Nvidia, which recently became the first company to achieve $5 trillion market value, has now lost $450 billion in market cap. Shares of NVDA have been sliding since Monday as three-day share price fall is the biggest since January, 2025, as per data cited by The Kobeissi Letter. On Thursday, the S&P 500 fell 1.1 per cent and the Dow Jones industrials declined 0.8 per cent. The Nasdaq composite fell 1.9 per cent. The biggest weights on the market included Nvidia, the largest company in the world by market value, which dropped 3.7 per cent.

The S&P 500 ended Thursday with a loss and looked set for a weekly decline. The benchmark index was last down over 2 per cent from its all-time closing peak on October 28 even after a generally strong third-quarter earnings season for large U.S. companies.

This week, concerns about expensive equity valuations, especially for high-flying stocks linked to enthusiasm over artificial intelligence, were exacerbated by tepid jobs data, including a report that showed surging layoff announcements from U.S. employers.

Investors were gauging whether the pullback in equities represented profit-taking and a healthy reset after an extended climb, or the start of a more severe slide. Fears that stocks are in an "AI bubble" have kept Wall Street on edge, with the benchmark S&P 500 up 14 per cent year-to-date and 35 per cent since its low for the year in April.

The S&P 500 technology sector, which has led the bull market that began over three years ago, has been hit harder in this latest drawdown, falling more than 5 per cent since last week.

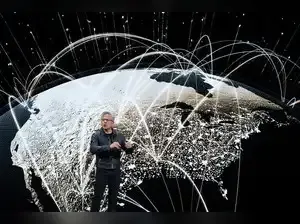

Nvidia CEO Jensen Huang said on Friday that there were "no active discussions" about selling the company's state-of-the-art Blackwell chips to China. Blackwell is Nvidia's current flagship artificial intelligence chip that the Trump administration has so far prevented from being sold to China, for fear it would aid the Chinese military and domestic AI industry.

While there was speculation last week that talks between U.S. President Donald Trump and Chinese President Xi Jinping in South Korea could end with a deal to allow a scaled-down version of the Blackwell to be sold in China, so far there have been no signs of an agreement.

"Currently, we are not planning to ship anything to China," Huang said, soon after arriving in the city of Tainan for his fourth public visit to Taiwan this year.

"It's up to China when they would like Nvidia products to go back to serve the Chinese market, I look forward to them changing their policy," he added.

The U.S. has allowed Nvidia to sell its H20 chip in China, but Huang has repeatedly said over the past month that China does not want Nvidia in the country, so its market share of the advanced AI chip market is zero.

FAQs

Q1. What are top three indexes of U.S. Stock Market?

A1. Top three indexes of U.S. Stock Market are S&P 500, Nasdaq, Dow Jones.

Q2. Which is the largest company in the world?

A2. Nvidia is the largest company in the world by market value.

The S&P 500 ended Thursday with a loss and looked set for a weekly decline. The benchmark index was last down over 2 per cent from its all-time closing peak on October 28 even after a generally strong third-quarter earnings season for large U.S. companies.

This week, concerns about expensive equity valuations, especially for high-flying stocks linked to enthusiasm over artificial intelligence, were exacerbated by tepid jobs data, including a report that showed surging layoff announcements from U.S. employers.

Investors were gauging whether the pullback in equities represented profit-taking and a healthy reset after an extended climb, or the start of a more severe slide. Fears that stocks are in an "AI bubble" have kept Wall Street on edge, with the benchmark S&P 500 up 14 per cent year-to-date and 35 per cent since its low for the year in April.

The S&P 500 technology sector, which has led the bull market that began over three years ago, has been hit harder in this latest drawdown, falling more than 5 per cent since last week.

Nvidia CEO Jensen Huang said on Friday that there were "no active discussions" about selling the company's state-of-the-art Blackwell chips to China. Blackwell is Nvidia's current flagship artificial intelligence chip that the Trump administration has so far prevented from being sold to China, for fear it would aid the Chinese military and domestic AI industry.

While there was speculation last week that talks between U.S. President Donald Trump and Chinese President Xi Jinping in South Korea could end with a deal to allow a scaled-down version of the Blackwell to be sold in China, so far there have been no signs of an agreement.

"Currently, we are not planning to ship anything to China," Huang said, soon after arriving in the city of Tainan for his fourth public visit to Taiwan this year.

"It's up to China when they would like Nvidia products to go back to serve the Chinese market, I look forward to them changing their policy," he added.

The U.S. has allowed Nvidia to sell its H20 chip in China, but Huang has repeatedly said over the past month that China does not want Nvidia in the country, so its market share of the advanced AI chip market is zero.

FAQs

Q1. What are top three indexes of U.S. Stock Market?

A1. Top three indexes of U.S. Stock Market are S&P 500, Nasdaq, Dow Jones.

Q2. Which is the largest company in the world?

A2. Nvidia is the largest company in the world by market value.