To enhance "Ease of Doing Business" for technology sector, Finance Minister Nirmala Sitharaman has announced a massive overhaul of the Safe Harbour Rules (SHR) for IT and IT-enabled services (ITeS).

This reform specifically targets Global Capability Centres (GCCs) and large-scale IT exporters who have long struggled with protracted transfer pricing litigation.

The most major change is the raising of the eligibility threshold for safe harbour protection.

Reduced Litigation: With higher thresholds and a unified margin, thousands of cross-border transactions will now be accepted by tax authorities without need for in-depth audits.

Boost to GCCs: India currently hosts over 2,000 GCCs. This move provides the "tax predictability" needed to attract higher-value mandates like AI development and platform engineering.

Operational Simplicity: Firms no longer need to spend years in Advance Pricing Agreement (APA) process for transactions below the ₹2,000 crore mark, as the safe harbour provides an immediate "Green Channel" for tax compliance.

-

Ghee instead of oil for rough hair? Reshmi Jella will return with a little trick from Henshel

-

Banke Bihari’s treasury opened, what was found?

-

Like every year this time also the political significance of Nirmala’s saree

-

Meet the new European unicorns of 2026

-

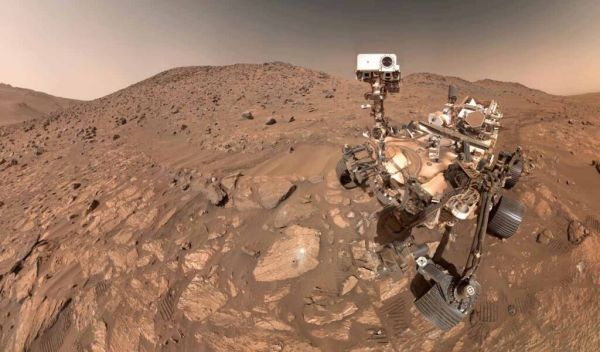

NASA’s Perseverance rover completes first AI-planned drives on Mars