Air India is bracing for what could be the worst financial year in its recent history, with losses expected to touch at least Rs 15,000 crore ($1.6 billion) for the year ending March 31.

The scale of the setback is striking, particularly because the airline had been inching closer to operational break-even before a deadly crash and a series of external shocks abruptly reversed its recovery.

Citing people familiar with the matter, Business Standard reported that the airline’s financial performance deteriorated sharply after a Dreamliner crash near Ahmedabad in June killed more than 240 people, triggering not only grief and scrutiny but also months of operational disruption.

At the same time, Pakistan’s decision to close its airspace to Indian carriers following a military clash added further strain, forcing Air India and its peers to fly longer and more expensive routes to Europe and the United States.

Together, the twin blows, a tragedy in the skies and a geopolitical standoff on the ground, wiped out years of painstaking progress towards stabilising the flag carrier.

A Turnaround Derailed at the Finish Line

Before the crash, Air India’s management had been targeting operational break-even in the current financial year. Under the joint ownership of the Tata Group and Singapore Airlines, the airline had embarked on an ambitious restructuring programme aimed at modernising its fleet, fixing customer service gaps and restoring financial discipline.

Those plans have now been shelved. “Profitability is now out of reach,” the report said, citing sources, as the airline struggles to absorb the combined impact of accident-related costs, higher fuel burn due to longer routes, and softer demand following months of negative headlines.

The reversal is all the more stark because Air India had been edging closer to profitability after years of heavy losses under government ownership. The June crash undid much of that progress in a matter of weeks.

Airspace Closure Adds to the Bill

One of the less visible but financially damaging blows came from Pakistan’s closure of its airspace to Indian airlines after a military confrontation. For Air India, which operates long-haul services to Europe and North America, the closure meant rerouting flights around Pakistani airspace, adding hours to flying time, burning more fuel, and increasing crew and maintenance costs.

These higher operating expenses compounded an already fragile balance sheet, pushing the airline deeper into the red at a time when management was hoping to demonstrate financial stability to lenders and investors.

A Troubled Industry Adds to the Pressure

Air India’s losses have unfolded against a turbulent backdrop for Indian aviation. Over the past year, the sector has been rattled by flyer anxiety, frequent delays and mass cancellations by a rival carrier, all of which have put renewed focus on the risks of India’s duopolistic airline market structure.

With limited competition on key routes and rising operating costs, even well-capitalised carriers have struggled to protect margins. For Air India, still in the middle of a complex turnaround, the timing could not have been worse.

Board Rejects Plan, Seeks Faster Recovery

The scale of the losses has unsettled both owners. A new five-year business plan submitted by Air India’s management projected a return to profit only in the third year. The board rejected that timeline and has asked for a more aggressive push to restore financial health, according to the people cited.

The airline’s recent history underlines why the board is concerned. Government filings compiled by business intelligence platform Tofler show that Air India has lost Rs 32,210 crore over the past three years. In October, Bloomberg News reported that the airline had sought at least Rs 10,000 crore in fresh financial support last year to shore up its balance sheet.

These figures have raised questions about how long shareholders are willing to keep funding the turnaround.

Leadership Under Review

The mounting losses are also prompting a rethink at the top. Tata Group has begun scouting for a new Chief Executive Officer to replace Campbell Wilson, although the search may not conclude until the official crash investigation report is released.

Leadership stability has been a cornerstone of Air India’s revival strategy. Any change at the helm would signal a more fundamental reset of the airline’s recovery plan.

Singapore Airlines, which acquired a 25.1 per cent stake after merging Vistara with Air India in 2024, is also feeling the impact. The carrier’s own earnings have been dragged down by Air India’s performance, even as it works closely with the Indian airline to bring aircraft maintenance in-house as part of a broader restructuring effort.

For now, Air India faces a long and uncertain road back to financial stability. The crash investigation, geopolitical risks and board-level pressure have created an environment where quick fixes are unlikely.

Yet the stakes remain high. For Tata Group, Air India is a flagship bet on restoring a national icon. For Singapore Airlines, it is a strategic investment in one of the world’s fastest-growing aviation markets. And for passengers, the airline’s ability to recover will determine whether the long-promised revival finally takes flight — or remains grounded by another year of losses.

-

Mykhailo Mudryk truth revealed amid return rumours for banned Chelsea star

-

Gurugram firm's suspended official held by ED for Rs 236 crore loan fraud

-

Telangana HC adjourns verdict on Group-I services exam

-

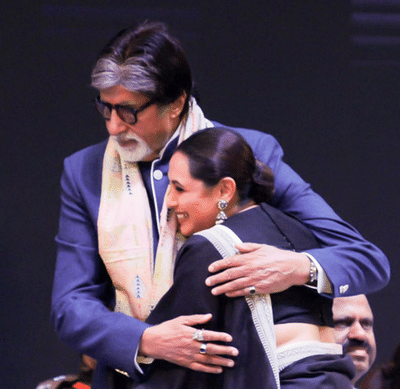

Rani Mukerji calls working with Amitabh Bachchan in Black as a masterclass in acting

-

Sadia Khateeb wraps up Vietnam schedule of 'Silaa'