Learn the difference between UPI and BHIM. Which app is better, and what are the UPI transaction limits? Get all the information here in simple language.

UPI vs BHIM: Nowadays, everyone has a smartphone and a digital wallet in their pocket. Whether it's sending money, paying bills, or recharging your mobile – everything is done with just a tap. But the biggest confusion is that people often think that UPI and BHIM are the same thing. In reality, they are different, and it's important to understand this difference.

What is UPI?

UPI, or Unified Payments Interface, was created by NPCI and is regulated by the RBI. It's not an app, but a system through which you can instantly send money from one bank account to another. Apps like Google Pay, PhonePe, Paytm, and BHIM all run on this UPI platform. Once you set your UPI PIN, it remains the same regardless of how many apps you use. This is why UPI has become the biggest foundation of digital payments in India today.

What is BHIM?

On the other hand, there is BHIM, which stands for Bharat Interface for Money. This is the Indian government's own UPI app, launched specifically to be simple and reliable. With BHIM, you can not only send money via UPI but also make payments by scanning QR codes, transfer money using bank account and IFSC details, recharge your mobile and pay bills, and even book tickets. In short, BHIM is an all-in-one app that comes with the trust of the government.

What is the difference between the two?

Now understand the difference. UPI is a technology on which several apps run. BHIM is one of those apps, but it is the official app of the Indian government. Even if you use GPay or PhonePe, you are still using UPI. The only difference is that BHIM has a simple interface and offers government assurance, while private apps come with offers, cashback, and more features.

Simple and Secure

If you want a simple and secure app, BHIM is the best. But if you're a fan of offers and cashback, apps like GPay or PhonePe will be better for you. In reality, UPI is the real hero, and BHIM is its government-backed face.

Also know the limits

Now let's talk about transaction limits. In a normal UPI transaction, you can send up to ₹1 lakh. For some specific categories like insurance, IPOs, and capital markets, this limit is up to ₹2 lakh. For larger transactions like IPOs and the Retail Direct Scheme, the limit is set at ₹5 lakh.

UPI is the technology, and BHIM is the government app that runs on it.

In short, the conclusion is that both UPI and BHIM are working together to make India a digital payments superpower. UPI has provided the technology, and BHIM has brought it to the common people with the backing of the government. So, the next time someone asks what the difference is between UPI and BHIM, you can clearly say that UPI is the technology, and BHIM is the government app that uses it.

-

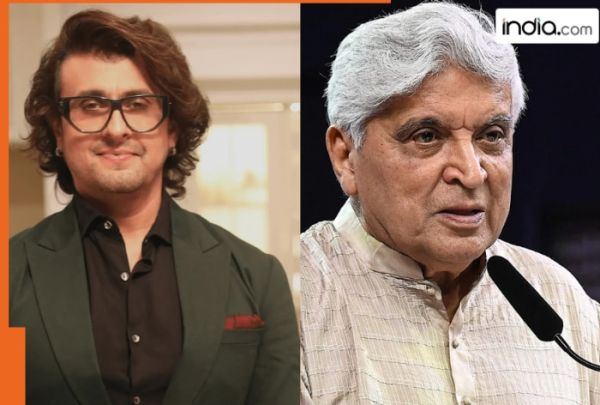

Sonu Nigam defends Sandese Aate Hain in Border 2 amid Javed Akhtar’s ‘creative bankruptcy’ remark: ‘Can’t imagine…’

-

Raffles Udaipur Celebrates the Republic Day Long Weekend with a Thoughtfully Curated Escape

-

Investigation Underway After Rail Track Damage Near Fatehgarh Sahib

-

DMK Leader Criticizes BJP After Modi's Tamil Nadu Visit

-

Beauty Gadgets: Creams and powders are a thing of the past, now it's the era of 'beauty tech'..