Investors in the stock market often reach a point where they have the opportunity to turn their investments into substantial profits. Sometimes, these profits are so significant that they can even fund the purchase of a dream home. If you are also planning to buy a house by selling your equity or shares, this news is very important for you. You can easily save on the hefty taxes levied on long-term capital gains from selling shares. Section 54F of the Income Tax Act comes in handy for this purpose, but understanding some technical details is crucial to avail of this benefit.

The Most Effective Tax-Saving Tool

Investors often believe that tax exemption is only available when selling one house to buy another, but this is not the case. According to tax expert Balwant Jain, Section 54F provides a special benefit. Under this section, if you sell any asset other than a residential property (such as shares, mutual funds, or gold) and use that money to buy a house, you can get an exemption from long-term capital gains tax. The catch here is that you have to invest the 'net proceeds' from the sale of shares, not just the profit. If you invest the entire amount in the house, the entire tax will be waived.

The Time Limit for Buying and Constructing a House

Paying attention to the time limit is most important to avail of this exemption. According to the law, you should buy a ready-to-move-in house within two years of the date you sold the shares. Interestingly, even if you bought the house a year before selling the shares, you can still claim this exemption. However, if you are not buying a ready-made house but are building one yourself or investing in an under-construction project, you get a little more time. In this case, the construction of the house should be completed within three years from the date of selling the shares.

What if You Have Taken a Home Loan?

Many people are concerned about whether they will get a tax exemption on the money received from selling shares if they have taken a home loan to buy the house. The answer is, absolutely yes. The law doesn't care whether you paid for the house with money from your own pocket or with a bank loan. What matters in the eyes of the law is that the price of the house must be greater than or equal to the amount received from selling the shares. You can also use the money earned from the stock market to pay the EMIs of your home loan or to repay a portion of the loan, provided the time limit is adhered to.

This condition applies to owning more than one house.

There's a major condition hidden in this tax-saving rule, which can be costly if ignored. You will only get the benefit of Section 54F if, excluding the new house, you do not own more than one residential property on the date of selling the shares. This means that if you already own two houses, you will not be able to save on taxes by buying a third house after selling shares. However, the good news is that this exemption is not a one-time benefit. You can sell shares and buy houses in different years and claim the exemption up to a limit of Rs. 10 crore, provided that the number of properties in your name does not exceed the specified limit.

Disclaimer: This content has been sourced and edited from TV9. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

The four Arsenal players who missed training as Mikel Arteta dealt fresh triple injury worry

-

Referee drops out of Premier League action after Man City and Pep Guardiola complaints

-

'I texted Tottenham transfer chief and told him to sign Omar Marmoush - this is how he reacted'

-

Vaibhav Suryavanshi smashed a blistering half-century, hitting 22 fours and 11 sixes as India posted 352 runs in the World Cup.

-

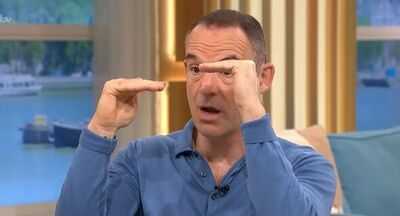

Martin Lewis gives £10,000 ISA advice and highlights 'over 60s rule'