New Delhi, 1 February. Finance Minister Nirmala Sitharaman made several important announcements for taxpayers while presenting the Union Budget 2026 on Sunday. He said that the new Income Tax Act will come into force from April 1, 2026 and the rules to income tax have been made more simple and transparent than before. A new scheme has also been proposed for small taxpayers, which will make tax compliance easier. However, no change has been made in the income tax slab in this budget.

Deadline for ITR filing extended, last date fixed as 31st July

Nirmala Sitharaman announced that the last date for filing ITR-1 and ITR-2 has been extended to July 31. This will provide great relief to lakhs of salaried and small taxpayers. The government says that along with simplifying the forms, the tax filing process has also been made digital and user-friendly.

Government fulfilled the promise made in 2021-22

The Finance Minister told Parliament that the government has fulfilled the promise made in 2021-22. As per the budget estimates, fiscal deficit is estimated to be 4.4 per cent of GDP in 2025-26, while it is expected to decline to 4.3 per cent in 2026-27. The government’s focus is on accelerating growth while maintaining fiscal discipline.

Big announcements for states also, grant of Rs 1.4 lakh crore will be given

Big announcements have also been made for the states in the budget. Nirmala said that a grant of Rs 1.4 lakh crore will be given to the states in the financial year 2027. The debt-to-GDP ratio for FY 2027 has been fixed at 55.6 percent, while net borrowing has been fixed at Rs 11.7 lakh crore.

Big relief in TCS rates

In Budget 2026, the government has given big relief in TCS rates. Under the Liberalized Remittance Scheme (LRS), TCS applicable on money sent abroad for studies and treatment has also been reduced from five percent to two percent. This will provide relief to those families who send money abroad for education or medical reasons.

To remove confusion in tax rules, the government has clarified that supply of human resource services will be included in the category of payments made to contractors. Under this, now only one percent or two percent TDS will be levied on these services, which will provide convenience to both businessmen and workers.

-

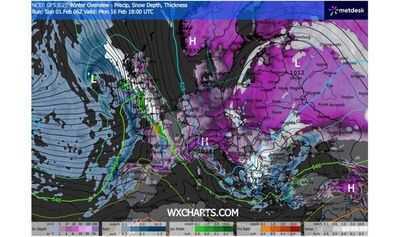

Snow maps forecast week of heavy blizzards with 95% of UK covered in new Polar freeze

-

I got a sneak peak inside LookFantastic's £55 Valentine's Day beauty box worth £215

-

Middle class to gain through affordable healthcare, Budget aims long-term relief: Dr Singh

-

Longevity expert's 'delicious' snack that's 'affordable for everyone'

-

Chelsea's new arrival decided with Jeremy Jacquet on verge of Liverpool transfer