The rise in Groww's stock...

Groww, the country's fastest growing stock broking platform, has shown amazing rally after listing. The way the shares of parent company Billionbrains Garage Ventures have soared as soon as it entered the market, it has surprised all the investors, big and small. This stock, which has been on the rise for five consecutive days, jumped almost 11% on Tuesday and touched the level of ₹ 193.91, and it seems that at the moment its momentum is showing no signs of stopping.

IPO investors got a great income of 94%

Groww had made a strong debut on the listing day itself and closed nearly 31% higher than the IPO price. After this, the continuous surge has brought more smiles on the faces of IPO investors. In just four trading sessions, early investors got a whopping return of about 94%. If the company continues to grow at this pace, then this stock may soon be included in the list of those stocks which are called multibagger in the market.

Market cap crosses Rs 1 lakh crore

This momentum brought another big achievement to Groww. The company's market cap crossed the ₹1 lakh crore mark after the stock jumped nearly 20% on Monday. With this, Groww has reached the category of those select 100 companies, which have touched this magical figure in the Indian stock market.

The most interesting thing is that Groww is now more valuable than the combined market cap of eight old players in the industry like Angel One, Nuvama Wealth, JM Financial, IIFL, 5Paisa, Anand Rathi and DAM Capital.

CEO becomes new billionaire

Its co-founder and CEO Lalit Keshere has also benefited from Groww's stock rally. The value of his holdings has now crossed $1 billion, making him among the new tech billionaires of India.

Is Groww's valuation overpriced?

While the boom is exciting investors, experts have mixed opinions regarding valuation. Many analysts believe that at this time Groww's rally seems to be running a little ahead of the fundamentals.

At the time of IPO, its P/E multiple was between 3337x, but now it is trading at around 61x, which is well above competitors like Motilal Oswal, Angel One or Nuvama. Financial experts say this premium is based on expectations of Groww's digital scale and its future product expansion, but for value-oriented investors, some caution may be necessary at the current levels.

Big sign of retail investor boom

Research analysts believe that the explosive listing of Groww proves that both the number and confidence of retail investors in the country are increasing rapidly. The company is now moving rapidly not only in broking but also in services like wealth management, commodities and margin trading.

Yet experts warn that current valuations already capture much of future growth. Therefore, further growth will depend on the execution and scaling of the company and not just on sentiment.

Q2 results will open the page of real fundamentals

Groww is scheduled to announce its second quarter results this Friday, November 21. Investors are waiting for this, because it will know whether the actual performance of the company justifies this sharp jump in valuation or not.

-

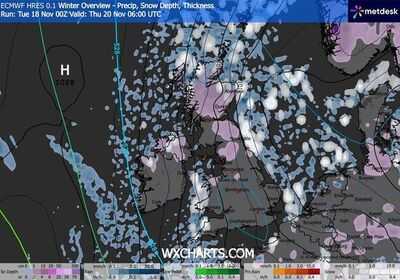

UK snow maps show blizzard as far as Plymouth as Britain braces for -9C freeze

-

Girl, 11, who died in 'unexplained' circumstances named and pictured for first time

-

Men 'too embarrassed' to seek help ignoring potentially serious health issues

-

'Brendon McCullum sledged me like never before': Usman Khawaja recalls

-

"We have chance to make a comeback": Bhuvneshwar Kumar backs Indian team to bounce back after 30-run loss to Proteas