Where is my refund? IRS opens 2026 tax filing season as Americans track payments, deadlines, and federal shake-ups - The 2026 U.S. tax filing season has officially begun, and for millions of Americans, one question dominates early January searches: Where is my refund? As the Internal Revenue Service opens its filing window, taxpayers are watching refund timelines closely while navigating staffing cuts, leadership changes, and a higher-than-normal workload at the agency. At the same time, Washington is grappling with broader accountability issues across defense contracting, homeland security spending, federal procurement systems, and cybersecurity rules—developments that could shape public trust in federal institutions throughout 2026.

The Internal Revenue Service says it expects to receive roughly 164 million individual tax returns this year, with the vast majority submitted electronically. While electronic filing typically speeds up refunds, the agency enters the season after losing nearly 25% of its workforce over the past year. That staffing reduction, paired with a late executive leadership shakeup announced days before filing opened, has raised questions about processing capacity and refund timing—especially for filers claiming credits or submitting amended returns.

Taxpayers have until April 15, 2026, to file their federal returns or request an extension. Refunds for electronically filed, error-free returns are still expected to arrive within 21 days, but the IRS continues to warn that identity verification issues, paper filings, and certain credits may cause delays.

However, 2026 introduces added complexity. The IRS is balancing record-level digital filings while operating with fewer staff. Officials say automation and AI-assisted review tools are helping offset workforce losses, but manual reviews are still required for returns flagged for discrepancies, fraud prevention, or eligibility checks for refundable credits.

For taxpayers, the most common causes of refund delays remain unchanged: incorrect Social Security numbers, mismatched income data, missing signatures on paper returns, and claims involving the Earned Income Tax Credit or Additional Child Tax Credit.

Lawmakers say that since President Trump began his second term, firms linked to venture capital group 1789 Capital—where Trump Jr. joined shortly after the inauguration—have received more than $70 million in Defense Department contracts. One startup backed by the firm reportedly secured the largest loan ever issued by the Pentagon’s Office of Strategic Capital.

Several of these companies had little or no prior history of receiving major defense awards before 2025. Lawmakers have asked Defense Secretary Pete Hegseth to respond by February 5, citing concerns over transparency, procurement standards, and potential conflicts of interest.

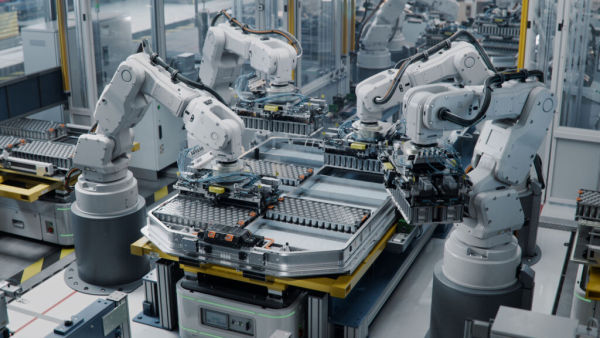

At the same time, the Army has officially retired its decades-old Standard Procurement System, replacing it with the Army Contract Writing System. The new platform supports more than 7,600 users and has migrated nearly 50,000 contract files in under a year. Contract volume processed through the system surged from $39 million in fiscal 2023 to $17 billion in fiscal 2025, underscoring how digital modernization is reshaping military acquisition.

While the House has already passed the remaining fiscal 2026 spending bills, Senate leaders are weighing whether to separate DHS funding from the package. Lawmakers note that most DHS spending supports non-border operations, including FEMA disaster response, TSA aviation security, and federal cybersecurity programs. Still, the incident has reignited debate over oversight, accountability, and the scope of law enforcement authority within DHS agencies.

Meanwhile, the Treasury Department has canceled 31 contracts with Booz Allen Hamilton, totaling $4.8 million annually and $21 million in total obligations. The move follows the conviction of former employee Charles Littlejohn, who is serving five years in prison for leaking thousands of tax records. Treasury officials say the decision reflects heightened sensitivity around data security and public trust.

In a related shift, the Office of Management and Budget has eliminated a Biden-era requirement for software vendors to submit Secure Software Development Attestation Forms. The rule was introduced after the 2021 SolarWinds breach, but the current administration argues the mandate was burdensome and ineffective. Agencies may still require software bills of materials at their discretion, signaling a more flexible—though controversial—approach to federal cybersecurity standards.

FAQs:

The Internal Revenue Service says it expects to receive roughly 164 million individual tax returns this year, with the vast majority submitted electronically. While electronic filing typically speeds up refunds, the agency enters the season after losing nearly 25% of its workforce over the past year. That staffing reduction, paired with a late executive leadership shakeup announced days before filing opened, has raised questions about processing capacity and refund timing—especially for filers claiming credits or submitting amended returns.

Taxpayers have until April 15, 2026, to file their federal returns or request an extension. Refunds for electronically filed, error-free returns are still expected to arrive within 21 days, but the IRS continues to warn that identity verification issues, paper filings, and certain credits may cause delays.

IRS refund status in 2026: what taxpayers should expect this filing season

Refund tracking remains one of the most heavily used IRS services each year. The agency encourages taxpayers to rely on its official “Where’s My Refund?” tool, which updates once every 24 hours and reflects real-time processing stages. Historically, more than 90% of refunds are issued within three weeks when returns are e-filed and direct deposit is selected.However, 2026 introduces added complexity. The IRS is balancing record-level digital filings while operating with fewer staff. Officials say automation and AI-assisted review tools are helping offset workforce losses, but manual reviews are still required for returns flagged for discrepancies, fraud prevention, or eligibility checks for refundable credits.

For taxpayers, the most common causes of refund delays remain unchanged: incorrect Social Security numbers, mismatched income data, missing signatures on paper returns, and claims involving the Earned Income Tax Credit or Additional Child Tax Credit.

Congress presses Pentagon over Trump Jr.–linked defense contracts and loans

As tax season begins, scrutiny is also intensifying on federal spending. A group of Democratic lawmakers, led by Elizabeth Warren, is demanding answers from the Department of Defense regarding contracts and loans awarded to companies tied to Donald Trump Jr..Lawmakers say that since President Trump began his second term, firms linked to venture capital group 1789 Capital—where Trump Jr. joined shortly after the inauguration—have received more than $70 million in Defense Department contracts. One startup backed by the firm reportedly secured the largest loan ever issued by the Pentagon’s Office of Strategic Capital.

Several of these companies had little or no prior history of receiving major defense awards before 2025. Lawmakers have asked Defense Secretary Pete Hegseth to respond by February 5, citing concerns over transparency, procurement standards, and potential conflicts of interest.

Army restructures communications force as procurement systems modernize

The U.S. Army is undergoing its own structural changes. As part of a broader force realignment, the service has elevated its public affairs officer community into a standalone basic branch, ending its long-standing designation as a functional area. The move, signed off by Army Secretary Dan Driscoll on January 15, reflects the growing importance of strategic communication in modern military operations.At the same time, the Army has officially retired its decades-old Standard Procurement System, replacing it with the Army Contract Writing System. The new platform supports more than 7,600 users and has migrated nearly 50,000 contract files in under a year. Contract volume processed through the system surged from $39 million in fiscal 2023 to $17 billion in fiscal 2025, underscoring how digital modernization is reshaping military acquisition.

DHS funding faces Senate resistance after fatal shooting

Federal spending debates are also intensifying on Capitol Hill. Senate Democrats are seeking to pause consideration of a Department of Homeland Security funding bill following the January 24 fatal shooting of a Veterans Affairs Medical Center nurse in Minneapolis by a Border Patrol agent.While the House has already passed the remaining fiscal 2026 spending bills, Senate leaders are weighing whether to separate DHS funding from the package. Lawmakers note that most DHS spending supports non-border operations, including FEMA disaster response, TSA aviation security, and federal cybersecurity programs. Still, the incident has reignited debate over oversight, accountability, and the scope of law enforcement authority within DHS agencies.

FEMA oversight, consulting scrutiny, and rollback of software security rules

Beyond Congress, the White House is reshaping federal oversight structures. President Trump has extended the FEMA Review Council’s charter through March 25, delaying a final vote on reform recommendations initially expected late last year. The council’s findings are closely watched amid workforce reductions at FEMA and proposals to shift more emergency response responsibility to state and local governments.Meanwhile, the Treasury Department has canceled 31 contracts with Booz Allen Hamilton, totaling $4.8 million annually and $21 million in total obligations. The move follows the conviction of former employee Charles Littlejohn, who is serving five years in prison for leaking thousands of tax records. Treasury officials say the decision reflects heightened sensitivity around data security and public trust.

In a related shift, the Office of Management and Budget has eliminated a Biden-era requirement for software vendors to submit Secure Software Development Attestation Forms. The rule was introduced after the 2021 SolarWinds breach, but the current administration argues the mandate was burdensome and ineffective. Agencies may still require software bills of materials at their discretion, signaling a more flexible—though controversial—approach to federal cybersecurity standards.

FAQs:

1. What is the tax filing deadline for 2026?

The deadline to file your 2025 federal income tax return is Wednesday, April 15, 2026. If you cannot file by this date, you must submit Form 4868 by April 15 to request an automatic extension until October 15, 2026.2. When will I receive my 2026 tax refund?

The IRS issues most refunds in less than 21 days for taxpayers who e-file and choose direct deposit. If you claim the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC), law requires the IRS to hold those refunds until mid-February. These payments are expected to hit bank accounts by March 2, 2026.3. How do I check my IRS refund status?

You can track your refund using the IRS "Where’s My Refund?" tool or the IRS2Go mobile app.- E-filers: Check 24 hours after the IRS accepts your return.

- Paper filers: Check 4 weeks after mailing your return.

- Required Info: You will need your Social Security Number (or ITIN), filing status, and exact refund amount.

4. Can I still get a paper refund check in 2026?

No, in most cases. Following Executive Order 14247, the IRS is phasing out paper checks to modernize payments. If you do not provide bank information, your refund may be frozen. You will receive a CP53E notice asking you to provide direct deposit details via your IRS Online Account. If no action is taken within 30 days, a paper check may be issued as a last resort after six weeks.5. What new deductions are in the "One Big Beautiful Bill"?

For the 2026 season, taxpayers can use the new Schedule 1-A to claim several new benefits:- No federal tax on tips.

- No federal tax on overtime pay.

- Deductions for car loan interest.

- Enhanced deductions for senior citizens.