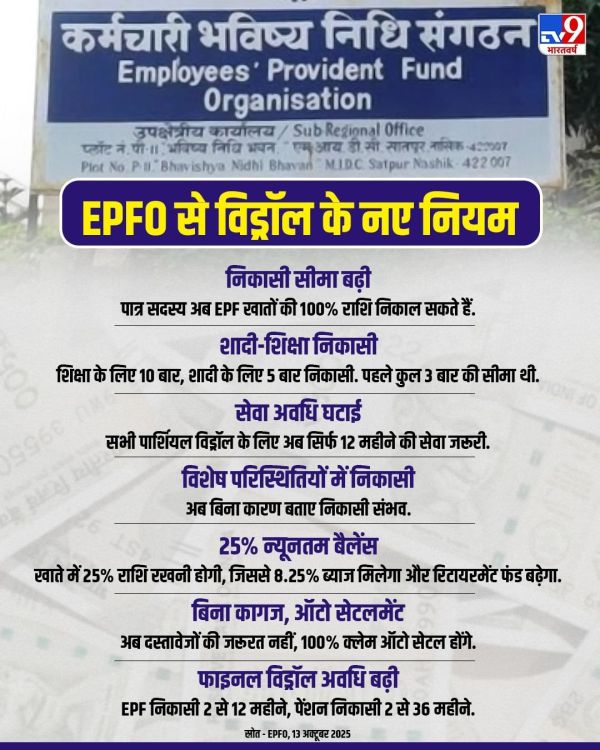

The Central Government has taken a historic and extremely relief decision for more than seven crore employed employees of the country. Now the members of Employees' Provident Fund Organization (EPFO) will be able to withdraw up to 100 percent of their hard-earned money i.e. Provident Fund (PF) if needed. In the meeting of the Central Board of Trustees (CBT) of EPFO held under the chairmanship of Union Labor Minister Mansukh Mandaviya, the complex and old rules related to PF withdrawal have been completely changed and made very simple and flexible.

The aim of this big decision is to make the life of employees easier, so that they can avoid visiting offices and lengthy paperwork to get their own money for their emergency financial needs, such as illness, children's education or marriage. The government has also clarified that these changes will not have any negative impact on the retirement savings of employees or their pension eligibility. Come, let us understand these new rules in detail to see how easy it has become for you to withdraw PF money.

No more hassles with complex rules

Till now there were 13 different terms and conditions for withdrawing money from PF, which were very complex. Employees often did not understand which form had to be filled for which requirement and what documents had to be attached. Due to this confusion, thousands of claims were either rejected or took a lot of time.

To eliminate this problem from its roots, the government has abolished all these 13 provisions and made a single, streamlined rule. Under this, withdrawals are now divided into only three main categories:

- Urgent needs: This includes important expenses like treatment of serious illness of a family member, higher education of children and marriage.

- Housing needs: If you want to buy a new house or flat, acquire land and build a house on it or want to renovate or expand your existing house.

- Special circumstances: This category has been made the most liberal. Earlier, some concrete reason had to be given like job loss, company closure or any natural disaster, but now members will be able to withdraw money under this category even without giving any specific reason.

The biggest benefit of this simplification is that now the requirement of submitting any kind of documents for partial withdrawal has been removed. This will make the entire process 100% automated and claims will be settled faster directly into your bank account.

What is the truth about 100% withdrawal?

Although the news is talking about 100% withdrawal, it is very important to understand the technical aspect of it. According to the new rules, employees can withdraw up to 100 percent of their 'eligible balance', which includes the share of both the employee and the employer.

But there is also an important condition here. The Board has mandated that every member must maintain at least 25 percent of his total contributions in his account at all times. If you understand in simple language, you will be able to withdraw only 75 percent of your current total PF balance at one time.

For example, suppose you have a total of Rs 10 lakh deposited in your PF account. So under the new rule, you can withdraw up to Rs 7.5 lakh for your needs, while the remaining Rs 2.5 lakh will remain in your account as the minimum balance. The government argues that by maintaining the minimum balance in the account, members will continue to benefit from the attractive interest rates (currently 8.25% per annum) and compound interest offered by EPFO, which will help in creating a large corpus for their retirement.

Now withdraw funds frequently for marriage and education

The government has also made the withdrawal limit more liberal than before. Earlier, any employee could withdraw money from PF only three times during his entire service for children's education and marriage. This limit proved inadequate for many families.

Now changing this rule, the withdrawal limit has been increased to 10 times for children's education and 5 times for marriage. This is a huge relief for those middle class families who often face financial crisis to meet the expensive education or marriage expenses of their children.

Along with this, another major change has been made regarding the minimum service period. Earlier there was a condition of different duration of employment for different withdrawals, but now it has been reduced to only 12 months i.e. one year, making it uniform for all types of partial withdrawals. This means that even if you have worked in an organization for just one year, you will be entitled to withdraw money from your PF for these needs. This rule will prove especially beneficial for new and young employees.

Withdraw money from your PF account at home like this

If you need money and want to withdraw advance money from your PF account, now it has become very easy. You do not need to go anywhere, you can do this work from your mobile or computer. Just follow the steps given below:

step 1: Go to EPFO website- First of all, you have to go to the EPFO member website. Its link is: https://unifiedportal-mem.epfindia.gov.in/memberinterface/

Step 2: Log in to your account – As soon as the website opens, log in by entering your UAN number, password and the given captcha code.

Step 3: Select the option of ‘Online Claim’ – After logging in, the option of ‘Online Services’ will appear in the top menu. Click on it and then select 'Claim (Form-31, 19, 10C & 10D)'.

Step 4: Verify your bank account- Now all your information will be visible on your screen. Here, verify your bank account by entering the last 4 digits and proceed by clicking on 'Yes'.

Step 5: Fill the withdrawal information- Now click on 'Proceed for Online Claim'. On the next page, go to 'I want to apply for' and select 'PF Advance (Form 31)'. After this, you will have to fill the reason for withdrawing money (eg illness, marriage, construction of a house) and the amount to be withdrawn. Also, enter your address.

Step 6: Confirm with Aadhaar OTP- After filling all the information, click on 'Get Aadhaar OTP'. An OTP will come on the mobile number linked to your Aadhar card.

Step 7: Submit the claim- Submit your claim by entering that OTP in the given space.

The work is done. Your claim has been successfully submitted. After completion of investigation by EPFO, the money will come directly into your bank account.

-

World AIDS Day 2025 : What causes AIDS infection? ‘These’ remedies will be effective in preventing infection

-

Stay healthy and get these surprising benefits – Obnews

-

No-rum Christmas plum cake recipe: Rich, fruity and irresistible festive treat your family will love

-

Gomukhasana is very beneficial for diabetic patients and women, know how to do it.

-

Price, features and booking information