Amid heated competition in the quick commerce market, the second largest player Swiggy Instamart won’t be adopting a discount heavy approach to gain further market share. During Swiggy’s Q3 earnings call, Swiggy management opined that the strategy of “buying growth” via discounting often leads to customers switching platforms without loyalty rather quickly.

While outlining the company’s bid to secure and retain market leadership, Instamart CEO Amitesh Jha underlined that this cannot be achieved by pouring money into discounts alone. Instead, it would require a focus on long-term structural growth driven by better SKUs and a sharper understanding of customer needs.

“We believe the level of irrational competition in the market is so high that it is leading to customers switching from one platform to another without any real loyalty. What we see as healthy growth is when customers stick to the platform and come back again and again, rather than chasing whatever others are offering at any given point,” Jha said.

As per him, what works in this case is the value proposition the company offers to the end consumer. “Our assortment, our approach to understanding what customers actually need, and ensuring that we deliver that assortment, is the right way to build and defend our market position,” he added.

Important to highlight that Swiggy’s commentary comes weeks after, Reliance owned JioMart claimed to be on track to become India’s second-largest quick commerce player by volume, behind Blinkit but ahead of Swiggy Instamart and Zepto. The company claimed that its quick commerce arm averaged delivering 1.6 Mn orders per day in Q3 FY26.

However, Instamart, which has been considered to be the second largest player in the quick commerce market, labelled orders per day (OPD) as a vanity metric for comparison as it may not necessarily reflect real demand, customer loyalty or business’ overall health.

Management highlighted that it has avoided chasing easy OPD gains by avoiding lowering order thresholds to INR 99, even though this would have inflated order volumes, albeit temporarily.

“If the question is whether we can drive higher numbers simply to show a higher OPD, the answer is yes. That can be done easily by putting more money into what is often called growth. However, we do not believe this is structural growth,” Jha noted.

Instead, the company is relying on investing in areas that can ensure sustainable growth in the long run. Its approach lies in bifurcating its user base broadly into two cohorts. The first includes sticky, loyal users who are unlikely to be impacted by short-term pricing moves. Offerings such as MaxxSavers are aimed at retaining and deepening engagement with this group. For context, MaxxSaver was an automatic in-app feature offering launched by Instamart that would give users up to INR 500 in savings on orders exceeding INR 999.

The second cohort comprises early or maturing users who are still developing repeat behaviour. Instamart said it is important to ensure that the value proposition for this group is not diluted by what it described as “irrational” market actions.

The commentary comes at a time when Instamart’s cash burn continues to weigh on Swiggy’s overall financials. The quick commerce arm reported a 50% YoY jump in losses to INR 791 Cr in the quarter as it ramped up investments, even as revenue grew sharply by 76% YoY to INR 1,016 Cr.

Operationally, Instamart saw strong growth, with total orders rising 45% YoY to 10.6 Cr and average order value increasing 40% YoY to INR 746. The company also expanded its footprint, adding 34 dark stores during the quarter to take its total network to 1,136 stores.

However, higher investments and operating costs meant that adjusted EBITDA losses widened further, rising 57% YoY and 7% QoQ to INR 908 Cr.

Overall, Swiggy’s consolidated net loss zoomed 33% YoY to INR 1,065 Cr in Q3 FY26 from INR 799 Cr in the year-ago quarter. Its top line crossed the INR 6,000 Cr mark in the quarter under review, zooming 54% YoY to INR 6,148 Cr.

Shares of Swiggy ended today’s trading session 1.17% higher at INR 327.40

The post Swiggy Instamart Says It Won’t ‘Buy Growth’ With Discounts Amid Quick Commerce Price Battle appeared first on Inc42 Media.

-

What is 3-6-9 formula? what is 3-6-9 formula in relationship

-

Bharat 6G Alliance, EU partners align research priorities for future-ready networks. Technology News

-

Pakistan is on its knees again after the jackal’s hooliganism! First threatened to boycott, now canceled Colombo ticket

-

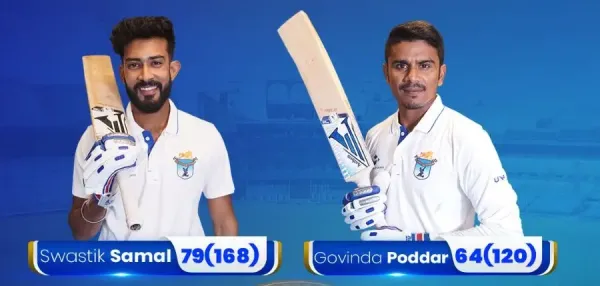

Ranji Trophy: Swastik Samal & Govinda Poddar Hit Fifties As Odisha Reach 242/6 Vs Jharkhand

-

Fans celebrated, RCB defeated UP Warriorz by eight wickets and made it to the finals of WPL 2026. Read