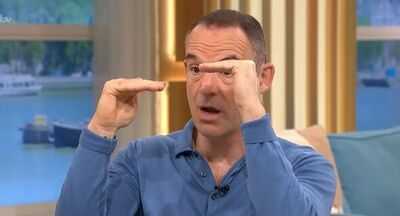

Money expert Martin Lewis has spoken out about different kinds of ISA available for people saving money - especially to buy homes. Speaking on his BBC podcast, Mr Lewis explained what impact on savings of £10,000 changing accounts could have after a listener asked what to do.

The issue is around Lifetime ISAs and predecessor the Help to Buy ISA and what to do if you hold both. And Martin Lewis also explained how one of the accountsallows withdrawals of cash without penalties with an 'over 60s' rule. A Help to Buy ISA is a government-backed, tax-free savings account for first-time buyers, now closed to new applicants. Existing holders can save up to £200/month, with the government adding a 25% bonus (max £3,000) on savings up to £12,000 when purchasing a first home worth up to £250,000 (£450,000 in London).

A Lifetime ISA (LISA) is a UK government-backed savings account for adults aged 18-39, designed for buying a first home (up to £450,000) or retirement. Users can deposit up to £4,000 annually-part of the £20,000 total ISA limit-and receive a 25% bonus (up to £1,000 a year). Accounts can be held as cash or stocks and shares, with contributions allowed until age 50. You can take your savings out of a Lifetime ISA when you're 60 or over. You'll pay a 25% charge if you withdraw money or transfer the Lifetime ISA to another type of ISA before 60.

Felice asked Martin: "We already know that generally Lifetime ISAs are better for first time buyers looking to save for a deposit because they're eligible to be used for a higher value home even outside of London. For those of us who put £1 in a Help to Buy ISA account before they were ended and have been steadily adding away over the years since, is it worth getting the money we've saved out and putting it into a Lifetime ISA instead? Will we face a penalty when we do that because the withdrawal is not for the purchase of a home and at what point would that penalty be offset by the amount we can gain from the government bonus on the money if we switch."

Martin replied: "For those who don't know the Help to Buy ISA was the predecessor of the Lifetime ISA. You are perfectly entitled to have both of them but you can only use one of them to get the 25 per cent bonus you get on savings towards your first house.

"So you can have money in both of them because especially the Lifetime ISA can also be used towards later life savings, money that you can take out once you're aged over 60.

"Now, you said in your question I think Felice, that Lifetime ISAs are better for first time buyers looking to save for a deposit. It's not that clear-cut. They both have pros and cons. In brief the big pro of the Lifetime ISA is you can put more money in each year which means, of course, then if you go and get your qualifying house, you're going to get more free cash because you can put up to £4,000 a year in a Lifetime ISA, you can't put anywhere near that much in a Help to Buy ISA - I think it's £2,400 a year if you exclude the first year.

"And then once the money's in the Lifetime ISA on any UK residential mortgage with a property worth up to £450,000. Whereas the Help to Buy ISA is a property worth up to £250,000, except in London where it's £450,000.

"Based on that you would absolutely think the Lifetime ISA is a winner over the Help to Buy ISA. And also because the Lifetime ISA the money is paid at exchange whereas the Help to Buy bonus is only paid at completion."

Mr Lewis said the Help to Buy ISA does have a 'big benefit' - and it impacts people withdrawing their money. He said: "So with the Lifetime ISA you could also use the money in there to help you with deposit that you're giving whomever you're buying the house off where with the Help to Buy ISA you could only use it towards your mortgage deposit.

"But the Help to Buy ISA does have one big benefit over the Lifetime ISA. That is if you withdraw your money not for buying a qualifying property there is no penalty. You will get back all the money you have put in - and the interest. You won't get the 25 per cent bonus because you're not buying a property. But you won't lose any money either.

"With the Lifetime ISA you get a 25 per cent bonus once you put the money in to be used on a first time property or after you're aged 60. But if you take the money out before aged 60 and you're not using it to buy a qualifying property , even if you're using it to buy a property that's only just above that £450,000 threshold, so £460,000 then you pay a 25 per cent penalty.

"What does that mean? So you get 25 per cent and then 25 per cent is taken off. But as 25 per cent being taken off is off a bigger number than the 25 per cent was being added on top of (I know i'm sorry) then effectively you lost 6.25 per cent of your money. So if you've got £10,000 in your Lifetime ISA when you take it out you will only have £9,375. You're effectively paying a fine to the state of £635 on £10,000. If you've got £10,000 in a Help to Buy ISA and you take it out not to buy a qualifying property, you get your £10,000 out.

"But remember you have to have had a Lifetime ISA open for a year before you can get that first time buyer bonus. So if you don't have a Lifetime ISA open and you're planning to buy within the next year that's a problem definitely stick within Help to Buy. If you have a Lifetime ISA open even with only £1 in it then any money you add to it now, you would be able to get the bonus on because it's been open for a year."

Mr Lewis said that's the first rule. He added: "The second rule is - should you move it into a Lifetime ISA? If you're definitely going to be buying a qualifying property under £450,000 then it gets tricky. Now we will assume you have money in the Help to Buy ISA and you have an open Lifetime ISA or you won't be buying the property in the next year.

"My next question is are you definitely going to be buying a qualifying property under £450,000. If the answer is no, you're probably safer to keep your money in the Help to Buy account because there's no risk of a penalty." Mr Lewis said if the person is buying a house if it's under £250,000 they would still get the bonus. He said if the property was between £250,000 and £450,000 outside London they'd only get the bonus on the Lifetime ISA, so the correct decision would be to shift it from the Help to Buy ISA.

To listen to the full podcast click here.

-

Do you know what "Bank" is called in Hindi? Most people probably don't

-

Supreme Court Adjourns Hearing on Plea Challenging School Fee Law in Delhi, New Date Set

-

Recruitment for Junior Office Assistant Posts: Read about the Selection Process

-

Nagaland State Lottery Result: January 27, 2026, 8 PM Live - Watch Streaming Of Winners List Of Dear Destiny Sambad Night Tuesday Weekly Draw

-

DC Vs GG, WPL 2026 Toss Update: Delhi Capitals Bowling First In Vadodara, Gujarat Make One Forced Change