HMRC has provided some guidance about how to reclaim tax on your pensions. The group set out the rules after a pensioner got in touch, as they had overpaid a large amount of tax.

The person contacted the authority over social media. Posting on February 17, they said their pension provider had "overpaid tax on my private pensions by several thousand pounds in the last year". They said they were keen to claim back some of the amount soon "rather than have to wait to do my next tax return".

They asked the tax body: "What's the best way to get it back?" HMRC responded to say that, given the time of year, it would be best to hold fire for now.

HMRC told the taxpayer: "As you've raised this with less than seven weeks before the end of the tax year, you will be best waiting until 6th April 2026 to complete your self assessment return for 25/26 and claim the refund through Self Assessment."

The tax year ends on April 5 each year, with the new financial year starting on April 6. If you need to file a tax return for the current 2025/2026 tax year, this needs to be submitted by October 31, 2026, if you want to file a paper return.

The more popular option is to file your tax return online, in which case you will need to get this in by January 31, 2027. Some key tax changes are coming in from April 2026.

The Making Tax Digital programme is coming in, so some people need to sign up and start sending in regular updates to HMRC. From April 6, self-employed people and landlords with income of more than £50,000 will need to start using the scheme.

Under the programme, you have to provide digital quarterly updates to HMRC about your tax affairs. Tax on dividend income is also increasing by two percentage points.

This will increase the ordinary rate from 8.75 percent to 10.75 percent, while the upper rate will rise from 33.75 percent to 35.75 percent. The additional rate will stay at the current 39.35 percent.

Pensioners may also want to factor in the increase to the state pension. Payments will go up 4.8 percent thanks to the triple lock metric. This policy ensures payments go up in April in line with whichever is highest: 2.5 percent, the rate of inflation or the rise in average earnings.

The full new state pension will go up from £230.25 a week to £241.30 a week, or £12.547.60 a year. You can claim the state pension when you reach the age of 66, while you can start to draw down from your pensions at age 55.

The state pension age is increasing gradually from April 2026, rising in stages to reach 67 by April 2026. The age you can access your private pensions is also going up relatively soon, increasing to 57 from April 2028.

Ensure our latest headlines always appear at the top of your Google Search by making us a Preferred Source. Click here to activate or add us as your Preferred Source in your Google search settings.

-

Dusk's 'buttery soft' muslin bedding is the 'epitome of luxury' with prices slashed to £20

-

Dusk's 'buttery soft' muslin bedding is the 'epitome of luxury' with prices slashed to £20

-

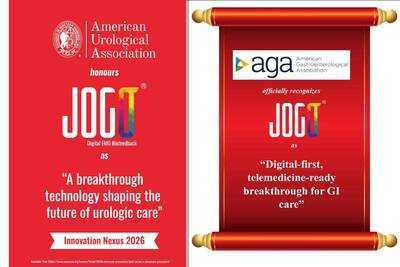

An Indian health tech startup received recognition from the American Urology and Gastroenterology Associations, marking a significant milestone for innovation emerging from the country.

-

TV doctor's NHS 'shortcut' skips 8am phone queues for GP appointments

-

Assam CM Himanta Biswa Sarma inaugurates Star Cement plant in Cachar