Precious metals have witnessed a massive rally over the past week, bringing fresh excitement to investors and buyers alike. Gold prices in India have recorded a sharp weekly increase, while silver has delivered an even stronger performance. The surge is being driven by global economic expectations, especially hopes of interest rate cuts by the US Federal Reserve and rising demand for safe-haven assets.

On January 25, 2026, gold prices reached record levels in both domestic and international markets, reflecting strong investor confidence in bullion as a hedge against uncertainty.

Gold Prices Hit New Highs in India

Over the last seven days, the price of 24-carat gold in India has increased by ₹16,480 per 10 grams. At the same time, 22-carat gold became costlier by around ₹15,100 per 10 grams.

In the national capital, Delhi, the price of 24-carat gold stood at ₹1,60,410 per 10 grams, while 22-carat gold was priced at ₹1,47,050 per 10 grams. This marks one of the steepest weekly rises in recent months.

Internationally, spot gold touched a historic level of around $4,967 per ounce, driven by expectations that global central banks may soon ease monetary policy.

Gold Rates Across Major Indian Cities

Gold prices remained largely similar across key metropolitan cities, with minor variations due to local taxes and demand.

In Mumbai, Chennai, and Kolkata, 24-carat gold was trading at approximately ₹1,60,260 per 10 grams, while 22-carat gold was priced near ₹1,46,900 per 10 grams.

Cities such as Pune and Bengaluru also reported similar levels, indicating uniform demand across regions. Other cities like Jaipur, Lucknow, and Chandigarh saw 24-carat gold rates close to ₹1,60,410 per 10 grams.

Why Are Gold Prices Rising So Fast?

Market analysts attribute the rally to several global and domestic factors. One of the biggest reasons is the growing expectation that the US Federal Reserve may reduce interest rates in the coming months. Lower interest rates make non-interest-bearing assets like gold more attractive for investors.

Investment bank Goldman Sachs has revised its gold price forecast upward for December 2026, increasing its estimate from $4,900 per ounce to $5,400 per ounce. According to the firm, investors seeking protection from geopolitical and policy risks are likely to continue holding gold rather than selling it.

Additionally, concerns over inflation, currency fluctuations, and global economic instability have further strengthened gold’s position as a safe asset.

Silver Prices Also See Massive Jump

Silver has outperformed gold in terms of weekly gains. Over the last week, silver prices rose by nearly ₹40,000 per kilogram in the domestic market.

As of January 25, silver was trading at around ₹3,35,000 per kilogram in India. In the international market, spot silver was hovering near $99.46 per ounce.

Silver’s rise is being supported by strong industrial demand, especially from sectors such as electronics, renewable energy, and electric vehicles, along with its role as a safe investment option.

Impact on Investors and Buyers

For investors, this surge has resulted in significant portfolio gains. Many market participants believe that precious metals may continue to remain strong if global uncertainties persist.

However, for jewellery buyers, the sharp rise in prices could make purchases more expensive. Experts advise consumers to track daily rates and consider long-term investment strategies rather than short-term speculation.

Conclusion

The strong rally in gold and silver prices highlights growing global concerns and shifting monetary policies. With expectations of interest rate cuts and increasing demand for safe assets, precious metals are once again proving their importance in uncertain times.

If current trends continue, gold and silver may remain on an upward path in the coming months, making them key instruments for both investors and long-term savers.

-

Uttar Pradesh: Amit Shah Urges Voters To Back BJP In Upcoming Assembly Elections

-

Uttar Pradesh : Foundation Day Highlights Development, Heritage, And Future Growth Vision

-

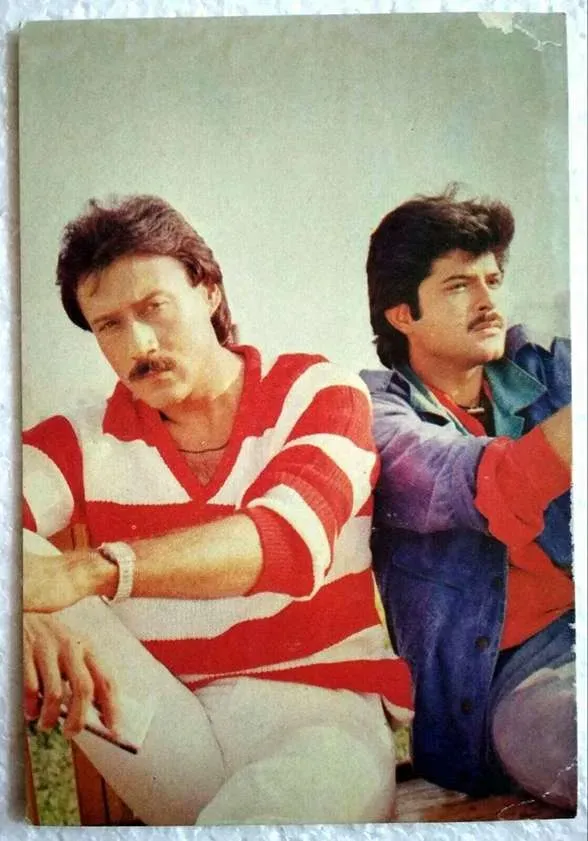

Jackie Shroff : and Anil Kapoor Celebrate Subhash Ghai’s 50-Year Cinematic Legacy

-

Delhi Police : Crack Street Robbery and Vehicle Forgery Syndicate in Major Operations

-

Mamta Kulkarni : Questions Religious Authority After Magh Mela Sangam Dispute