The Union Budget 2026 has proposed an important change in the Income Tax Return (ITR) filing timeline, aiming to reduce last-minute pressure on taxpayers and improve compliance efficiency. The government has introduced a staggered return-filing schedule, meaning different categories of taxpayers will now have different deadlines instead of a single uniform date.

However, it is crucial to understand that the extended deadline of August 31 will not apply to all taxpayers. Contrary to widespread assumptions, most salaried individuals will continue to follow the existing July 31 deadline.

What Is the New Staggered ITR Filing Timeline?

Under the Budget 2026 proposals, the government has decided to allow select categories of taxpayers additional time to file their income tax returns. This move is intended to ease compliance for taxpayers who generally need more time to finalize accounts or gather financial information.

The Finance Ministry has clarified through budget documents and Income Tax Department FAQs that the August 31 deadline is limited to specific non-audit cases, and not a blanket extension for everyone.

Who Can File ITR Until August 31?

The August 31 ITR deadline applies only to:

-

Non-audit business taxpayers

-

Professionals whose accounts do not require tax audit

-

Partners of non-audit firms

-

In certain cases, spouses of such partners

-

Non-audit trusts

This relaxation is particularly beneficial for small business owners, freelancers, consultants, and independent professionals, who often require additional time to close books and calculate income accurately.

What About Salaried Taxpayers?

For salaried individuals, there is no change in the return filing timeline. If you file ITR-1 or ITR-2, the deadline remains July 31, just as before.

The government has clearly stated that it would be incorrect to assume the August 31 deadline applies to all taxpayers. The extension is selective and targeted, ensuring that salaried taxpayers with relatively straightforward income structures continue to follow the existing schedule.

Understanding Non-Audit Business Cases

Non-audit cases typically include businesses or professionals whose turnover falls below the prescribed audit threshold. Generally, this covers:

-

Businesses with turnover below ₹1 crore

-

Taxpayers opting for presumptive taxation schemes

-

Freelancers and professionals with income below audit limits

Since these taxpayers are not required to undergo a formal tax audit, the government has decided to provide them with additional time to complete compliance under the revised income tax framework.

Why Have Trusts Been Given More Time?

Trusts are legal entities created for charitable, religious, or private purposes. When a trust’s accounts do not require an audit, it will now be eligible to file its income tax return by August 31.

This change is expected to:

-

Reduce compliance-related stress

-

Minimize errors caused by rushed filings

-

Improve overall accuracy in tax reporting

The relaxation ensures that trusts can meet statutory obligations without unnecessary penalties.

When Will the New Rule Come Into Effect?

The revised ITR filing timeline has been introduced under Section 263(1)(c) of the Income Tax Act, 2025. It will come into force from April 1, 2026, and will apply from Assessment Year 2027–28 (Tax Year 2026–27).

To ensure a smooth transition, similar amendments have also been made to the Income Tax Act, 1961, allowing taxpayers to adapt seamlessly to the new structure.

What Taxpayers Should Keep in Mind

-

Salaried taxpayers must not miss the July 31 deadline

-

Small businesses, freelancers, and non-audit trusts can file returns until August 31

-

Correctly identifying your taxpayer category is essential to avoid penalties

-

Late filing beyond the applicable deadline may still attract fines and interest

Bottom Line

The Budget 2026 proposal aims to make tax compliance more practical by recognizing that not all taxpayers have the same filing requirements. While the August 31 deadline offers relief to non-audit businesses and trusts, salaried individuals must continue to plan for a July 31 filing date.

Understanding which category you fall into is key to staying compliant and avoiding unnecessary trouble with the tax authorities.

-

Newcastle bought player with £100m release clause in record January transfer

-

Tottenham wrapped up deadline day transfer for PSG star with Neymar calling deal 'unfair'

-

Cheme Serdeon Conquers Mount Kilimanjaro: A Journey of Determination

-

Should Wi-Fi and Mobile Internet Be Turned Off at Night? What Science Really Says

-

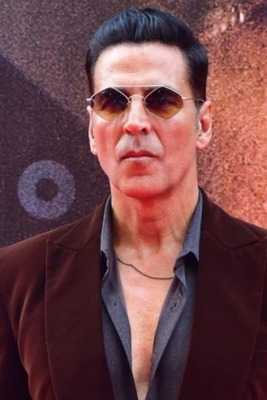

Golmaal 5 Gets Bigger! Akshay Kumar To Play The Antagonist In Ajay Devgn Film