In a time of rising inflation and falling bank deposit rates, finding a safe investment with assured returns has become a priority for many Indian savers. Over the past year, repeated repo rate cuts by the Reserve Bank of India (RBI) have prompted banks to reduce fixed deposit (FD) interest rates, making traditional FDs less attractive. Against this backdrop, government-backed small savings schemes are gaining renewed attention—and one option that stands out is the National Savings Certificate (NSC).

Currently, the Government of India is offering a 7.7% annual interest rate on NSC, which is higher than what most major banks are paying on five-year fixed deposits. Backed by a sovereign guarantee, NSC combines safety, stable returns, and tax benefits, making it a compelling alternative for conservative investors.

What Is the National Savings Certificate (NSC)?The National Savings Certificate is a popular small savings scheme operated through post offices across India. It comes with a fixed maturity period of five years and offers assured returns, as the invested amount is fully backed by the central government. Due to this guarantee, the risk associated with NSC is considered almost zero, making it suitable for risk-averse investors.

The government reviews and revises NSC interest rates every quarter to align them with prevailing market conditions. Despite changes in the broader interest rate environment, NSC has consistently remained competitive.

Current Interest Rate: Why NSC Stands OutFor the January–March 2026 quarter, NSC offers an annual interest rate of 7.7%, compounded yearly. This rate is notably higher than the interest offered by most banks on five-year FDs.

Five-Year FD Interest Rates (Indicative Comparison)-

State Bank of India (SBI): 6.05%

-

Punjab National Bank: 6.10%

-

Canara Bank: 6.25%

-

HDFC Bank: 6.40%

-

ICICI Bank: 6.50%

-

YES Bank: 6.75%

Even some private banks offering relatively higher FD rates struggle to match NSC’s combination of higher returns and government-backed security.

Investment Limits: Easy Entry, No Upper CapNSC is accessible to a wide range of investors due to its low entry barrier:

-

Minimum investment: ₹1,000

-

Subsequent investments: In multiples of ₹100

-

Maximum limit: No upper cap

Similarly, FDs also allow large investments, but minimum deposit requirements may vary from ₹1,000 to ₹10,000 depending on the bank.

How Interest Is Paid in NSC vs FDNSC follows a cumulative interest structure:

-

Interest is added annually to the principal.

-

The entire maturity amount is paid after five years.

In contrast, bank FDs offer flexibility:

-

Investors can opt for periodic interest payouts (monthly/quarterly).

-

Or choose cumulative FDs where interest is paid at maturity.

However, NSC comes with a five-year lock-in, and premature withdrawal is generally not allowed, except in special cases such as the investor’s death or a court order. Tax-saving FDs also have a five-year lock-in, while regular FDs can be broken early with a penalty.

Tax Benefits: An Added AdvantageOne of NSC’s biggest advantages is its tax-saving feature:

-

Investments of up to ₹1.5 lakh qualify for deduction under Section 80C of the Income Tax Act (under the old tax regime).

-

The interest earned, however, is taxable as per the investor’s income tax slab.

Similarly, FD interest is also taxable, and tax-saving FDs offer Section 80C benefits—but usually at lower interest rates than NSC.

NSC vs FD: Which Is Better for You?If your primary goal is capital safety with predictable returns, NSC has a clear edge due to:

-

Higher interest rate (7.7%)

-

Government guarantee

-

Tax-saving eligibility under Section 80C

On the other hand, FDs may suit investors who need liquidity or regular income, as they allow premature withdrawals and periodic interest payouts.

Bottom LineWith bank FD rates under pressure, the National Savings Certificate emerges as a strong, safe, and rewarding investment option. Its combination of higher guaranteed returns, sovereign backing, and tax benefits makes it especially attractive for salaried individuals and middle-class investors looking to protect their savings while earning steady growth.

For those seeking a secure alternative to low-interest fixed deposits, NSC is currently one of the most reliable government-backed choices available.

-

How to Turn Off Time Limit on Instagram: Step-by-Step Guide for Unlimited Usage

-

SIP Calculation: How long will it take to build a fund of Rs. 10 lakh with a monthly SIP of Rs. 4000? Read the calculation..

-

Instagram Quick Share Feature Explained: How to Instantly Send Posts to Frequent Contacts

-

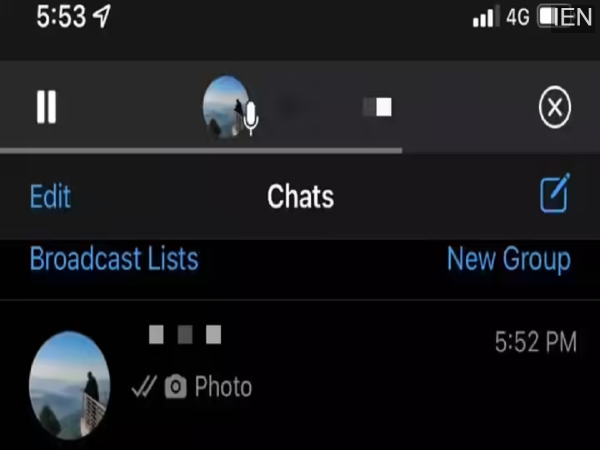

How to Use WhatsApp’s New Voice Message Player on iPhone: Step-by-Step Guide

-

How to Change or Remove a Bank Account in WhatsApp Payments: Step-by-Step Guide