New Delhi: For every rupee in the government’s coffers, the largest slice of 64 paise will come from direct and indirect taxes, according to the Union Budget 2026-27 documents.

Around 24 paise will come from borrowings and other liabilities, 10 paise from non-tax revenue like disinvestment, and 2 paise from non-debt capital receipts, the Budget documents showed.

Income tax will yield 21 paise, corporation tax 18 paise, and Goods and Services Tax (GST) 15 paise per rupee of revenue.

Besides, the government looks to earn 6 paise from excise duty and 4 paise from customs levy in every rupee of revenue.

Also Read

Union Budget 2026: Here is what gets cheaper, what gets costlierThe collection from “borrowings and other liabilities” will be 24 paise per rupee, as per the Union Budget 2026-27 presented in Parliament by Finance Minister Nirmala Sitharaman on Sunday, February 1.

The Budget documents provide a fractional break-up for Re 1 that comes in and gets spent.

On the expenditure side, the outlay for interest payments and states’ share of taxes and duties, respectively, stood at 20 paise and 22 paise for every rupee.

Allocation for defence stands at 11 paise per rupee.

Expenditure on central sector schemes will be 17 paise out of every rupee, while the allocation for centrally-sponsored schemes is 8 paise.

The expenditure on ‘Finance Commission and other transfers’ is pegged at 7 paise. Subsidies and pensions will account for 6 paise and 2 paise, respectively.

The government will spend 7 paise out of every rupee on ‘other expenditures’.

Get the latest updates in Hyderabad City News, Technology, Entertainment, Sports, Politics and Top Stories on WhatsApp & Telegram by subscribing to our channels. You can also download our app for Android and iOS.

-

Angela Rayner has already launched her campaign to replace Keir Starmer as Prime Minister

-

Angela Rayner has already launched her campaign to replace Keir Starmer as Prime Minister

-

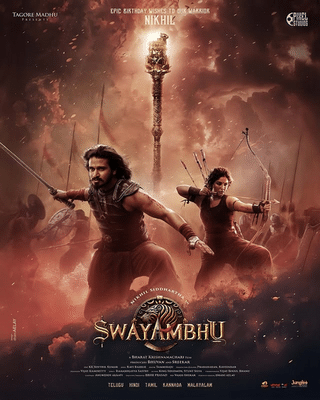

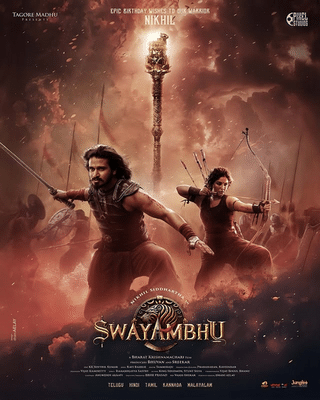

Nikhil Siddhartha relishes ice cream after staying on a two-year diet for historical film 'Swayambhu'!

-

Nikhil Siddhartha relishes ice cream after staying on a two-year diet for historical film 'Swayambhu'!

-

Woman gives birth to baby boy inside ambulance in Chikkamagaluru district