Listen to this article in summarized format

Loading...

×Mumbai: People from India and the UK bought more properties in Dubai than other nationalities in 2025, showed latest industry data. A record decline in the rupee against the dollar and the UAE dirham pushed more buyers toward dollar-pegged real estate assets, as a currency hedge and a long-term income play.

The rupee weakened more than 7% against the dollar-pegged UAE dirham in the past year, touching nearly Rs 25 per AED, compared to Rs 23.3 a year ago.

That, coupled with low rental returns in the domestic market, is skewing a growing tally of Indians — including professionals and small businessmen — towards Dubai to prevent wealth erosion.

(Join our ETNRI WhatsApp channel for all the latest updates)

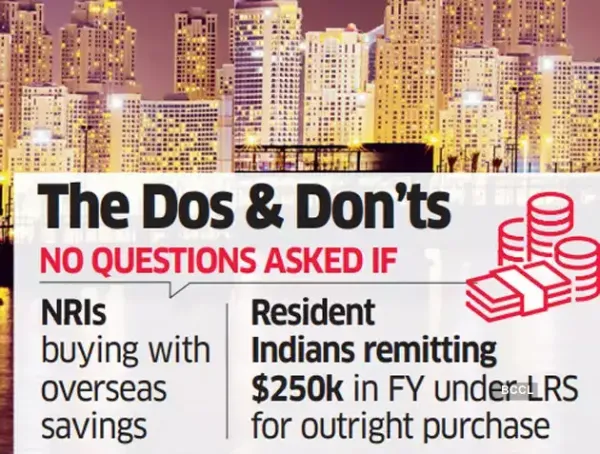

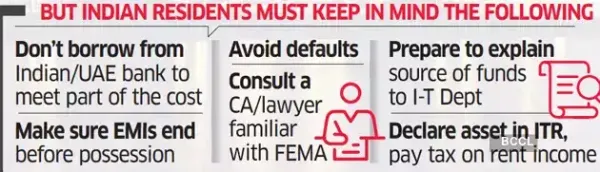

Indian buyers are also increasingly turning to non-resident relatives or overseas family offices to structure these high-value property purchases amid tighter Foreign Exchange Management Act (FEMA) rules and tax compliance norms for foreign remittances, according to tax experts.

“I have liquidated my assets in India to buy a house in downtown Dubai to hedge against the dollar and to get a good rental income, as my daughter is studying in the US and my wealth in India is eroding against the dollar,” said a Mumbai-based resident who didn't wish to be named. The wider rental yield differential is reinforcing demand in Emirate.

Consistent Demand

Consistent Demand

“Rental yields in Gurgaon’s prime locations are close to 2-3% in residential properties, whereas in Dubai, they are 8-10%,” said Shikha Kapoor, a Gurgaon-based real estate agent who recently bought an apartment in Dubai and is now recommending the market to her clients. For comparison, a Rs 3 crore property in a city like Gurgaon can potentially generate annual rental income of Rs 6-9 lakh, against Rs 24-30 lakh in Dubai.

According to Knight Frank, Indians accounted for 10% of property sales in Dubai in 2025, up from 6% the year before, signalling a broader industry trend. Relatively low interest rates are also encouraging more Indians to focus on Dubai, said a report by Betterhomes, a leading UAE-based real estate agency. Last year, Dubai saw a record AED 547 billion in residential sales across 203,000 transactions. During the year, average residential sale prices rose 12%, while leasing volumes surged and average rents held at around AED 207,000, reflecting strong tenant demand and pricing stability, according to Betterhomes. Indians accounted for 14% of Betterhomes’ transactions in 2025.

The rupee weakened more than 7% against the dollar-pegged UAE dirham in the past year, touching nearly Rs 25 per AED, compared to Rs 23.3 a year ago.

That, coupled with low rental returns in the domestic market, is skewing a growing tally of Indians — including professionals and small businessmen — towards Dubai to prevent wealth erosion.

(Join our ETNRI WhatsApp channel for all the latest updates)

Indian buyers are also increasingly turning to non-resident relatives or overseas family offices to structure these high-value property purchases amid tighter Foreign Exchange Management Act (FEMA) rules and tax compliance norms for foreign remittances, according to tax experts.

“I have liquidated my assets in India to buy a house in downtown Dubai to hedge against the dollar and to get a good rental income, as my daughter is studying in the US and my wealth in India is eroding against the dollar,” said a Mumbai-based resident who didn't wish to be named. The wider rental yield differential is reinforcing demand in Emirate.

“Rental yields in Gurgaon’s prime locations are close to 2-3% in residential properties, whereas in Dubai, they are 8-10%,” said Shikha Kapoor, a Gurgaon-based real estate agent who recently bought an apartment in Dubai and is now recommending the market to her clients. For comparison, a Rs 3 crore property in a city like Gurgaon can potentially generate annual rental income of Rs 6-9 lakh, against Rs 24-30 lakh in Dubai.

According to Knight Frank, Indians accounted for 10% of property sales in Dubai in 2025, up from 6% the year before, signalling a broader industry trend. Relatively low interest rates are also encouraging more Indians to focus on Dubai, said a report by Betterhomes, a leading UAE-based real estate agency. Last year, Dubai saw a record AED 547 billion in residential sales across 203,000 transactions. During the year, average residential sale prices rose 12%, while leasing volumes surged and average rents held at around AED 207,000, reflecting strong tenant demand and pricing stability, according to Betterhomes. Indians accounted for 14% of Betterhomes’ transactions in 2025.

Subscription

Subscription