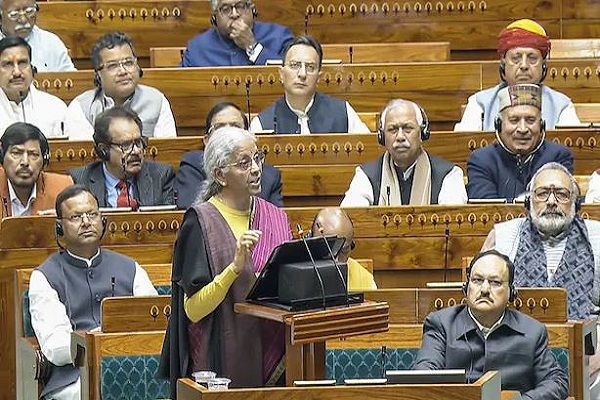

New Delhi, Feb 1 (IANS) Finance Minister Nirmala Sitharaman announced a dedicated Rs 10,000 crore SME (small and medium enterprises) Growth Fund, to create future champions by incentivising enterprises based on select criteria as part of the Budget 2026-27 proposals presented in the Parliament on Sunday.

She also proposed to top up the Self-Reliant India Fund set up in 2021, with Rs 2,000 crore to continue support to micro enterprises and maintain their access to risk capital.

"The Government led by Prime Minister Narendra Modi has decisively and consistently chosen action over ambivalence, reform over rhetoric and people over populism," the Finance Minister remarked.

She further stated that the Government is inspired by 3 'kartavyas' (duties), out of which the first is to accelerate and sustain economic growth, by enhancing productivity and competitiveness, and building resilience to volatile global dynamics.

Recognising MSMEs as a vital engine of growth, the Finance Minister proposed a three-pronged approach to help them grow as "Champions under the first Kartavya" with the first being the setting up Rs 10,000 crore SME fund for equity support.

On the second approach of "liquidity support", the Finance Minister said that with TReDS, more than Rs 7 lakh crore has been made available to MSMEs.

To leverage its full potential, she proposed four measures, which include making TReDS the transaction settlement platform for all purchases from MSMEs by CPSEs, serving as a benchmark for other corporates and introducing a credit guarantee support mechanism through CGTMSE for invoice discounting on the TReDS platform. Besides, linking GeM with TReDS for sharing information with financiers about government purchases from MSMEs, and introducing TReDS receivables as asset-backed securities, helping develop a secondary market, enhancing liquidity and settlement of transactions, figure as the other two measures.

On the final approach of “professional support,” Sitharaman pointed out that the government will facilitate professional institutions such as the Institute of Chartered Accountants of India (ICAI), the Institute of Company Secretaries of India (ICSI), and the Institute of Cost Accountants of India (ICMAI) to design short-term, modular courses and practical tools to develop a cadre of ‘Corporate Mitras’, especially in Tier-II and Tier-III towns. These accredited para-professionals will help MSMEs meet compliance requirements at affordable costs.

--IANS

sps/vd

-

From Diwali Aarti to worship method, all you want to know

-

Why is Digital Detox important for Gen Z? what is digital detox

-

India’s new AI platform ‘Bharat Vistaar’ will transform agriculture, know how.

-

What became cheaper and what became expensive? Finance Minister announced

-

Budget 2026: Pockets will be less loose while driving! Tax will not have to be paid on Bio-CNG Mix…public will get relief