Bank Account Rules: If your bank account is suddenly frozen, everyday tasks can be disrupted, and problems can increase. There's no need to panic in this situation. Activate your bank account this way.

Almost every citizen in India has at least one bank account today. Whether it's receiving a salary, receiving a subsidy, deducting an EMI, or making an online payment, everything is linked to the bank account. In such a situation, if an account suddenly freezes, it can be problematic.

When a bank account is frozen, no money can be withdrawn or transactions be made. Therefore, it's important to understand why an account is frozen and how to reactivate it. An account freeze means that all transactions from the account have been temporarily halted.

Sometimes, banks take this step due to failure to update KYC. Sometimes, an account is considered inactive if there are no transactions for a long period of time. Suspicious transactions can also be blocked for security reasons. In India, the authority to freeze bank accounts is provided under regulations.

According to Reserve Bank of India guidelines, banks can take action for security reasons. Furthermore, the Income Tax Department, courts, and the Securities and Exchange Board of India can also order account freezing if necessary.

Sudden large transactions, such as foreign debit card purchases or multiple simultaneous online payments, trigger system alerts. The bank suspects the account has been compromised. In such cases, the account is temporarily closed for customer safety.

KYC updates are required every three years. If this process is not completed, the bank can freeze the account. Similarly, if there are no transactions for six months, the account is frozen. If an order is issued by the Income Tax Department or a court, the bank cannot take any action on its own. The account is reactivated only after obtaining permission from the relevant department.

If your account has been frozen for any of these reasons. So, first, contact your bank branch or customer service. Then, determine the reason for the bank freeze. If the reason is KYC or a suspicious transaction, submitting the necessary documents can quickly resolve the issue. Taking the appropriate steps can help reactivate your account.

-

ABP Live Pet First | 7 Budget Grooming Tips That Actually Work For A Healthy Pet

-

O’Romeo Box Office Collection Picks Up on Day 5, Enters Shahid Kapoor’s Top 10 Highest-Grossing Films

-

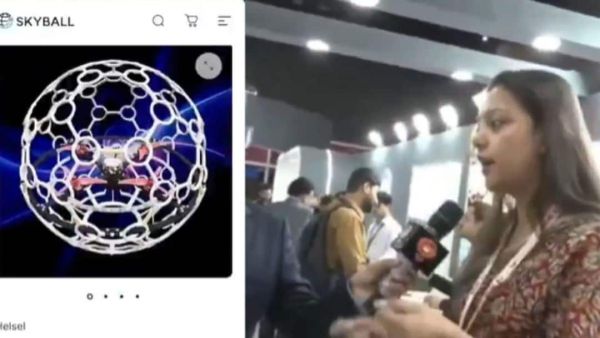

After Robot Dog Row, Galgotias University’s 'In-House' Soccer Drone Claim Goes Viral

-

Who Is Neha Singh? Galgotias Professor At Centre Of AI Summit ‘Robot Dog’ Controversy

-

Google DeepMind CEO Demis Hassabis Says AGI 'On The Horizon' In 5–8 Years, Calls It A Big Opportunity For India’s Youth