BOBCARD Limited, a wholly owned subsidiary of Bank of Baroda, has partnered with Etihad Airways to introduce two new co-branded credit cards in India. Designed especially for frequent international travelers, these cards aim to provide enhanced travel rewards, airline privileges, and lifestyle benefits. The newly launched cards operate on the Mastercard network and are positioned to help travelers earn greater value on everyday spending as well as airline bookings.

The collaboration marks BOBCARD’s entry into premium airline partnerships and targets Indian consumers who travel abroad frequently or prefer flying with Etihad Airways. With competitive fees, reward miles, and travel-focused perks, the cards are expected to appeal to both premium and entry-level travel card users.

Two Card Variants for Different Travel Needs

BOBCARD and Etihad Airways have launched two variants:

-

BOBCARD Etihad Guest Premium Credit Card

-

BOBCARD Etihad Guest Credit Card

The Premium Credit Card comes with an annual fee of ₹5,000, while the entry-level card is priced at ₹2,500 per year. In both cases, the annual fee may be waived if the cardholder meets the specified annual spending criteria, making the cards more attractive for regular users.

Premium Credit Card: Key Features and Benefits

The BOBCARD Etihad Guest Premium Credit Card offers higher rewards and exclusive travel privileges. Cardholders earn 2 Etihad Guest Miles for every ₹100 spent on both domestic and international transactions. For bookings made directly with Etihad Airways, the reward rate increases significantly to 6 miles per ₹100 spent.

New cardholders can earn 5,000 bonus Etihad Guest Miles by spending ₹25,000 within the first 60 days of card issuance. Additionally, users receive Etihad Guest Silver Tier status after their first transaction, providing priority benefits. There is also an opportunity to upgrade to Gold Tier status when making eligible purchases on Etihad’s official website.

Travel convenience is further enhanced with:

-

12 domestic and 8 international airport lounge visits per year

-

Zero foreign exchange markup, making overseas spending more economical

-

Milestone rewards of up to 24,000 miles annually

-

Concierge services and exclusive hotel offers

These features make the premium card suitable for frequent flyers seeking comfort, rewards, and reduced travel costs.

Entry-Level Card: Ideal for Budget-Conscious Travelers

The BOBCARD Etihad Guest Credit Card is designed for users who want travel benefits at a lower cost. Cardholders earn 1 Etihad Guest Mile per ₹100 spent, while Etihad Airways bookings fetch 3 miles per ₹100.

New users receive 2,500 bonus miles after spending ₹10,000. The card also provides:

-

8 domestic and 4 international lounge accesses per year

-

A 1% foreign exchange markup, which is still competitive compared to many standard cards

This card is well-suited for occasional international travelers or those beginning their journey with airline co-branded credit cards.

Why These Cards Matter for Travelers

For consumers who frequently travel overseas or regularly fly with Etihad Airways, these credit cards can significantly reduce overall travel expenses. Benefits such as airline miles, complimentary lounge access, lower forex charges, and elite status privileges help improve the travel experience while delivering tangible savings.

By choosing the right card variant based on spending habits and travel frequency, users can maximize rewards on both daily purchases and flight bookings. The partnership also strengthens BOBCARD’s presence in the premium travel credit card segment.

Final Takeaway

The launch of BOBCARD–Etihad co-branded credit cards provides Indian travelers with new options to enhance their international travel experience. With flexible pricing, attractive reward structures, and airline-focused benefits, the cards offer meaningful value to frequent flyers and travel enthusiasts alike.

As global travel continues to rebound, such co-branded offerings are expected to gain popularity among consumers seeking smarter and more rewarding ways to manage travel spending.

-

Newcastle bought player with £100m release clause in record January transfer

-

Tottenham wrapped up deadline day transfer for PSG star with Neymar calling deal 'unfair'

-

Cheme Serdeon Conquers Mount Kilimanjaro: A Journey of Determination

-

Should Wi-Fi and Mobile Internet Be Turned Off at Night? What Science Really Says

-

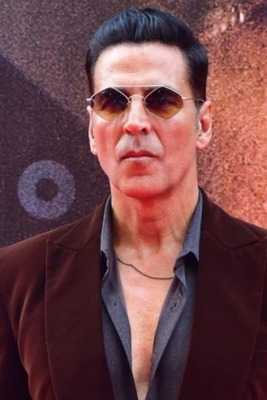

Golmaal 5 Gets Bigger! Akshay Kumar To Play The Antagonist In Ajay Devgn Film