The Indian corporate world always has some surprises up its sleeves: record-breaking news weird stats and important business milestones. Some unusual news can include updates on stocks and shares CEOs with the longest reign or fastest growing sectors. So without further ado let’s take a look at some unusual business records. Briefest Budget Speech! Updates regarding the business sector are usually related to profits earned the stock market or new policies implemented. However when we dug up some old records we found this interesting fact. In 1977 the then acting finance minister Hirubhai M Patel gave the shortest budget speech in India’s history. Comprising of just 800 words Patel gave the budget speech during the tenure of the Morarji Desai government. The budget speech majorly briefed outlay and didn’t go into details. Longest Speech Cut to 2020 Sitharaman won the award for the longest speech recorded in the budget history. Last year’s budget speech by Finance Minister Nirmala Sitharaman lasted over 2 hours. This budget speech announced the most significant financial reforms and shared sector-specific updates. The difference between the shortest and longest speech is evident. Budget speeches have now become more detailed over time providing a clearer picture of the government’s intent to investors and citizens. Highest Quarterly Profit by Unexpected Companies Recently some small and mid-cap companies registered their highest quarterly net profits. These companies operate in sectors like engineering consumer products and IT services. With India clocking slower GDP growth over the past few years it was a surprise to see these companies register such high quarterly net profits. A few of these companies attribute their success to tighter cost controls and higher sales of new products. It just goes to show that big companies don’t always have to set the profit records. Indian Stocks Witness Huge Volatility Amidst everything that’s been happening in India Indian stocks have witnessed massive volatility as well. Gold and Silver Exchange Traded Funds (ETFs) in India have seen wild swings in prices over the past few months. While gold ETFs have recovered partially from their drastic fall in prices many investors are asking- should they buy gold now? Export-intensive stocks jumped following hopes of trade and tariff reforms between the USA and China. The correlation between international trade and the stock market is real. Final Wordings India is on its way to hitting the $5 trillion mark. But what lies ahead? If the recent business trends are anything to go by we can expect more unusual news. From fintech revolutions to new AGM guidelines for corporates keep stopping by to catch the latest updates.

-

Sunny Deol's Inspiring Visit to INS Vikrant: A Tribute to India's Naval Pride

-

Egg Retrieval: What Happens, Recovery Tips, and Possible Risks

-

5 Hindu Gods to Worship for Love Marriage Success and Family Acceptance

-

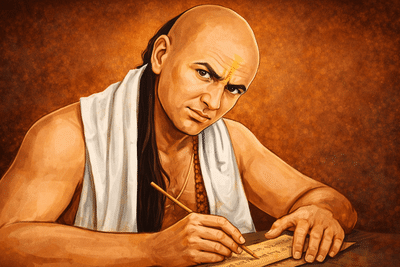

Why Is Your Destiny Not Changing? Chanakya Niti Points to Two Habits

-

Delhi Police to Use AI-Powered Smart Glasses for Security on Republic Day; Here's How They Will Work