debt trap

Debt often starts with very simple decisions. Smartphone taken on EMI, credit card recourse in the last days of the month, or a small personal loan taken to repay an old bill. These decisions do not seem wrong at all at that time, but gradually these habits take you on a path from which it becomes difficult to get out. Experts call this situation debt trap.

Today this problem is increasing rapidly. Credit card usage is increasing, but the number of people who are unable to make full payment on time is also continuously increasing. The biggest problem is that many people do not realize that they are in financial trouble until the situation gets out of hand. Now the question is how do you recognize whether you are getting trapped in the debt trap or are already trapped.

You are only paying the minimum amount

If you are paying only the minimum due of credit card or loan every month, then this is the first warning sign. This saves the fine, but the actual amount i.e. the principal remains almost the same. The interest keeps increasing and your loan does not end for years. Everything seems fine from outside, but the burden keeps increasing inside.

New loan to repay old loan

When there is shortage of money, people start taking new loans to pay old bills. Initially it seems that this is a temporary solution, but this habit gradually creates a dangerous cycle. Before one loan is finished, another one is started and the total burden keeps increasing.

If you are paying regular EMIs, yet the total balance of your loan is hardly decreasing, then understand that alarm bells have rung. This means that a large part of your income is going only towards paying interest. You are paying money not to get out of debt, but to stay there.

A large part of your income goes towards EMI.

When as soon as the salary comes, a large part of it gets spent in EMI and money starts falling short for other expenses, then it is a very serious sign. If more than 30-35 percent of your income is going towards repaying the loan, then the financial balance starts deteriorating. In such a situation, a person is not able to save and somehow manages every month.

No savings even after working for years

If you do not have any savings even after working for many years, then it clearly shows that debt is stopping your progress. Without savings, even a small emergency forces you to borrow again, and the cycle continues.

Getting into debt is not irresponsible. Often, easy credit, rising expenses and the convenience of EMIs push people to this situation. The good thing is that if the signs are recognized at the right time, it is possible to get out of it. Small steps, like controlling expenses, paying off high-interest loans first and building a small emergency fund, can gradually improve the situation. Debt is dangerous when it starts stopping you from moving forward.

-

Michael Mosley's simple method to lose 1 stone in 12 weeks - no diet

-

HM Amit Shah praises security agencies investigating Red Fort blast case

-

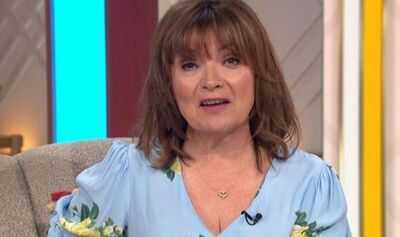

ITV Lorraine 'so excited' as she shares huge career news

-

Mum gets £455 Christmas food shop for just £14 in Tesco, but people are divided

-

Fury as royal fan makes 'Granny Diana' comment to Prince George