Ethereum continued to dominate liquidation activity, accounting for more than $100 million in forced unwinds.

- Ripple led gains among top tokens, rising nearly 3% with $4.6 million in liquidations in the last 24 hours.

- Bitcoin's price stood at $87,000 as its total liquidation reduced more than half from its previous day.

- The crypto market saw a total liquidation of $247.0 million in the last 24 hours, with most traders deleveraging on the long side rather than panic selling.

Ripple’s native token (XRP) led gains among top tokens on Tuesday night, even as on-chain analysts said that Bitcoin's (BTC) price swings are far from over.

XRP’s price gained about 3% in the last 24 hours, to trade at about $1.93, outperforming Bitcoin and other major altcoins. CoinGlass data showed that XRP derivatives were relatively calm, with about $4.6 million in total liquidations over 24 hours, mostly from long positions being wiped out. On Stocktwits, retail sentiment around XRP continued to be in ‘bearish’ territory with ‘low’ levels of chatter over the past day.

Bitcoin’s Risk Continues

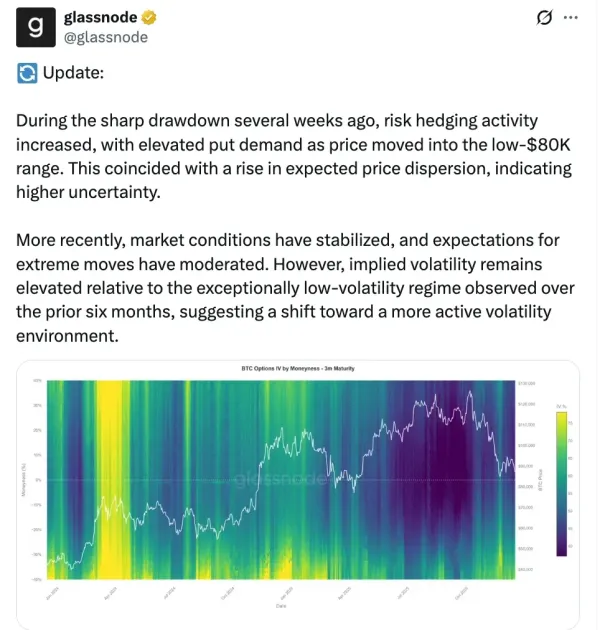

This comes at a time when Bitcoin's prices are calmer compared to last week. Glassnode said on X that Bitcoin has recently entered a more active trading phase. It said that when prices fell to $80,000 a week ago, traders sought more insurance against further losses due to heavy uncertainty at the time.

Glassnode noted that even though the market has calmed down with fewer huge price swings, Bitcoin isn’t out of the danger zone yet. Glassnode analysts believe that Bitcoin is likely to see more uneven trading instead of a smooth move in the near future.

Bitcoin’s price was trading at $87,400 on Tuesday night, up almost 1.5% from the previous day. BTC saw roughly $62 million in liquidations in the last 24 hours, less than the previous day, when it saw $174.14 million wiped out. On Stocktwits, retail sentiment around BTC remained in ‘extremely bearish’ territory with ‘low’ levels of chatter over the past day.

Ethereum Leads Liquidation Rally

Ethereum (ETH) stayed close to $2,955, with daily gains of less than 1% in the last 24 hours. ETH continued to lead in liquidation flows, with almost $105 million in total liquidations over the past 24 hours. On Stocktwits, retail sentiment around ETH remained in ‘extremely bearish’ territory over the past day. The chatter around the coin dipped from ‘normal’ to ‘low’ levels over the past day.

Altcoins Trade Higher

Solana (SOL) traded close to $129, up about 2% on the day. It saw around $9.6 million in liquidations in the last 24 hours, with about half of them being long positions. The retail sentiment around the coin dropped from ‘neutral’ to ‘bearish’, with ‘low’ levels of chatter over the past day.

Dogecoin (DOGE) was up by 2% to trade near $0.132, and there were about $2.6 million in liquidations in the last 24 hours. Most of the forced unwinds came from long positions, which suggests that speculative bets were cut down even if the price went up. On Stocktwits, the retail sentiment around DOGE continued to be in ‘extremely bearish’ territory over the past day as chatter around the coin remained at ‘low’ levels.

Binance Coin (BNB) went up by 1.4% to around $869. Liquidations in BNB stayed relatively low, totaling less than $0.5 million in the last 24 hours. On Stocktwits, the retail sentiment around BNB remained in ‘bearish’ territory, with ‘low’ levels of chatter over the past day.

TRON (TRX) was trading at $0.28, up less than 1% over the day. TRX had very few liquidations, with less than $1 million in 24 hours. On Stocktwits, the retail sentiment around TRX remained in ‘bearish’ territory, with ‘normal’ levels of chatter over the past day.

Cardano (ADA) was trading at roughly $0.38, up about 0.6% in the last 24 hours. ADA had almost $1.3 million in liquidations, mostly on the long side, as traders continued to reduce their positions. On Stocktwits, retail sentiment around ADA dropped from ‘bearish’ to ‘extremely bearish’ territory over the past day. The chatter around the coin also slipped from ‘normal’ to ‘low’ levels over the past day.

Overall, the cryptocurrency market experienced a total liquidation of $247.0 million, with most traders deleveraging on the long side rather than panic-selling.

Read also: Coinbase CEO Remains Bullish On Stablecoins Despite Growth Slowing Down

For updates and corrections, email newsroom[at]stocktwits[dot]com<

-

UP: After killing his wife and two children, the man buryes them in a seven-foot-deep trench at home

-

Australia vs England 3rd Test, Ashes 2025 26: Players from England and Australia Show Support and Show Consideration for the Bondi Beach Attack Victims

-

Viral khabar: A woman runs away with the kids’ teacher, and her husband complains about their “kiss selfie,” saying he doesn’t want her back

-

Tamil Hanuman Jayanti 2025: Time, Date, Meaning, and Customs of Hanumath Jayanthi

-

Mahindra Scorpio N Facelift Launch Date: Check out the details of the Mahindra Scorpio N Facelift, which was seen testing again and now has a panoramic sunroof