With rising inflation and an uncertain future, regular income after retirement has become a primary need for everyone. Investors often seek options that minimize risk and offer complete income assurance. Life Insurance Corporation of India is known for its reliable pension plans. The "Smart Pension Plan" is one such option designed to provide financial stability after retirement.

Smart Pension Scheme StructureThis is an immediate annuity plan in which the policyholder invests a lump sum amount. The pension begins immediately upon investment and continues for life. The key feature of this plan is that it is not linked to the stock market. There is no investment risk, making it a "zero-risk" pension plan.

Investment TermsThe minimum investment amount in this pension plan is ₹1 lakh, while there is no maximum investment limit. This means investors can invest as much as they want, depending on their capacity and needs. This plan is available in both individual and joint options, providing protection for both husband and wife.

Fixed pension amountThe biggest advantage of this LIC plan is that the pension amount is fixed at the time of policy purchase. Once the annuity rate is locked, it remains fixed for the entire life. Investors can choose to receive their pension on a monthly, quarterly, half-yearly, or annual basis, depending on their convenience. This makes household expense planning much easier.

Additional benefits and protectionThis plan also offers several additional benefits to policyholders. Investors can choose to increase their pension by 3% or 6% each year. Furthermore, there is the option to return the principal invested amount to the nominee upon death. This feature ensures the financial security of the family.

Calculation of pensionIf an investor deposits a lump sum of ₹20 lakh under this plan, they can receive an annual pension of approximately ₹136,000, according to LIC's calculator. Calculated on a monthly basis, this amount comes to approximately ₹10,880 per month. However, the actual pension amount depends on the investor's age, the option chosen, and the payment method.

Beneficiaries of the schemeThis pension plan is particularly useful for those who seek regular income after retirement and want to avoid market fluctuations. Retired employees from the government or private sectors, self-employed individuals, and senior citizens can strengthen their financial position through this plan.

-

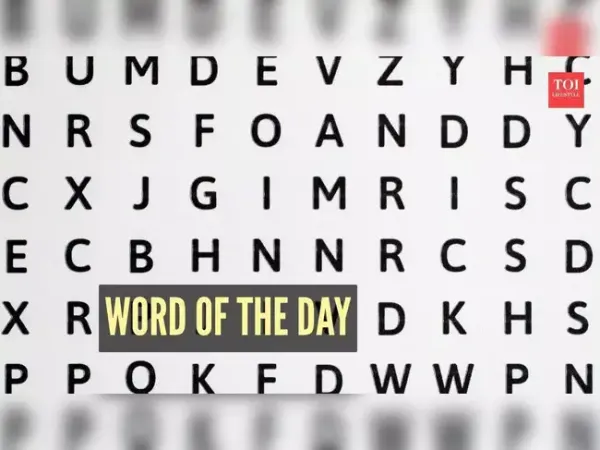

Word of the day: Sonorous

-

Can Budget take a leaf out of China's BYD story to give India its own EV giant?

-

Ram Mohan Naidu discusses sustainable fuel, air mobility cooperation with French minister

-

Three missing Quebec girls rescued in Richmond Hill, Toronto man and teen charged with human trafficking, police warn of potential additional victims

-

Word of the Day: Dextrocardia