Mumbai. Domestic stock markets fell heavily on Sunday after the Budget proposed to increase the Securities Transaction Tax (STT) on futures deals. Sensex fell 1,547 points while Nifty closed down 495 points. Analysts said the market did not like Finance Minister Nirmala Sitharaman’s announcement in the budget speech to increase STT in futures and options segment and it went down very sharply.

BSE’s benchmark index Sensex, based on 30 shares, lost its initial gains and slipped below the crucial 80,000 mark to 79,899.42 points in afternoon trade with a huge fall of 2,370.36 points or 2.88 per cent. However, later the Sensex showed slight improvement and closed at 80,722.94 points, down 1,546.84 points or 1.88 percent. National Stock Exchange’s standard index Nifty also fell by 495.20 points or 1.96 percent and closed at 24,825.45 points.

At one time during trading, it fell 748.9 points or 2.95 percent to a low of 24,571.75 points. The announcement in the budget speech to increase the STT rate on futures trading from 0.02 percent to 0.05 percent was held responsible for this huge decline. There was normal trading in the stock markets despite it being a Sunday due to the presentation of the Union Budget for the next financial year.

According to market experts, the main reason for investors’ concern was the increase in STT on futures and options (F&O) trading. “The sharp increase in STT on F&O, especially on futures, has increased the overall transaction costs for market participants,” said Pranav Haridasan, managing director (MD) and chief executive officer (CEO), Axis Securities. This created concern among foreign and domestic investors regarding the possibility of impact on liquidity, participation and cost competitiveness of the Indian market, which was reflected in the quick reaction of the market.

Among the Sensex companies, State Bank of India (SBI) fell the most by 5.61 percent while Adani Ports fell by 5.53 percent. Apart from this, major decline was also recorded in Bharat Electronics, ITC, Tata Steel, UltraTech Cement and Reliance Industries. On the other hand, shares of Tata Consultancy Services, Infosys, Sun Pharma and Titan closed with gains. Analysts cautioned that the STT hike could weigh on foreign portfolio investors (FPI) sentiment in the near term.

Akash Shah, technical research analyst at Choice Equity Broking, said, “Increased STT on futures and options could be a negative signal, especially for highly leveraged and derivative-focused global funds.” According to stock market data, foreign institutional investors had bought shares worth Rs 2,251.37 crore on Friday. “The proposed increase in STT may put pressure on capital market entities in the short term, however, it may also have positive effects in the long term,” said Dheeraj Ralli, managing director and chief executive officer (CEO), HDFC Securities.

Vinod Nair, head of research at Geojit Investments Ltd, said, “The budget has supported emerging sectors like data centres, semiconductors and manufacturing and sectors affected by global trade tariffs, but there was an immediate negative reaction in the market due to increase in STT on futures trading.” Markets in Asia and Europe remained closed on Sunday due to holidays, while US markets closed with losses on Friday. Earlier on Friday, Sensex fell 296.59 points to 82,269.78 and Nifty fell 98.25 points to close at 25,320.65.

-

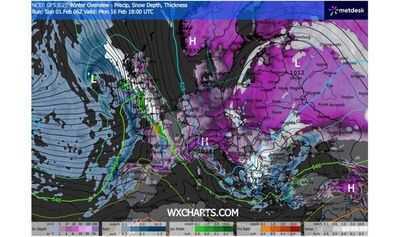

Snow maps forecast week of heavy blizzards with 95% of UK covered in new Polar freeze

-

I got a sneak peak inside LookFantastic's £55 Valentine's Day beauty box worth £215

-

Middle class to gain through affordable healthcare, Budget aims long-term relief: Dr Singh

-

Longevity expert's 'delicious' snack that's 'affordable for everyone'

-

Chelsea's new arrival decided with Jeremy Jacquet on verge of Liverpool transfer