The Income Tax Department has released the Draft Income Tax Rules, 2026, proposing major changes in how and where PAN (Permanent Account Number) will be required. These new rules are expected to come into effect from April 1, 2026, after public feedback is reviewed.

If implemented, the revised rules will directly impact several day-to-day financial transactions, including vehicle purchases, property deals, insurance payments, hotel bills, and cash withdrawals from banks. The aim is to simplify compliance in some areas while tightening oversight in others to curb tax evasion.

Public Feedback Open Till February 22

The draft rules have been opened for public consultation, and stakeholders can submit their suggestions till February 22, 2026. Based on the responses received, the Income Tax Department will notify the final version of the rules.

Let’s take a closer look at where PAN will be mandatory under the proposed changes.

PAN Requirement for Vehicle Purchases

At present, PAN is required for almost all vehicle transactions except scooters and motorcycles, with no minimum value limit.

Under the new draft rules:

-

PAN will be mandatory for any motor vehicle transaction above ₹5 lakh

-

This will now include two-wheelers

-

Tractors are exempted from this rule

This change is aimed at tracking high-value vehicle purchases more effectively.

Hotel and Restaurant Bills

Currently, PAN is required if cash payment at a hotel or restaurant exceeds ₹50,000 in a single transaction.

Proposed change:

-

PAN will be required only if the bill exceeds ₹1 lakh

This move is expected to reduce compliance burden for mid-range consumers while continuing oversight on luxury spending.

Life Insurance Premium Payments

As of now:

-

PAN is mandatory if the annual life insurance premium exceeds ₹50,000

Under the draft rules:

-

PAN will be compulsory for all account-based relationships

-

This means most life insurance policies, regardless of premium amount, will require PAN

This step will help improve financial transparency in insurance-related transactions.

Property Transactions

Current rule:

-

PAN is mandatory for property deals exceeding ₹10 lakh

Proposed change:

-

PAN requirement threshold to be raised to ₹20 lakh

This is expected to ease compliance for smaller property transactions, particularly in semi-urban and rural areas.

Cash Withdrawals From Bank or Post Office

At present:

-

Reporting is required if cash withdrawals exceed ₹20 lakh in a financial year

Proposed revision:

-

The reporting threshold will be reduced to ₹10 lakh

This move is intended to discourage excessive cash usage and help track unaccounted money.

Why These Changes Matter

The proposed PAN-related changes strike a balance between:

-

Reducing unnecessary compliance for smaller transactions

-

Strengthening monitoring of high-value and cash-heavy dealings

If approved, these rules will redefine how individuals and businesses manage their financial activities from the next financial year.

Conclusion

The New Income Tax Draft Rules 2026 signal a shift toward tighter financial transparency while offering relief in certain areas. Taxpayers should closely track the final notification and prepare to align their financial transactions with the revised PAN requirements.

With April 1 approaching fast, staying informed could help you avoid compliance issues and penalties in the future.

-

UK car hire company crashes into administration - in business since 1981

-

I'm a travel writer - there's one frustrating mistake I always see Brits make at airport

-

CBI arrests Delhi Jal Board employee, aide in bribery case

-

Raghav Chadha pushes for "Right to Recall" for voters to remove "non-performing" MPs and MLAs

-

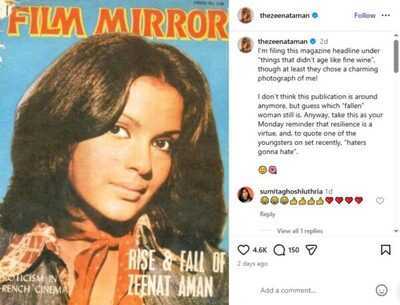

“Haters Gonna Hate,” Zeenat Aman Claps Back At Old Magazine That Once Declared Her 'Finished'