Personal Loan Guide: How to Use a Personal Loan Wisely to Escape High Debt and Cut Down EMI Burden

If you are struggling with multiple expensive loans or high monthly EMIs, a personal loan, when used smartly, can actually reduce financial pressure instead of increasing it. Many people view personal loans only as emergency credit, but when planned strategically, they can significantly lower interest outflow, consolidate costly debt, and ease monthly cash flow. Here’s how to use personal loans in a disciplined and beneficial way.

Consolidate Expensive Debts into One Loan

If you are juggling several debts such as credit card outstanding balances or unsecured loans with very high interest rates, taking one personal loan at a lower rate to clear them can be an excellent money-saving move.

A single consolidated loan reduces the number of payments, simplifies tracking, and significantly lowers the total interest cost. It also spreads the repayment over manageable EMIs, reducing stress while improving credit health.

Financial advisors often recommend replacing high-interest debt with a low-interest personal loan, especially when interest rates on credit cards range between 30–42% per year, while personal loans can be available at much lower rates.

Choose a Short Repayment Tenure to Save Interest

Many borrowers opt for long loan tenures to reduce EMI amounts. Although the EMI becomes easier to handle, the total interest paid becomes much higher in the long run.

A shorter loan tenure means higher monthly EMIs but substantially lower overall interest. Experts suggest that if your income allows, always choose the shortest possible loan duration to reduce long-term cost.

Use Loans for Productive Purposes

Not all debt is bad. If the loan is used for something that builds your future earning capacity, it is considered a smart financial decision. Examples include:

-

Professional training or education

-

Career-related tools or equipment

-

Skill development or certifications

Many banks currently offer personal loans starting from around 9.99% annual interest to eligible borrowers, which can be beneficial when the purpose is productive and returns are expected.

How to Get a Personal Loan at a Lower Interest Rate

The simplest way to save money is to secure the best interest rate from the beginning. Lenders offer competitive rates to applicants with:

-

Strong credit score (preferably 750+)

-

Stable employment or business income

-

Clean repayment history

Always compare loan offers from multiple banks and NBFCs and try negotiating rates—this can significantly reduce total loan cost.

Make Prepayments to Reduce Debt Faster

One of the biggest advantages of personal loans is the option of prepayment or part-payment. Every payment you make directly reduces the principal amount, which lowers interest charged on the remaining balance.

Using bonuses, tax refunds, incentives, or additional income to make periodic prepayments can help you close the loan earlier and save a substantial amount of interest. Many borrowers overlook this strategy and end up paying much more than necessary.

Important Things to Check Before Taking a Personal Loan

✔ Compare interest rates across banks and lenders

✔ Select a suitable tenure—short tenure saves interest, long tenure reduces EMI

✔ Maintain a strong credit score for easier approval and lower rates

✔ Check processing fees, prepayment charges, and hidden fees before finalizing

✔ Ensure EMI fits comfortably within your monthly budget

Final Thoughts

Personal loans can be powerful financial tools when used wisely. Instead of adding pressure, a well-planned personal loan can help clear expensive debt, improve cash flow, and strengthen financial stability. The key is to borrow responsibly, compare offers, choose the right tenure, and use prepayment benefits effectively.

-

GMB star calls out Holly Willoughby for breaking scooter rider's neck in car crash

-

Loose Women horror as host rushes partner to A&E and postpones Christmas plans

-

Man Utd trio set to leave next month including Chido Obi and summer transfer

-

Exciting Anganwadi Worker Opportunities for Women in Uttar Pradesh

-

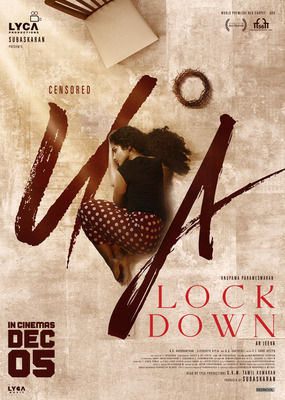

Censor Board clears Anupama Parameswaran's 'Lockdown' for release with U/A certificate