PDD Holdings Inc (PDD) shares jumped nearly 11% before the bell on Monday after the company reported second-quarter results that beat Wall Street expectations on the back of steady demand in China and in international markets.

The company’s quarterly revenue rose 7% to RMB 103.98 billion ($14.51 billion), compared with analysts’ estimates of RMB 103.20 billion, according to data compiled by Fiscal AI.

The retail user message count jumped over 170% in the last 24 hours on Stocktwits for Temu-owner PDD Holdings. The retail sentiment on PDD Holdings remained unchanged in the ‘extremely bullish’ territory, with chatter at ‘extremely high’ levels, according to data from Stocktwits.

“In the past quarter, we continued to invest in merchant support initiatives, and are encouraged by the progress made towards a healthier and more sustainable platform ecosystem,” said Co-CEO Lei Chen. PDD’s adjusted earnings per share came in at RMB 22.07, compared with expectations of RMB 14.80.

“Revenues growth further moderated this quarter amid intense competition,” said Jun Liu, VP of Finance of PDD Holdings. "As we remain focused on long-term value creation, the sustained investments may continue to weigh on short-term profitability.”

PDD said its total operating expenses were RMB 32.33 billion, marking an increase of 5% from RMB 30.80 billion a year ago, due to a jump in sales and marketing expenses.

Shares of PDD jumped 11% this year and have gained over 27% in the last 12 months.

RMB 1 = $0.14

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

KKR eyes THIS star player for IPL 2026 captaincy? Ajinkya Rahane’s future in doubt

-

Coolie Box Office Collection Day 13: Rajinikanth’s film hits lowest collection even on Ganesh Chaturthi holiday due to….

-

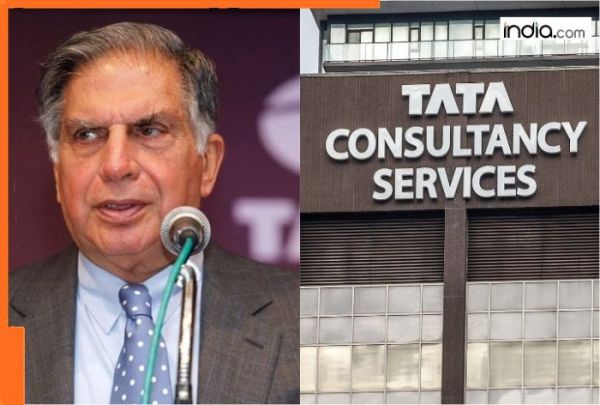

After announcing massive layoffs, Ratan Tata’s TCS leases 1.4 million sq ft of space in THIS city, rent could buy over 250 helicopters, rent is Rs…

-

Amid 12000 layoffs TCS forms new AI, services transformation unit in…, appoints new head named as…, who is he?

-

Storm hits Vietnam, heavy rain and flood warning in many parts of Southeast Asia