Pensioners could get an additional £458 every month from the Department for Work and Pensions (DWP). This is due to a planned increase in certain payments by 3.8 per cent from April next year.

Currently, more than 1.7 million people of State Pension age across Great Britain are receiving up to £1,362 each month through two separate payments from the Department for Work and Pensions (DWP) and Social Security Scotland. The Attendance Allowance and Pension Age Disability Payment (PADP) are paid separately from the State Pension and can provide additional financial support for older people with a disability, long-term illness, or physical or mental health condition.

These benefits, which are not means-tested, are worth either £73.90 for the lower rate or £110.40 for the higher rate each week. As these benefits are usually paid every four weeks, this amounts to either £295.60 or £441.60 every payment period.

- M&S shoppers race to buy half-price £30 gift set with over 100 five-star reviews

- New UK bank account rule coming into force for anyone with less than £120,000

Pensioners could boost their current income by up to £5,740 to help with extra costs through either of these disability benefits. However, as reported by the Daily Record, this could rise to £5,959 from April 2026.

The September Consumer Price Index (CPI) inflation rate was 3.8 per cent, a figure typically used by the UK Government for the annual uprating of disability benefits. This projected increase would see the lower rate rise from £73.90 per week to £76.70, and the higher rate go up from £110.40 per week to £114.60.

The State Pension increase will be determined by the earnings growth of the Triple Lock, which is 4.8 per cent. The full New State Pension is currently worth £230.25 per week and as the payment is typically made every four weeks this amounts to £921.

Annual payments are worth £11,973 over the 2025/26 financial year. Under the Triple Lock, this could rise to £241.30 per week or £965.20 every four-week payment period.

Coupled with the uprated higher award for Attendance Allowance or PADP (£458.40), someone on the full New State Pension could receive £1,423.60 every month from next April - albeit in separate payments.

It's important to note that not all of the 4.1 million people on the New State Pension receive the full amount as it is linked to National Insurance Contributions. The full Basic State Pension is currently worth £176.45 per week, £705.80 every four-week payment period.

Annual payments are worth £9,175.40 over the 2025/26 financial year. Payments would rise to £184.90 per week, some £739.65 every four-week pay period under the Triple Lock.

Chancellor Rachel Reeves is set to confirm the uprating of State Pension and benefits during the Autumn Budget on 26 November. It's important for Scottish pensioners to note that they can no longer claim Attendance Allowance, but must instead apply for Pension Age Disability Payment (PADP) from Social Security Scotland.

By the end of 2025, PADP will replace Attendance Allowance for all existing claimants residing in Scotland. The amount received for either Attendance Allowance or PADP depends on the level of support required. The benefit aims to assist individuals of State Pension age with daily living costs due to their condition, potentially enabling them to maintain independence in their own homes for a longer period.

Eligible health conditionsThe main health conditions providing support to older people across Great Britain include:

- Arthritis

- Spondylosis

- Back Pain

- Disease Of The Muscles, Bones or Joints

- Trauma to Limbs

- Visual Disorders and Diseases

- Hearing Disorders

- Heart Disease

- Respiratory Disorders and Diseases

- Asthma

- Cystic Fibrosis

- Cerebrovascular Disease

- Peripheral vascular Disease

- Epilepsy

- Neurological Diseases

- Multiple Sclerosis

- Parkinsons Disease

- Motor Neurone Disease

- Chronic Pain Syndromes

- Diabetes Mellitus

- Metabolic Disease

- Traumatic Paraplegia/Tetraplegia

- Major Trauma Other than Traumatic Paraplegia/Tetraplegia

- Learning Difficulties

- Psychosis

- Psychoneurosis

- Personality Disorder

- Dementia

- Behavioural Disorder

- Alcohol and Drug Abuse

- Hyperkinetic Syndrome

- Renal Disorders

- Inflammatory Bowel Disease

- Bowel and Stomach Disease

- Blood Disorders

- Haemophilia

- Multi System Disorders

- Multiple Allergy Syndrome

- Skin Disease

- Malignant Disease

- Severely Mentally impaired

- Double Amputee

- Deaf/Blind

- Haemodialysis

- Frailty

- Total Parenteral Nutrition

- AIDS

- Infectious diseases: Viral disease - Coronavirus COVID-19

If you have a disability or illness and require help or supervision throughout the day or at times during the night - even if you don't currently receive that help - you should apply for Attendance Allowance. This could include:

- Assistance with personal care - such as getting dressed, eating or drinking, getting in and out of bed, bathing or showering and using the toilet

- Help to ensure your safety

You should also consider applying if you struggle with personal tasks, such as those that take a considerable amount of time, cause discomfort or require physical assistance, like needing a chair for support. Attendance Allowance isn't solely for individuals with a physical disability or illness.

It's also advisable to make a claim if you require assistance or supervision throughout the day or night and have:

- A mental health condition

- Learning difficulties

- A sensory condition - such as being deaf or visually impaired

For further information, visit the Government website here.

-

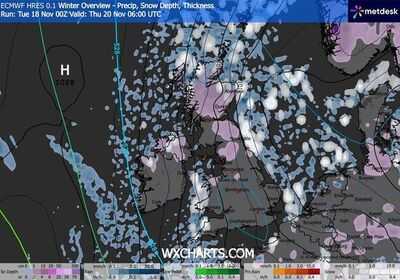

UK snow maps show blizzard as far as Plymouth as Britain braces for -9C freeze

-

Girl, 11, who died in 'unexplained' circumstances named and pictured for first time

-

Men 'too embarrassed' to seek help ignoring potentially serious health issues

-

'Brendon McCullum sledged me like never before': Usman Khawaja recalls

-

"We have chance to make a comeback": Bhuvneshwar Kumar backs Indian team to bounce back after 30-run loss to Proteas