Principality Building Society is offering a market leading 7.5% interest rate on a savings account. The lender's six month Regular Saver can be managed online, in branch or by post and allows payments up to £200 per month.

The least you can pay in is £1 and the most is £1,200. You don't have to add money every month, but withdrawals aren't allowed. Principality said the account is right for people who want to save regularly towards a goal, don't need to take the money out and are looking for the certainty of a fixed rate.

It's not for anyone who wants to pay in over £200 a month, wish to make withdrawals before the six months is up and plan to save more than £1,200.

Fixed for six months, the interest rate is 7.50% AER (7.36% gross), calculated daily and paid into the account after the half-year period expires.

So paying in £200 per month for the whole six months would result in a total £1,225.93, assuming the first payment is made on the date the account opens.

Principality's offer tops Moneyfactscompare.co.uk's best regular savings accounts list.

It is followed by Zopa' Regular Saver account, which offers a variable rate of 7.10%, and First Direct's Regular Saver Account - a 12 month bond with a fixed rate of 7.00%.

Savers searching for tax-free savings options have already seen providers raising rates this week. Plum announced on Wednesday (January 28) that it had increased its Cash ISA rate for new customers to 4.36% AER, with the bonus part of that rate now 1.82% AER.

Moneybox raised the interest rate on its Cash ISA to 4.39% a day later, leading to an "excellent" rating by experts at Moneyfactscompare.co.uk.

Mark Hicks, Director of Active Savings at broker Hargreaves Lansdown, advised those with cash available now to take advantage of strong, easy access rates and fixed deals still on offer.

He said: "The one-year fixed rate market is particularly competitive at the moment - especially among online banks and savings platforms - so it's worth shopping around for a decent rate."

Mr Hicks' advice came as Bank of England data showed deposits in banks and building societies rose by £4.8billion in December - down from £8.8bn in November.

Savers paid another £5.2bn into cash ISAs and £5.1bn into easy access accounts paying interest. They withdrew £1.8bn from easy access accounts paying no interest and £0.1bn from fixed rate accounts.

Mortgage approvals for house purchases fell 3,100 to 61,000 and the rate on new mortgages fell from 4.2% to 4.15%, according to Hargreaves Lansdown, citing the BoE data.

-

How we empower the ugly Indian abroad every day

-

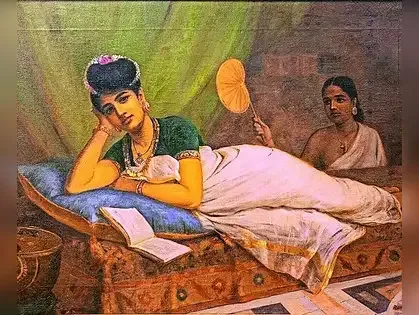

The great Indian non-fiction reading cop-out

-

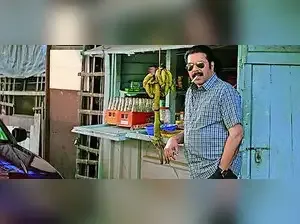

Taking the sting off the venom: Why Mammootty's Kalamkaval falls short of its true story

-

Is ‘AI-washing’ behind new wave of tech layoffs?

-

SpaceX seeks FCC nod for solar-powered satellite data centres for AI