The Union Budget 2026–27 raised high expectations among salaried individuals and the middle class, with many hoping for revised tax slabs, higher standard deductions, or additional relief under the new tax regime. However, instead of altering tax rates, the government chose a different path—overhauling and simplifying the income tax system.

Finance Minister Nirmala Sitharaman focused on reducing complexity, easing compliance, improving return filing, and resolving long-pending tax disputes. While tax slabs remain unchanged, the Budget introduces 10 major income tax reforms that are expected to significantly affect salaried taxpayers, professionals, businesses, investors, and the broader middle class.

1. New Income Tax Act to Replace the 1961 Law

The most important announcement is the introduction of the Income Tax Act, 2025, which will come into effect from April 1, 2026. This new law will replace the six-decade-old Income Tax Act of 1961.

The government has clarified that the new Act will be revenue-neutral, meaning tax rates will remain the same. However, the number of sections and legal language will be reduced by nearly 50%, making the law easier to understand and interpret.

2. Simplified Language and Fewer Ambiguous Provisions

Under the new framework, unclear and overlapping provisions will be removed. The objective is to minimize disputes arising from complex interpretations and ensure greater transparency for taxpayers.

3. Clear Distinction Between Errors and Tax Evasion

The Budget introduces a clear separation between unintentional mistakes and deliberate tax evasion.

-

If income is under-reported due to genuine error or oversight, the penalty will be limited to 50% of the tax amount.

-

If income is deliberately concealed or misreported, penalties can go up to 200% of the tax payable.

This move aims to protect honest taxpayers while cracking down on intentional tax fraud.

4. New, User-Friendly ITR Forms

The government has announced that new and simplified ITR forms will be launched along with the revised tax law. These forms will be designed keeping ordinary taxpayers in mind, making filing easier for salaried individuals and first-time filers.

Taxpayers will also be given adequate time to understand the new system before it is fully enforced.

5. Extended Deadline for Filing Revised ITR

Another major relief is the extension of the deadline for filing revised income tax returns. The last date has been proposed to move from December 31 to March 31, with only a nominal fee.

This change gives taxpayers more time to correct mistakes or declare missed income without facing heavy penalties.

6. TDS Refund Allowed Even for Late ITR Filers

In a significant relief for salaried employees, taxpayers will now be able to claim TDS refunds even if the ITR is filed late. No penalty will be imposed solely for claiming a refund.

This addresses a long-standing issue where excess TDS deductions caused financial stress for employees who missed filing deadlines.

7. No Interest on Penalty During Appeals

If a penalty is imposed and the case is pending before the first appellate authority, no interest will be charged on the penalty amount during this period. This reduces financial pressure on taxpayers involved in prolonged litigation.

8. Special Six-Month Window for Foreign Asset Disclosure

The Budget introduces a six-month disclosure window for reporting foreign assets in cases of genuine oversight. This is especially beneficial for students, professionals returning from abroad, and tech workers who may have unintentionally missed disclosures earlier.

The measure allows corrections without harsh consequences.

9. MAT Relief and Rate Reduction

The Budget also brings relief under Minimum Alternate Tax (MAT):

-

Non-residents under presumptive taxation will be exempt from MAT

-

MAT will be treated as a final tax

-

MAT rate proposed to be reduced from 15% to 14%

These changes aim to reduce uncertainty for businesses and foreign taxpayers.

10. Other Key Tax Changes Affecting Investors and Individuals

Several smaller yet impactful changes include:

-

Motor Accident Claims Tribunal awards made tax-free

-

TCS on foreign education and medical expenses reduced from 5% to 2%

-

TCS on overseas tour packages cut to 2%

-

STT increased on futures and options trading

-

Share buyback proceeds to be taxed as capital gains for all shareholders

No Change in Tax Rates, But a Major System Overhaul

While income tax slabs remain unchanged, Budget 2026 clearly signals a shift toward a simpler, clearer, and more taxpayer-friendly system. The focus is on ease of compliance, reduced disputes, and giving taxpayers more time and flexibility.

Though immediate tax relief through lower rates may be missing, these reforms could deliver long-term benefits by making India’s income tax framework more predictable, transparent, and reliable.

-

Newcastle bought player with £100m release clause in record January transfer

-

Tottenham wrapped up deadline day transfer for PSG star with Neymar calling deal 'unfair'

-

Cheme Serdeon Conquers Mount Kilimanjaro: A Journey of Determination

-

Should Wi-Fi and Mobile Internet Be Turned Off at Night? What Science Really Says

-

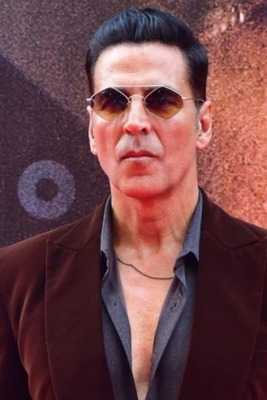

Golmaal 5 Gets Bigger! Akshay Kumar To Play The Antagonist In Ajay Devgn Film