Airtel, India's second-largest telecom service provider (TSP), introduced its network-based AI spam detection solution for calls and SMS in September 2024. Later, in May 2025, the company launched its AI-enabled fraud detection feature for email and WhatsApp in India. Now, Airtel has launched its new fraud alert system to prevent bank-related scams using leaked one-time passwords (OTPs). Using AI, the alert system will identify "potentially risky situations" to alert subscribers. This comes at a time when cases of digital fraud, financial crimes, and other financial crimes are on the rise. Recently, the Supreme Court reportedly stated that Indians lost approximately ₹54,000 crore to digital fraud scams.

Airtel's Fraud Alerts use AI to detect potentially risky incoming calls.

On Wednesday, the company announced that it is introducing a new fraud alert system to warn users about OTP-related bank scams. This feature is already live in Haryana. However, the company plans to roll out fraud alerts to all Airtel users nationwide within the next two weeks.

When a user receives an OTP via SMS, this feature uses AI to identify incoming risky calls. The company claims to offer real-time fraud protection on its network. This will send an alert to customers, warning them about the risk of approving banking transactions using OTPs while on a call.

The company stated that scammers often exploit the "urgency associated with OTPs for day-to-day services," including delivery services. Fraudsters then trick users into sharing their banking transaction OTPs, leaving their account savings vulnerable to fraud.

Fraud Alert is the latest addition to the company's suite of scam and spam protection features. In September 2024, Airtel launched an AI-powered spam detection feature for calls and SMS, which was later expanded to include Indian regional languages in April 2025.

Similarly, in May 2025, Airtel introduced a fraud detection solution for OTT apps and social media platforms, including WhatsApp, Instagram, and Facebook. The company uses AI to identify fraudulent links and websites and blocks access if they are flagged as a potential risk.

This comes amid growing concerns about rising cases of digital arrests and telephonic scams. Mint reports that the Supreme Court recently said that Indians have lost over Rs 54,000 crore to digital fraud, during which victims are forced to share their banking details and OTP, or transfer money to the fraudster's account.

Disclaimer: This content has been sourced and edited from Dainik Jagran. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

Tet congestion in HCMC slows emergency response despite sirens

-

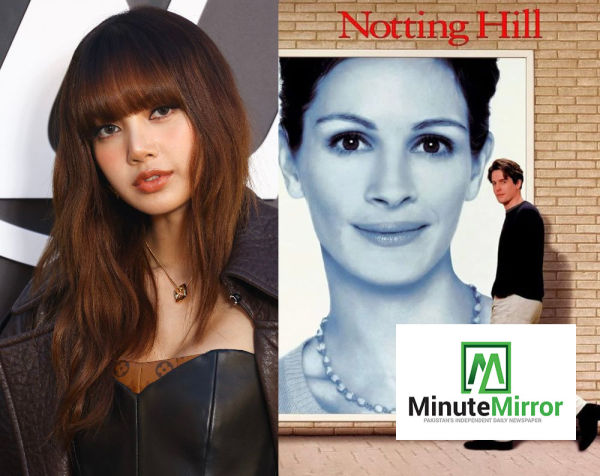

BLACKPINK’s Lisa set to star in Netflix rom-com

-

If you also have excessive sensitivity in teeth, then use of alum and rock salt will give relief…

-

The Common Design Flaw In Bras That Probably Wouldn’t Happen If Men Wore Them

-

3 Zodiac Signs Attract Really Good Luck All Week, From February 16 – 22, 2026