensure sustainability of the scheme.

In a statement the government said that this will ensure old-age income security for millions of low-income and unorganised sector workers and enhance financial inclusion and support India's transition to a pensioned society.