duty on gold and silver

The country's precious metal (gold and silver) refining sector has high expectations from Budget 2026. The country's leading refining company MMTC-PAMP has demanded from the government to bring parity in duty between domestic refiners and imported bullion (finished gold and silver), so that the Indian industry does not have to suffer loss in competition. The company's managing director and CEO Sameet Guha said that the current duty structure has become a challenge for domestic refiners.

Not limited to MMTC-PAMP

According to Sameet Guha, this problem is not limited to MMTC-PAMP only, but the entire precious metal refining sector has been facing inequality in duty for a long time. Especially the difference in duty on import of raw bullion and import of finished bullion through SEPA route puts domestic refiners in a weak position. Its effect is that the finished bullion coming from foreign companies often becomes cheaper, due to which the competitiveness of Indian refiners decreases.

He said that in the Free Trade Agreements (FTA) signed after SEPA, bullion has been kept out of the scope of low duty. The industry wants that such exemption should not be given to gold and silver in future agreements also, so that the domestic industry can get protection.

Guha says that if India has to be strengthened globally in the field of refining and more and more LBMA (London Bullion Market Association) accredited refiners are to be created, then the government will have to provide input related benefits. This benefit can be given by increasing the duty differential or through change in policy. This will encourage domestic companies to increase investment, get better returns and improve their technical capacity.

This much duty on gold and silver

Currently, gold and silver bullion attracts 6% duty, while refiners get a differential of 0.65%, leaving the effective duty at 5.35%. MMTC-PAMP mainly imports gold in the form of strings. In the financial year 2024-25, the company had imported about 40 tonnes of gold and 50 tonnes of silver. During April-December of the current financial year, the company imported 36 tonnes of gold and 60 tonnes of silver, which shows strong demand for silver. The industry believes that if the government removes this duty related disparity in Budget 2026, it will give a big boost to the domestic refining sector and India can emerge as a global refining hub.

-

ISPL Season: Thrilling One-Run Finish and Dominant Mumbai Win Highlight Three Action

-

Techno-Legal Framework: India Proposes to Strengthen Responsible Artificial Intelligence Governance

-

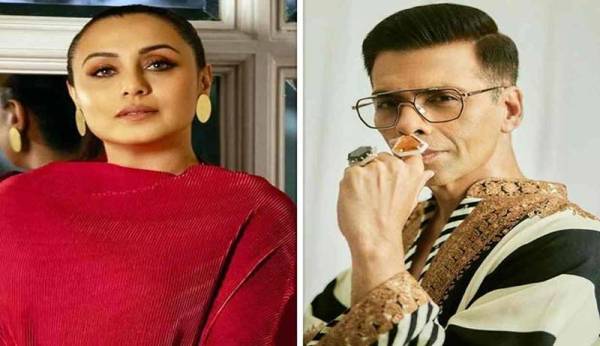

Rani Mukerji : Marks Three Decades in Cinema With Karan Johar and Mardaani 3 Buzz

-

Uttarakhand And Himachal Regions: Severe Snowfall Triggers Large-Scale Rescue Operations Across

-

Snowfall wreaks havoc in North India, IMD issues new alert