Powell: US Federal Reserve Chair Jerome Powell sidestepped repeated questions about his future at the central bank during a broad-ranging press conference, choosing instead to steer attention toward monetary policy and the Fed’s economic outlook. His brief, consistent responses offered little insight into whether he plans to remain in his role, reinforcing a message of institutional focus rather than personal speculation.

Powell Declines to Address His Tenure

When asked directly whether he has decided to continue serving as a Federal Reserve governor, Powell answered simply that he had not. Follow-up questions about the timing of any decision drew the same response, with Powell saying he had nothing further to share. He also declined to explain why he might consider stepping aside, noting that there are appropriate moments for such discussions and that this was not one of them.

No Comment on Political or Legal Matters

Powell also avoided questions related to potential subpoenas or political actions involving the Federal Reserve. He offered no assessment or reaction, repeating that he had nothing to add on those topics. Similarly, he declined to speculate about how a leadership transition might unfold should a new Fed chair be nominated, emphasizing that such processes are governed by Congress and established procedures.

Emphasis on Central Bank Independence

Rather than engage in conjecture about leadership changes, Powell used the opportunity to underscore the importance of central bank independence. He said the principle is designed to protect the institution’s ability to make decisions in the public interest, not to shield individual policymakers. According to Powell, independence is a widely adopted framework among advanced democracies because it supports long-term economic stability.

Warning on Public Trust and Credibility

Powell cautioned that eroding public confidence in the Federal Reserve would have lasting consequences. He said credibility, once lost, would be difficult to rebuild and could undermine the effectiveness of monetary policy. He added that he and his colleagues remain firmly committed to preserving that trust and maintaining the Fed’s nonpartisan role.

How Fed Leadership Is Determined

The chair of the Federal Reserve is nominated by the US president and confirmed by the Senate, a process that places the position at the intersection of economic policy and public accountability. While questions about leadership often intensify during periods of political attention, the central bank operates independently from the White House once appointments are confirmed.

Inflation Remains Above Desired Levels

Turning to economic conditions, Powell said inflation remains somewhat elevated, pointing to higher goods prices influenced in part by tariffs. While price pressures have eased from earlier peaks, he indicated that progress toward the Fed’s long-term inflation goal has been uneven, requiring continued vigilance from policymakers.

Interest Rates Left Unchanged

Powell confirmed that the Federal Open Market Committee chose to keep its benchmark interest rate unchanged. The target range for the federal funds rate remains between 3.5 percent and 3.75 percent. He said the decision reflects a careful balance between supporting economic growth and ensuring that inflation continues to move lower over time.

Economic Growth Shows Mixed Signals

According to Powell, the US economy expanded at a solid pace last year and is entering 2026 on what he described as firm footing. Consumer spending has shown resilience, and business investment has continued to grow. However, he acknowledged that the housing sector remains weak, reflecting the impact of higher borrowing costs and tighter financial conditions.

-

ISPL Season 3: Bhushan Gole’s Late Heroics Guide Bengaluru Strikers To Gritty Win Over Ahmedabad Lions

-

ICC Suspends USA Batter Aaron Jones Over Fixing Charges In Barbados-Based T10 League

-

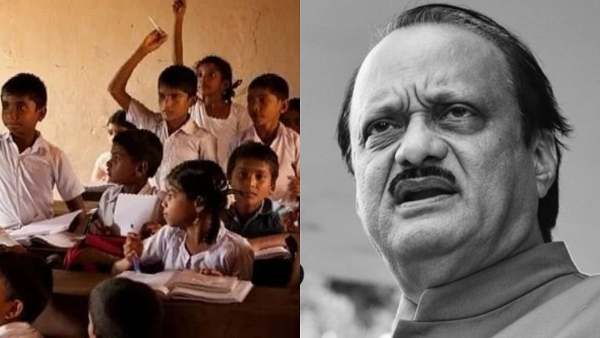

Mumbai Schools & Colleges To Function As Usual On Jan 29; MU Defers Today's Exams As State Mourns Ajit Pawar's Demise

-

NMEPS To Host World Wetlands Day 2026 Event In Navi Mumbai On February 1 With Focus On Conservation And Community Action

-

FPJ Interview: 'Read History And Form Your Own Perception,' Says Freedom At Midnight Season 2 Actor Anurag Thakur